Tax season can be a daunting time for many individuals, especially when it comes to understanding the various forms and reports required by the IRS. One such form that may cause confusion is the Fidelity Form 3922, also known as the "Transfer of Stock Acquired Through an Employee Stock Purchase Plan Under Section 423(c)". In this article, we will delve into the world of Fidelity Form 3922, explaining its purpose, how to read it, and what it means for your taxes.

What is Fidelity Form 3922?

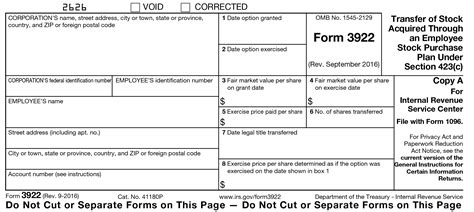

Fidelity Form 3922 is a tax reporting form used to report the transfer of stock acquired through an Employee Stock Purchase Plan (ESPP) under Section 423(c) of the Internal Revenue Code. An ESPP is a type of employee benefit plan that allows employees to purchase company stock at a discounted price. When an employee acquires stock through an ESPP, the employer is required to report the transfer of stock on Form 3922.

How to Read Fidelity Form 3922

Reading Fidelity Form 3922 can seem overwhelming at first, but breaking it down into sections can make it more manageable. Here's a step-by-step guide to help you understand the form:

- Box 1: Date of Transfer: This box shows the date the stock was transferred to the employee.

- Box 2: FMV on Date of Transfer: This box shows the fair market value of the stock on the date of transfer.

- Box 3: Exercise Price: This box shows the price at which the employee purchased the stock.

- Box 4: Number of Shares: This box shows the number of shares transferred to the employee.

- Box 5: Code: This box shows a code that indicates the type of transfer (e.g., "A" for a qualifying disposition).

How Fidelity Form 3922 Affects Your Taxes

The information reported on Fidelity Form 3922 is used to calculate the employee's tax liability. The form reports the transfer of stock, which may trigger a taxable event. Here are some possible tax implications:

- Ordinary Income: If the employee sells the stock within two years of the transfer date or within one year of the first day the stock was offered, the gain is considered ordinary income and is subject to income tax.

- Capital Gains: If the employee sells the stock after the two-year or one-year holding period, the gain is considered a capital gain and is subject to capital gains tax.

Common Questions and Answers

- Q: What is the purpose of Fidelity Form 3922? A: The purpose of Fidelity Form 3922 is to report the transfer of stock acquired through an Employee Stock Purchase Plan (ESPP) under Section 423(c).

- Q: How do I report the information on Fidelity Form 3922 on my tax return? A: The information on Fidelity Form 3922 should be reported on Schedule 1 (Form 1040) and Schedule D (Form 1040).

Tips for Managing Your ESPP

- Keep Accurate Records: Keep accurate records of your ESPP transactions, including the date of transfer, fair market value, exercise price, and number of shares.

- Understand the Holding Period: Understand the holding period requirements to avoid triggering ordinary income tax.

- Consult a Tax Professional: Consult a tax professional to ensure you are reporting the information on Fidelity Form 3922 correctly.

Conclusion

Fidelity Form 3922 may seem complex, but understanding its purpose and how to read it can help you navigate the tax implications of your Employee Stock Purchase Plan (ESPP). By following the tips outlined in this article, you can ensure you are managing your ESPP correctly and avoiding any potential tax pitfalls.

Take Action

- Review your Fidelity Form 3922 carefully to ensure accuracy.

- Consult a tax professional to ensure you are reporting the information correctly.

- Keep accurate records of your ESPP transactions.

FAQ Section

What is an Employee Stock Purchase Plan (ESPP)?

+An Employee Stock Purchase Plan (ESPP) is a type of employee benefit plan that allows employees to purchase company stock at a discounted price.

What is the purpose of Fidelity Form 3922?

+The purpose of Fidelity Form 3922 is to report the transfer of stock acquired through an Employee Stock Purchase Plan (ESPP) under Section 423(c).

How do I report the information on Fidelity Form 3922 on my tax return?

+The information on Fidelity Form 3922 should be reported on Schedule 1 (Form 1040) and Schedule D (Form 1040).