As a Depop seller, you're likely no stranger to the thrill of making a sale and growing your online business. However, with the excitement of entrepreneurship comes the responsibility of managing your finances and filing taxes. In this article, we'll provide you with 5 essential Depop tax form filing tips to help you navigate the process with ease.

Understanding Your Tax Obligations

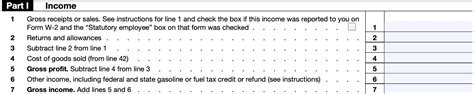

Before we dive into the tips, it's essential to understand your tax obligations as a Depop seller. As a self-employed individual, you're required to report your income and expenses on your tax return. This includes income from sales, as well as any expenses related to running your business, such as shipping costs, marketing expenses, and equipment purchases.

Tip 1: Keep Accurate Records

Accurate record-keeping is crucial when it comes to filing your taxes as a Depop seller. Make sure to keep track of all your sales, expenses, and receipts throughout the year. You can use a spreadsheet, accounting software, or even a simple notebook to keep your records organized.

Some essential records to keep include:

- Sales receipts and invoices

- Expense receipts and invoices

- Bank statements and deposit records

- Shipping records and receipts

- Marketing and advertising expenses

Why Accurate Records Matter

Accurate records will help you to:

- Calculate your taxable income accurately

- Claim legitimate business expenses

- Avoid audits and penalties

- Make informed business decisions

Tip 2: Understand Your Business Structure

As a Depop seller, you're likely operating as a sole proprietorship or single-member LLC. Understanding your business structure is essential for tax purposes, as it will determine how you report your income and expenses.

- Sole Proprietorship: As a sole proprietor, you'll report your business income and expenses on your personal tax return (Form 1040).

- Single-Member LLC: As a single-member LLC, you'll report your business income and expenses on your personal tax return (Form 1040), unless you elect to be taxed as a corporation.

Why Business Structure Matters

Understanding your business structure will help you to:

- Determine your tax obligations

- Claim business expenses correctly

- Make informed decisions about business growth and expansion

Tip 3: Claim Business Expenses

As a Depop seller, you're entitled to claim business expenses on your tax return. This includes expenses related to running your business, such as:

- Shipping costs

- Marketing and advertising expenses

- Equipment purchases (e.g., camera, lighting, etc.)

- Business use of your home (home office deduction)

- Use Form 8829 to claim the home office deduction

- Use Schedule C to claim business expenses

Why Claiming Business Expenses Matters

Claiming business expenses will help you to:

- Reduce your taxable income

- Lower your tax liability

- Increase your cash flow

Tip 4: File Form 1099-K

If you've earned over $20,000 in gross payments and have more than 200 transactions in a calendar year, you'll receive a Form 1099-K from Depop. This form will report your payment card and third-party network transactions to the IRS.

- File Form 1099-K with your tax return (Form 1040)

- Use the information on Form 1099-K to calculate your taxable income

Why Filing Form 1099-K Matters

Filing Form 1099-K will help you to:

- Report your income accurately

- Avoid penalties and fines

- Stay compliant with IRS regulations

Tip 5: Seek Professional Help

Tax filing can be complex, especially for self-employed individuals. If you're unsure about any aspect of the tax filing process, consider seeking professional help from a tax accountant or enrolled agent.

- A tax professional can help you navigate the tax filing process

- A tax professional can ensure you're taking advantage of all eligible deductions and credits

Why Seeking Professional Help Matters

Seeking professional help will help you to:

- Avoid errors and penalties

- Maximize your deductions and credits

- Ensure compliance with IRS regulations

Get Ahead of the Game

Filing taxes as a Depop seller can be complex, but with the right guidance, you can navigate the process with ease. By following these 5 essential tips, you'll be well on your way to ensuring a smooth tax filing experience. Remember to keep accurate records, understand your business structure, claim business expenses, file Form 1099-K, and seek professional help when needed.

What is the deadline for filing taxes as a Depop seller?

+The deadline for filing taxes as a Depop seller is typically April 15th of each year. However, this deadline may vary depending on your business structure and location.

What expenses can I claim as a Depop seller?

+As a Depop seller, you can claim business expenses related to running your business, such as shipping costs, marketing and advertising expenses, equipment purchases, and business use of your home.

Do I need to file Form 1099-K as a Depop seller?

+If you've earned over $20,000 in gross payments and have more than 200 transactions in a calendar year, you'll receive a Form 1099-K from Depop. You'll need to file this form with your tax return (Form 1040).