As the tax season approaches, investors often find themselves overwhelmed with a multitude of forms and paperwork. One such form that can be a source of confusion is the Vanguard Form 5498. If you're an investor with a retirement account, you've likely received this form in the mail or via email. But what does it mean, and how does it impact your investments? In this comprehensive guide, we'll delve into the world of Vanguard Form 5498, exploring its purpose, benefits, and what you need to know as an investor.

Understanding Vanguard Form 5498

Vanguard Form 5498 is an annual statement provided by Vanguard, a leading investment management company, to its customers who have retirement accounts, such as Individual Retirement Accounts (IRAs) or 401(k)s. The form is designed to report the fair market value of your account as of December 31st of each year, as well as any contributions, distributions, or other transactions that occurred during the tax year.

What Information Does Vanguard Form 5498 Provide?

The form typically includes the following information:

- Account holder's name and address

- Account type (e.g., traditional IRA, Roth IRA, 401(k), etc.)

- Fair market value of the account as of December 31st

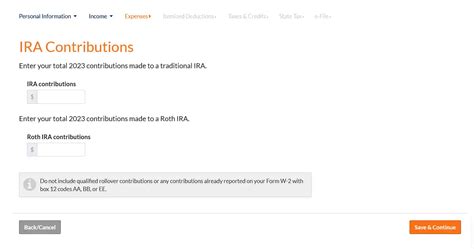

- Contributions made during the tax year

- Distributions taken during the tax year

- Any loans or withdrawals made from the account

- Required Minimum Distribution (RMD) information (if applicable)

Why Is Vanguard Form 5498 Important?

Vanguard Form 5498 serves several purposes:

- Tax reporting: The form helps you and the IRS track contributions, distributions, and other transactions related to your retirement account.

- Account record-keeping: The form provides a record of your account's fair market value, which can be useful for tax planning and investment decisions.

- Compliance: Vanguard is required by law to provide this form to account holders and the IRS, ensuring compliance with tax regulations.

How to Read and Understand Vanguard Form 5498

When reviewing your Vanguard Form 5498, pay attention to the following:

- Section 1: Account Information: Verify your account details, including your name, address, and account type.

- Section 2: Fair Market Value: Note the fair market value of your account as of December 31st.

- Section 3: Contributions: Review the contributions made during the tax year, including any catch-up contributions.

- Section 4: Distributions: Check the distributions taken during the tax year, including any required minimum distributions (RMDs).

- Section 5: Loans and Withdrawals: Review any loans or withdrawals made from the account.

What to Do with Vanguard Form 5498

Once you've received and reviewed your Vanguard Form 5498, you can:

- File it with your tax return: Use the information on the form to complete your tax return, reporting any contributions, distributions, or other transactions.

- Keep it for your records: Store the form with your other tax documents, as it may be useful for future reference.

- Contact Vanguard or a tax professional: If you have questions or concerns about the form or your account, reach out to Vanguard or a tax professional for guidance.

Common Questions and Answers

Q: What is the deadline for receiving Vanguard Form 5498? A: Vanguard typically sends Form 5498 by January 31st of each year.

Q: Do I need to file Vanguard Form 5498 with my tax return? A: No, you do not need to file the form with your tax return. However, you will need to report the information on the form on your tax return.

Q: Can I access my Vanguard Form 5498 online? A: Yes, you can access your form online through Vanguard's website.

Conclusion

Vanguard Form 5498 is an essential document for investors with retirement accounts. By understanding the purpose and contents of the form, you can better manage your investments and ensure compliance with tax regulations. Remember to review the form carefully, file it with your tax return, and keep it for your records. If you have any questions or concerns, don't hesitate to reach out to Vanguard or a tax professional for guidance.

What is Vanguard Form 5498?

+Vanguard Form 5498 is an annual statement provided by Vanguard to its customers with retirement accounts, reporting the fair market value of the account and any contributions, distributions, or other transactions.

Why do I receive Vanguard Form 5498?

+You receive Vanguard Form 5498 to report the fair market value of your retirement account and any transactions that occurred during the tax year, which is necessary for tax reporting and compliance.

Do I need to file Vanguard Form 5498 with my tax return?

+No, you do not need to file Vanguard Form 5498 with your tax return. However, you will need to report the information on the form on your tax return.