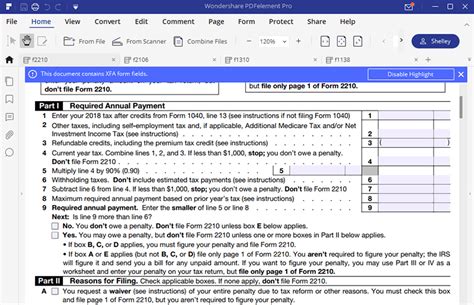

Filling out tax forms can be a daunting task, and Form 2210 is no exception. Form 2210, also known as the Underpayment of Estimated Tax by Individuals, Estates, and Trusts, is used to calculate and report the underpayment of estimated tax. Line 8 of this form can be particularly tricky, as it requires you to calculate the annualized income installment method. In this article, we will provide you with 5 tips to help you fill out Form 2210 Line 8 correctly.

Understanding the Annualized Income Installment Method

Before we dive into the tips, it's essential to understand what the annualized income installment method is. This method is used to calculate the estimated tax liability for individuals who receive income that is not subject to withholding, such as self-employment income or capital gains. The annualized income installment method takes into account the varying levels of income throughout the year, rather than assuming a constant income stream.

Tip 1: Determine Your Eligibility

Not everyone needs to use the annualized income installment method. To determine if you are eligible, you must meet one of the following conditions:

- You received income that is not subject to withholding, such as self-employment income or capital gains.

- You have a change in income during the year that affects your estimated tax liability.

- You have a prior year's tax liability that is affected by the annualized income installment method.

If you meet any of these conditions, you will need to use the annualized income installment method to calculate your estimated tax liability.

Calculating the Annualized Income Installment Method

To calculate the annualized income installment method, you will need to follow these steps:

- Determine your total income for the year.

- Calculate your estimated tax liability using the tax tables or tax rates.

- Divide your estimated tax liability by the number of installments due (usually 4).

- Multiply the result by the applicable fraction for each installment period.

The applicable fraction is based on the number of days in each installment period. For example, the first installment period is from January 1 to April 15, which is 105 days. The applicable fraction for this period would be 105/365.

Tip 2: Use the Correct Form and Schedules

To calculate the annualized income installment method, you will need to use Form 2210 and Schedule AI. Schedule AI is used to calculate the annualized income installment method, and it must be attached to Form 2210.

Make sure to use the correct version of the forms and schedules for the tax year you are filing. You can download the forms and schedules from the IRS website or use tax preparation software.

Common Mistakes to Avoid

When filling out Form 2210 Line 8, there are several common mistakes to avoid:

- Failing to calculate the annualized income installment method correctly.

- Not using the correct forms and schedules.

- Failing to attach Schedule AI to Form 2210.

- Not keeping accurate records of income and expenses.

By avoiding these common mistakes, you can ensure that you fill out Form 2210 Line 8 correctly and avoid any potential penalties or interest.

Tip 3: Keep Accurate Records

To calculate the annualized income installment method, you will need to keep accurate records of your income and expenses. This includes:

- Income statements and receipts.

- Expense records and receipts.

- Business records, such as ledgers and journals.

By keeping accurate records, you can ensure that you have the necessary information to calculate the annualized income installment method correctly.

Using Tax Preparation Software

If you are not comfortable calculating the annualized income installment method manually, you can use tax preparation software to help you. Tax preparation software can guide you through the process and ensure that you fill out Form 2210 Line 8 correctly.

Some popular tax preparation software includes TurboTax, H&R Block, and TaxAct. These software programs can help you navigate the complex tax laws and regulations, and ensure that you take advantage of all the deductions and credits you are eligible for.

Tip 4: Seek Professional Help

If you are still unsure about how to fill out Form 2210 Line 8, consider seeking professional help. A tax professional can guide you through the process and ensure that you fill out the form correctly.

A tax professional can also help you navigate any complex tax laws or regulations, and ensure that you take advantage of all the deductions and credits you are eligible for.

Avoiding Penalties and Interest

If you fail to fill out Form 2210 Line 8 correctly, you may be subject to penalties and interest. To avoid this, make sure to:

- File Form 2210 on time.

- Pay any estimated tax due on time.

- Keep accurate records of income and expenses.

By following these tips, you can avoid any potential penalties or interest, and ensure that you fill out Form 2210 Line 8 correctly.

Tip 5: Review and Double-Check

Finally, before submitting Form 2210, review and double-check your calculations. Make sure that you have filled out the form correctly, and that you have attached all necessary schedules and forms.

By reviewing and double-checking your calculations, you can ensure that you fill out Form 2210 Line 8 correctly, and avoid any potential penalties or interest.

In conclusion, filling out Form 2210 Line 8 can be a complex process, but by following these 5 tips, you can ensure that you fill out the form correctly. Remember to determine your eligibility, calculate the annualized income installment method correctly, use the correct forms and schedules, keep accurate records, and review and double-check your calculations. By following these tips, you can avoid any potential penalties or interest, and ensure that you fill out Form 2210 Line 8 correctly.

We hope this article has been helpful in guiding you through the process of filling out Form 2210 Line 8. If you have any further questions or concerns, please don't hesitate to comment below. We would be happy to hear from you and provide any additional guidance or support.

What is Form 2210?

+Form 2210 is the Underpayment of Estimated Tax by Individuals, Estates, and Trusts. It is used to calculate and report the underpayment of estimated tax.

What is the annualized income installment method?

+The annualized income installment method is a calculation method used to determine the estimated tax liability for individuals who receive income that is not subject to withholding.

What are the common mistakes to avoid when filling out Form 2210 Line 8?

+The common mistakes to avoid when filling out Form 2210 Line 8 include failing to calculate the annualized income installment method correctly, not using the correct forms and schedules, failing to attach Schedule AI to Form 2210, and not keeping accurate records of income and expenses.