As a nonresident of California, filing taxes can be a daunting task, especially when it comes to navigating the state's tax laws. The California Tax Form 540NR is specifically designed for nonresidents who need to report their income earned in the state. In this comprehensive guide, we will walk you through the process of completing the California Tax Form 540NR, highlighting key sections, and providing valuable tips to ensure accuracy and compliance.

Understanding Who Needs to File Form 540NR

Before diving into the nitty-gritty of the form, it's essential to determine if you need to file the California Tax Form 540NR. You are required to file this form if you are a nonresident of California and have earned income from sources within the state. This includes:

- Wages, salaries, and tips

- Self-employment income

- Rental income

- Interest and dividends

- Capital gains

Gathering Necessary Documents

To complete the California Tax Form 540NR accurately, you'll need to gather the following documents:

- W-2 forms from your employer(s)

- 1099 forms for self-employment income, interest, and dividends

- Rental income statements

- Records of capital gains and losses

- California withholding certificates (if applicable)

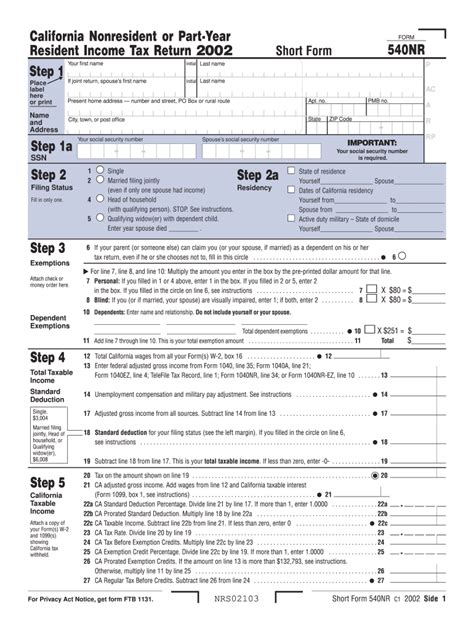

Breaking Down the Form 540NR

The California Tax Form 540NR consists of several sections, each with its own set of requirements. Let's take a closer look at the main sections:

Section 1: Identification and Address

In this section, you'll need to provide your name, address, and social security number or Individual Taxpayer Identification Number (ITIN). Make sure to double-check your information for accuracy.

Section 2: Filing Status

Select your filing status from the options provided. As a nonresident, you may be single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

Section 3: Income

This section is where you'll report your California-sourced income. You'll need to complete the following lines:

- Wages, salaries, and tips (Line 1)

- Self-employment income (Line 2)

- Rental income (Line 3)

- Interest and dividends (Line 4)

- Capital gains (Line 5)

Tips and Tricks:

- Make sure to report all income earned from California sources, even if it's not reported on a W-2 or 1099.

- If you have self-employment income, you'll need to complete Schedule C (Form 1040) and attach it to your Form 540NR.

- If you have rental income, you'll need to complete Schedule E (Form 1040) and attach it to your Form 540NR.

Section 4: Deductions and Credits

In this section, you'll claim deductions and credits that may reduce your tax liability. You can claim the standard deduction or itemize deductions on Schedule A (Form 1040).

Tips and Tricks:

- If you're eligible, claim the California Earned Income Tax Credit (CalEITC) on Line 17.

- If you have education expenses, you may be eligible for the California Education Credit on Line 18.

Section 5: Tax Computation

This section is where you'll calculate your tax liability. You'll need to complete the following lines:

- Taxable income (Line 20)

- Tax (Line 21)

- Credits (Line 22)

- Net tax (Line 23)

Tips and Tricks:

- Make sure to check if you're eligible for any tax credits, such as the California Child and Dependent Care Credit.

- If you owe taxes, you can pay online, by phone, or by mail.

Filing and Payment Options

Once you've completed the California Tax Form 540NR, you can file it electronically or by mail. If you owe taxes, you can pay online, by phone, or by mail.

Common Mistakes to Avoid

When completing the California Tax Form 540NR, it's essential to avoid common mistakes that can delay processing or result in penalties. Some common mistakes include:

- Inaccurate or incomplete information

- Failure to report all income earned from California sources

- Incorrect filing status or dependents

- Math errors or miscalculations

Conclusion:

Filing the California Tax Form 540NR as a nonresident can be a complex process, but with the right guidance, you can ensure accuracy and compliance. Remember to gather all necessary documents, report all income earned from California sources, and claim deductions and credits you're eligible for. If you're unsure about any part of the process, consider consulting a tax professional or seeking guidance from the California Franchise Tax Board.

Next Steps:

If you have any questions or concerns about completing the California Tax Form 540NR, don't hesitate to reach out. Share your experiences or ask for advice in the comments below.

FAQ Section:

Who needs to file the California Tax Form 540NR?

+You need to file the California Tax Form 540NR if you are a nonresident of California and have earned income from sources within the state.

What documents do I need to gather to complete the Form 540NR?

+You'll need to gather W-2 forms, 1099 forms, rental income statements, records of capital gains and losses, and California withholding certificates (if applicable).

Can I file the Form 540NR electronically?

+Yes, you can file the Form 540NR electronically through the California Franchise Tax Board's website or through a tax preparation software.