Filing tax returns can be a daunting task, especially when it comes to navigating complex forms and regulations. For individuals and businesses required to file Form 500, understanding the process and best practices is crucial to avoid errors, delays, and potential penalties. In this article, we will delve into the world of Form 500 tax returns, exploring its significance, and providing five essential tips to ensure a smooth filing experience.

The Importance of Form 500

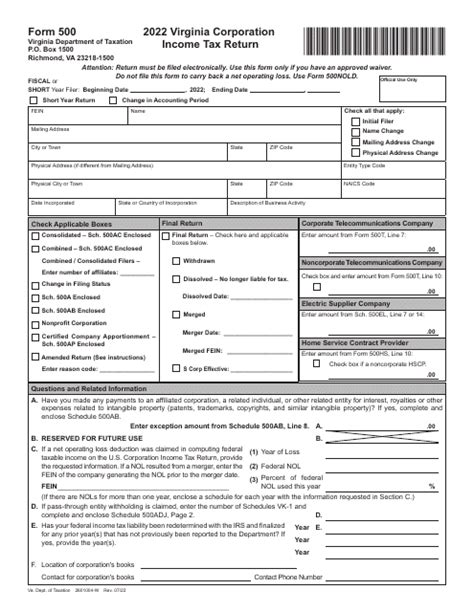

Form 500 is a critical document for businesses and individuals operating in certain industries, such as construction, real estate, and finance. This form is used to report specific types of income, deductions, and credits, which are essential for determining tax liabilities. Failure to file Form 500 accurately and on time can result in severe consequences, including fines, penalties, and even audits.

Understanding Form 500: A Brief Overview

Before diving into the tips, it's essential to have a basic understanding of Form 500. This form is typically used to report income and expenses related to specific business activities, such as:

- Rental income and expenses

- Royalty income and expenses

- Business income and expenses from self-employment

- Investment income and expenses

The form is divided into several sections, including:

- Section 1: Income from rental properties and royalties

- Section 2: Business income and expenses from self-employment

- Section 3: Investment income and expenses

- Section 4: Credits and deductions

Tip #1: Gather All Necessary Documents and Information

Before starting the filing process, it's crucial to gather all necessary documents and information. This includes:

- Financial statements and records

- Receipts and invoices

- Bank statements and canceled checks

- W-2 and 1099 forms

- Previous year's tax returns

Having all the necessary documents and information will help ensure accuracy and reduce the risk of errors.

Tip #2: Understand the Filing Deadline and Requirements

The filing deadline for Form 500 varies depending on the taxpayer's status and the specific form being filed. It's essential to understand the filing deadline and requirements to avoid penalties and fines. Some key deadlines to keep in mind include:

- April 15th for individual taxpayers

- March 15th for partnership and S-corporation taxpayers

- September 15th for extended filing deadlines

Tip #3: Take Advantage of Available Credits and Deductions

Form 500 offers various credits and deductions that can help reduce tax liabilities. Some common credits and deductions include:

- Mortgage interest and property tax deductions

- Business use of home deductions

- Retirement plan contributions

- Education credits

It's essential to understand the available credits and deductions and take advantage of them to minimize tax liabilities.

Tip #4: Use Tax Software or Consult a Tax Professional

Filing Form 500 can be complex and time-consuming, especially for those without experience. Using tax software or consulting a tax professional can help ensure accuracy and reduce the risk of errors. Some popular tax software options include:

- TurboTax

- H&R Block

- TaxAct

When choosing a tax professional, look for someone with experience in filing Form 500 and a good reputation.

Tip #5: Review and Double-Check the Return

Before submitting the return, it's essential to review and double-check the information. This includes:

- Verifying income and expense amounts

- Ensuring accurate calculation of credits and deductions

- Reviewing for completeness and accuracy

A thorough review can help catch errors and reduce the risk of delays or penalties.

Conclusion: A Smooth Filing Experience

Filing Form 500 can be a daunting task, but by following these five essential tips, taxpayers can ensure a smooth and accurate filing experience. Remember to gather all necessary documents and information, understand the filing deadline and requirements, take advantage of available credits and deductions, use tax software or consult a tax professional, and review and double-check the return.

By following these tips, taxpayers can reduce the risk of errors, delays, and penalties, and ensure a successful filing experience.

What is Form 500 used for?

+Form 500 is used to report specific types of income, deductions, and credits, which are essential for determining tax liabilities.

What are the common credits and deductions available on Form 500?

+Some common credits and deductions available on Form 500 include mortgage interest and property tax deductions, business use of home deductions, retirement plan contributions, and education credits.

Can I use tax software to file Form 500?

+Yes, you can use tax software to file Form 500. Some popular tax software options include TurboTax, H&R Block, and TaxAct.