Transferring property ownership in Texas can be a complex process, but using a free Texas gift deed form template can simplify the task. A gift deed is a type of deed that transfers ownership of a property from one person to another without any payment or compensation. This article will guide you through the process of using a gift deed in Texas, including the benefits, requirements, and a step-by-step guide to completing the form.

Benefits of Using a Gift Deed in Texas

Using a gift deed in Texas offers several benefits, including:

- No payment or compensation is required, making it an attractive option for transferring property to family members or loved ones.

- It provides a clear and official record of the property transfer, which can help avoid disputes or confusion in the future.

- A gift deed can be used to transfer ownership of a property to a trust, which can provide tax benefits and protection for the property.

Types of Gift Deeds in Texas

There are several types of gift deeds that can be used in Texas, including:

- Warranty Deed: This type of deed guarantees that the grantor (the person giving the property) has the right to transfer the property and that the property is free of any liens or encumbrances.

- Special Warranty Deed: This type of deed guarantees that the grantor has the right to transfer the property, but does not guarantee that the property is free of any liens or encumbrances.

- Quitclaim Deed: This type of deed transfers the grantor's interest in the property to the grantee, but does not guarantee that the grantor has the right to transfer the property.

Requirements for a Gift Deed in Texas

To create a valid gift deed in Texas, the following requirements must be met:

- The deed must be in writing and signed by the grantor.

- The deed must include the names and addresses of the grantor and grantee.

- The deed must include a description of the property being transferred.

- The deed must include the statement "This deed is given as a gift" or similar language.

- The deed must be notarized.

- The deed must be recorded with the county clerk's office in the county where the property is located.

How to Complete a Gift Deed Form in Texas

To complete a gift deed form in Texas, follow these steps:

- Download and print the gift deed form: You can download a free Texas gift deed form template from this website.

- Fill in the grantor's information: Enter the grantor's name and address in the designated spaces.

- Fill in the grantee's information: Enter the grantee's name and address in the designated spaces.

- Fill in the property description: Enter the property description, including the county, city, and any other relevant information.

- Fill in the statement of gift: Enter the statement "This deed is given as a gift" or similar language.

- Sign the deed: The grantor must sign the deed in the presence of a notary public.

- Notarize the deed: The notary public must sign and date the deed.

- Record the deed: The deed must be recorded with the county clerk's office in the county where the property is located.

Gift Deed Form Template

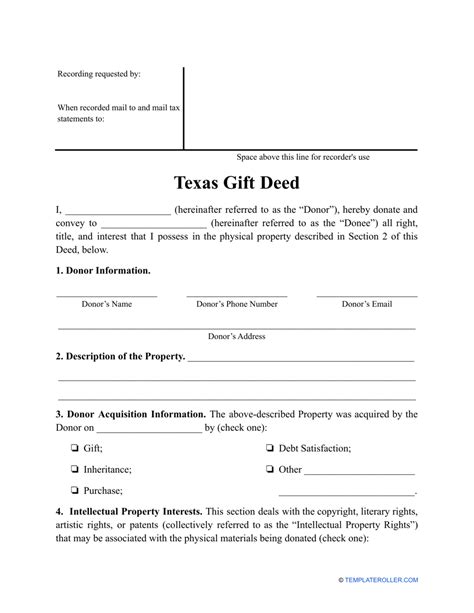

Here is a free Texas gift deed form template that you can use:

TEXAS GIFT DEED

I, [Grantor's Name], being the owner of the following described property in [County], Texas:

[Property Description]

do hereby give, grant, and convey unto [Grantee's Name], whose address is [Grantee's Address], the said property, together with all improvements, rights, and appurtenances thereto, as a gift.

This deed is given as a gift, without any payment or compensation.

Grantor's Signature

We, the undersigned, being two witnesses, do hereby attest and declare that we witnessed the signing of this deed by the grantor.

Witness 1 Signature

Witness 2 Signature

Notary Public:

[Notary Public's Signature] [Notary Public's Seal]

Texas Gift Deed Law

Texas law requires that a gift deed be in writing and signed by the grantor. The deed must also be notarized and recorded with the county clerk's office.

Texas Property Law

Texas property law governs the transfer of property in the state. The law requires that all property transfers be in writing and signed by the grantor.

Conclusion

Using a free Texas gift deed form template can simplify the process of transferring property ownership in Texas. By following the steps outlined in this article, you can ensure that your gift deed is valid and effective.

We encourage you to share your thoughts and experiences with gift deeds in Texas. Have you used a gift deed to transfer property in Texas? Share your story in the comments below.

FAQ Section:

What is a gift deed in Texas?

+A gift deed in Texas is a type of deed that transfers ownership of a property from one person to another without any payment or compensation.

What are the requirements for a gift deed in Texas?

+The requirements for a gift deed in Texas include that the deed must be in writing and signed by the grantor, the deed must include the names and addresses of the grantor and grantee, and the deed must be notarized and recorded with the county clerk's office.

How do I complete a gift deed form in Texas?

+To complete a gift deed form in Texas, follow the steps outlined in this article, including filling in the grantor's information, filling in the grantee's information, filling in the property description, filling in the statement of gift, signing the deed, notarizing the deed, and recording the deed.