Transferring funds between accounts can be a daunting task, especially when dealing with complex financial institutions. However, with the right guidance, navigating the process can become much more manageable. In this article, we will delve into the world of TD Ameritrade internal transfer forms, exploring the benefits, steps, and requirements involved in transferring funds within the TD Ameritrade platform.

Understanding TD Ameritrade Internal Transfers

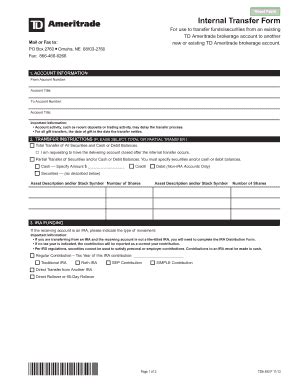

TD Ameritrade is a well-established online brokerage firm that offers a wide range of financial services, including trading, investment, and wealth management. One of the convenient features of TD Ameritrade is the ability to transfer funds between accounts internally. This process allows users to move money between their various TD Ameritrade accounts, such as from a brokerage account to a retirement account, or from a bank account to a trading account.

Benefits of TD Ameritrade Internal Transfers

Internal transfers within TD Ameritrade offer several benefits, including:

- Convenience: Transferring funds between accounts is a straightforward process that can be completed online or through the TD Ameritrade mobile app.

- Speed: Internal transfers are typically processed quickly, often in real-time, allowing users to access their funds when needed.

- Security: TD Ameritrade employs robust security measures to protect user accounts and ensure that transfers are secure and reliable.

- Flexibility: Users can transfer funds between various account types, including brokerage, retirement, and bank accounts.

How to Complete a TD Ameritrade Internal Transfer Form

To initiate an internal transfer within TD Ameritrade, users will need to complete a transfer form. The process can be completed online or through the mobile app. Here's a step-by-step guide to help you navigate the process:

- Log in to your TD Ameritrade account online or through the mobile app.

- Navigate to the "Transfer" or "Move Money" section.

- Select the account you want to transfer funds from (the "source" account).

- Choose the account you want to transfer funds to (the "destination" account).

- Enter the transfer amount and select the transfer frequency (one-time or recurring).

- Review the transfer details and confirm the transaction.

Requirements for TD Ameritrade Internal Transfers

To complete an internal transfer, users will need to meet the following requirements:

- Both the source and destination accounts must be in good standing and have sufficient funds.

- The transfer amount must be within the allowed limits for the account type.

- Users must have the necessary permissions and access rights to complete the transfer.

TD Ameritrade Internal Transfer Form: Tips and Tricks

To ensure a smooth internal transfer process, keep the following tips and tricks in mind:

- Verify account information: Double-check the account numbers and transfer amounts to avoid errors.

- Check transfer limits: Be aware of the transfer limits for each account type to avoid exceeding them.

- Use the correct transfer method: Choose the correct transfer method (e.g., wire transfer, ACH transfer) for your needs.

- Monitor transfer status: Keep track of the transfer status to ensure it is processed successfully.

Common Issues with TD Ameritrade Internal Transfers

While internal transfers within TD Ameritrade are generally straightforward, users may encounter some common issues, including:

- Insufficient funds: Ensure that the source account has sufficient funds to cover the transfer amount.

- Account restrictions: Check if there are any restrictions on the source or destination account that may prevent the transfer.

- Transfer errors: Verify account information and transfer details to avoid errors.

Conclusion: Streamlining Your TD Ameritrade Internal Transfers

In conclusion, TD Ameritrade internal transfer forms can be completed easily and efficiently, allowing users to move funds between accounts with ease. By understanding the benefits, steps, and requirements involved, users can navigate the process with confidence. Remember to verify account information, check transfer limits, and monitor transfer status to ensure a smooth and successful transfer.

We hope this article has been informative and helpful in guiding you through the TD Ameritrade internal transfer process. If you have any further questions or concerns, please don't hesitate to reach out to TD Ameritrade support.

Now it's your turn! Share your experiences with TD Ameritrade internal transfers in the comments below. Have you encountered any issues or have any tips to share? Let's discuss!

What is the minimum transfer amount for TD Ameritrade internal transfers?

+The minimum transfer amount for TD Ameritrade internal transfers varies depending on the account type. For example, the minimum transfer amount for a brokerage account is $100, while the minimum transfer amount for a retirement account is $1,000.

Can I cancel a TD Ameritrade internal transfer?

+Yes, you can cancel a TD Ameritrade internal transfer, but it must be done before the transfer is processed. To cancel a transfer, log in to your account online or through the mobile app and navigate to the "Transfer" or "Move Money" section. Select the transfer you want to cancel and follow the prompts to cancel the transaction.

Are TD Ameritrade internal transfers secure?

+Yes, TD Ameritrade internal transfers are secure. TD Ameritrade employs robust security measures, including encryption and two-factor authentication, to protect user accounts and ensure that transfers are secure and reliable.