The Charles Schwab Simple IRA form is a crucial document for employers who want to establish a Simple IRA plan for their employees. This type of plan is a popular choice for small businesses and self-employed individuals, as it offers a simple and cost-effective way to provide retirement benefits. In this article, we will guide you through the 5 steps to fill out the Charles Schwab Simple IRA form.

Understanding the Importance of Simple IRA Plans

Before we dive into the steps, let's quickly discuss the importance of Simple IRA plans. A Simple IRA, also known as a Savings Incentive Match Plan for Employees Individual Retirement Account, is a type of retirement plan that allows employers to make contributions to their employees' IRAs. This type of plan is ideal for small businesses and self-employed individuals who want to provide retirement benefits to their employees without the complexity and cost of a traditional 401(k) plan.

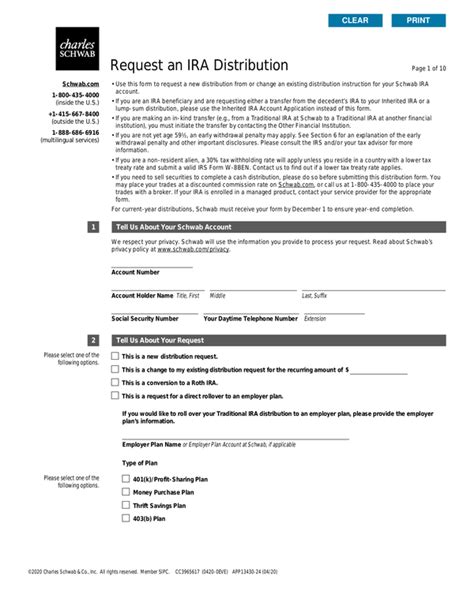

Step 1: Gather Required Information

Before you start filling out the Charles Schwab Simple IRA form, make sure you have all the required information. This includes:

- Your business name and address

- Your Employer Identification Number (EIN)

- The name and address of your plan administrator

- The effective date of your Simple IRA plan

- The type of contributions you want to make (employer or employee)

Step 2: Choose Your Plan Options

Plan Options

In this section, you will need to choose your plan options. This includes:

- The type of contributions you want to make (employer or employee)

- The percentage of compensation you want to contribute

- The frequency of contributions (e.g., monthly, quarterly)

- The investment options you want to offer your employees

Step 3: Complete the Employer Information Section

In this section, you will need to provide information about your business. This includes:

- Your business name and address

- Your Employer Identification Number (EIN)

- The name and title of your plan administrator

- The date you want to establish your Simple IRA plan

Step 4: Complete the Employee Information Section

Employee Information

In this section, you will need to provide information about your employees. This includes:

- The names and Social Security numbers of your employees

- The dates of birth and hire dates of your employees

- The compensation amounts for each employee

Step 5: Review and Sign the Form

Once you have completed all the sections, review the form carefully to ensure that all the information is accurate and complete. Sign and date the form, and make sure to keep a copy for your records.

Take Action

Now that you have completed the Charles Schwab Simple IRA form, it's time to take action. Submit the form to Charles Schwab, and they will guide you through the next steps to establish your Simple IRA plan. Remember to review and update your plan annually to ensure that it remains compliant with IRS regulations.

Final Thoughts

Establishing a Simple IRA plan is a great way to provide retirement benefits to your employees. By following these 5 steps, you can fill out the Charles Schwab Simple IRA form with confidence. Remember to review and update your plan annually to ensure that it remains compliant with IRS regulations.

FAQ Section

What is a Simple IRA plan?

+A Simple IRA plan is a type of retirement plan that allows employers to make contributions to their employees' IRAs.

Who is eligible to establish a Simple IRA plan?

+Small businesses and self-employed individuals are eligible to establish a Simple IRA plan.

What is the deadline to establish a Simple IRA plan?

+The deadline to establish a Simple IRA plan is October 1st of each year.