As the annual tax filing season approaches, millions of individuals and businesses are scrambling to gather their financial documents and submit their returns on time. For small businesses and self-employed individuals, one of the most important forms to file is the SSS Mat 1 Form. In this article, we will provide a comprehensive guide to filing the SSS Mat 1 Form, including its purpose, requirements, and step-by-step instructions.

Understanding the SSS Mat 1 Form

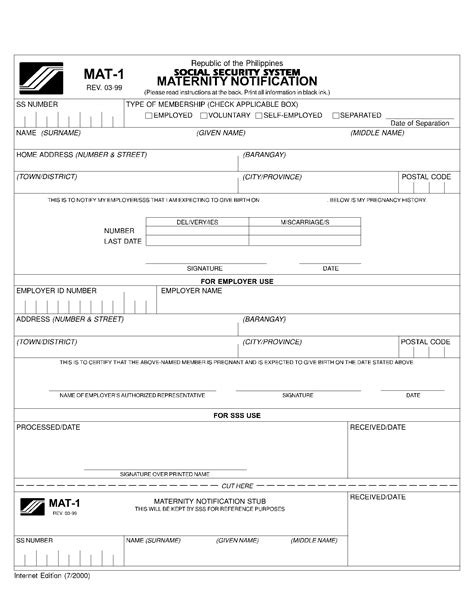

The SSS Mat 1 Form, also known as the "SSS Maternity Benefit Application Form," is a required document for self-employed individuals and small business owners who are members of the Social Security System (SSS). The form is used to apply for maternity benefits, which provide financial assistance to female SSS members who are on maternity leave.

The SSS Mat 1 Form is an essential document for many female entrepreneurs and small business owners who rely on their businesses to support themselves and their families. By filing this form, they can receive the financial support they need during their maternity leave, ensuring that they can take care of their newborns without worrying about their business finances.

Who Needs to File the SSS Mat 1 Form?

Not all SSS members need to file the SSS Mat 1 Form. To be eligible, you must meet the following requirements:

- You must be a female SSS member who is self-employed or owns a small business.

- You must have paid at least three monthly contributions within the 12-month period immediately preceding the semester of your childbirth or miscarriage.

- You must have notified your employer or the SSS of your pregnancy and intended date of childbirth.

- You must have submitted your maternity leave application to your employer or the SSS.

If you meet these requirements, you are eligible to file the SSS Mat 1 Form and apply for maternity benefits.

Requirements for Filing the SSS Mat 1 Form

To file the SSS Mat 1 Form, you will need to provide the following documents:

- A copy of your SSS membership ID or a valid government-issued ID.

- A copy of your marriage certificate (if applicable).

- A copy of your birth certificate or a certified true copy of your child's birth certificate.

- A medical certificate confirming your pregnancy and expected date of childbirth.

- A notification of pregnancy and intended date of childbirth, which must be submitted to your employer or the SSS at least 60 days before your expected date of childbirth.

Step-by-Step Guide to Filing the SSS Mat 1 Form

Filing the SSS Mat 1 Form is a straightforward process that can be completed in a few steps. Here's a step-by-step guide to help you file your form successfully:

- Download the SSS Mat 1 Form: You can download the SSS Mat 1 Form from the SSS website or obtain a copy from your local SSS branch.

- Fill out the form: Fill out the form completely and accurately, making sure to provide all the required information.

- Attach required documents: Attach all the required documents, including your SSS membership ID, marriage certificate, birth certificate, medical certificate, and notification of pregnancy.

- Submit the form: Submit the form and attached documents to your local SSS branch or through the SSS online portal.

- Wait for processing: Wait for the SSS to process your application. You will receive a notification once your application has been approved.

Benefits of Filing the SSS Mat 1 Form

Filing the SSS Mat 1 Form provides several benefits to self-employed individuals and small business owners. Here are some of the benefits:

- Financial support: The SSS Mat 1 Form provides financial support to female SSS members who are on maternity leave, ensuring that they can take care of their newborns without worrying about their business finances.

- Reduced financial stress: Filing the SSS Mat 1 Form can reduce financial stress and anxiety, allowing you to focus on your business and family.

- Increased productivity: By providing financial support during maternity leave, the SSS Mat 1 Form can increase productivity and help you get back to work sooner.

Common Mistakes to Avoid When Filing the SSS Mat 1 Form

When filing the SSS Mat 1 Form, there are several common mistakes to avoid. Here are some of the most common mistakes:

- Inaccurate information: Make sure to provide accurate information on the form, including your name, address, and SSS membership ID.

- Incomplete documents: Make sure to attach all the required documents, including your SSS membership ID, marriage certificate, birth certificate, medical certificate, and notification of pregnancy.

- Late submission: Make sure to submit the form and attached documents on time, as late submissions may be rejected.

Tips for Filing the SSS Mat 1 Form Successfully

Here are some tips for filing the SSS Mat 1 Form successfully:

- Read the instructions carefully: Make sure to read the instructions carefully before filling out the form.

- Use a pen and not a pencil: Use a pen to fill out the form, as pencil marks may be erased or smudged.

- Keep a copy of the form: Keep a copy of the form and attached documents for your records.

Conclusion

Filing the SSS Mat 1 Form is an essential step for self-employed individuals and small business owners who are members of the Social Security System. By following the step-by-step guide and avoiding common mistakes, you can ensure a successful filing process and receive the financial support you need during your maternity leave.

We hope this article has provided you with a comprehensive guide to filing the SSS Mat 1 Form. If you have any questions or concerns, please don't hesitate to comment below.

What is the purpose of the SSS Mat 1 Form?

+The SSS Mat 1 Form is used to apply for maternity benefits, which provide financial assistance to female SSS members who are on maternity leave.

Who needs to file the SSS Mat 1 Form?

+Self-employed individuals and small business owners who are members of the Social Security System need to file the SSS Mat 1 Form.

What documents are required to file the SSS Mat 1 Form?

+A copy of your SSS membership ID, marriage certificate, birth certificate, medical certificate, and notification of pregnancy are required to file the SSS Mat 1 Form.