Filing annual reports is a crucial step for businesses in Wisconsin to maintain their good standing and compliance with state regulations. The Wisconsin Annual Report Form 18 is a required filing for various business entities, including corporations, limited liability companies (LLCs), and nonprofits. In this article, we will explore five ways to file the Wisconsin Annual Report Form 18, discussing the benefits and requirements of each method.

Understanding the Wisconsin Annual Report Form 18

Before we dive into the filing methods, it's essential to understand what the Wisconsin Annual Report Form 18 is and what it entails. This form is used to update the state on any changes to your business, such as changes in the board of directors, officers, or business address. The form requires you to provide basic business information, including the business name, registered agent, and principal office address.

Why File the Wisconsin Annual Report Form 18?

Filing the Wisconsin Annual Report Form 18 is mandatory for businesses operating in Wisconsin. Failure to file can result in penalties, fines, and even the dissolution of your business. By filing this form, you can ensure that your business remains in good standing with the state and avoid any potential consequences.

Method 1: Filing Online through the Wisconsin Department of Financial Institutions

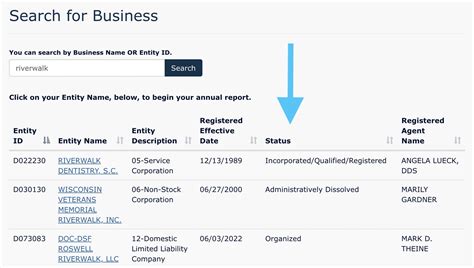

One of the most convenient ways to file the Wisconsin Annual Report Form 18 is online through the Wisconsin Department of Financial Institutions (DFI) website. To file online, you will need to create an account or log in to your existing account. Once logged in, you can access the annual report form and fill it out electronically.

Benefits of online filing:

- Convenient and easy to use

- Fast processing times

- Reduced errors

- Environmentally friendly

Requirements for Online Filing

To file online, you will need to provide the following information:

- Business name and registration number

- Registered agent and address

- Principal office address

- Business type (e.g., corporation, LLC, nonprofit)

- Authorized person's name and title

Method 2: Filing by Mail

If you prefer to file by mail, you can download the Wisconsin Annual Report Form 18 from the DFI website or request a paper copy by phone or email. Once completed, mail the form to the address listed on the form.

Benefits of mail filing:

- No need for internet access

- Can be done at your own pace

- Can be filed at any time

Requirements for Mail Filing

To file by mail, you will need to provide the same information as online filing, including:

- Business name and registration number

- Registered agent and address

- Principal office address

- Business type (e.g., corporation, LLC, nonprofit)

- Authorized person's name and title

Method 3: Filing through a Registered Agent

If you have a registered agent, you can file the Wisconsin Annual Report Form 18 through them. Registered agents are authorized to receive and forward documents, including annual reports.

Benefits of filing through a registered agent:

- Convenient for businesses with multiple entities

- Can be done online or by mail

- Reduced errors

Requirements for Filing through a Registered Agent

To file through a registered agent, you will need to provide the same information as online or mail filing, including:

- Business name and registration number

- Registered agent and address

- Principal office address

- Business type (e.g., corporation, LLC, nonprofit)

- Authorized person's name and title

Method 4: Filing through a Business Service Provider

You can also file the Wisconsin Annual Report Form 18 through a business service provider. These providers offer annual report filing services, among other business compliance services.

Benefits of filing through a business service provider:

- Convenient for businesses with multiple entities

- Can be done online or by mail

- Reduced errors

Requirements for Filing through a Business Service Provider

To file through a business service provider, you will need to provide the same information as online or mail filing, including:

- Business name and registration number

- Registered agent and address

- Principal office address

- Business type (e.g., corporation, LLC, nonprofit)

- Authorized person's name and title

Method 5: Filing through an Attorney

Finally, you can also file the Wisconsin Annual Report Form 18 through an attorney. Attorneys can provide guidance and assistance with the filing process.

Benefits of filing through an attorney:

- Expert guidance and assistance

- Can be done online or by mail

- Reduced errors

Requirements for Filing through an Attorney

To file through an attorney, you will need to provide the same information as online or mail filing, including:

- Business name and registration number

- Registered agent and address

- Principal office address

- Business type (e.g., corporation, LLC, nonprofit)

- Authorized person's name and title

We hope this article has provided you with a comprehensive guide on how to file the Wisconsin Annual Report Form 18. Remember to choose the method that best suits your business needs, and don't hesitate to seek help if you need assistance with the filing process.

What is the deadline for filing the Wisconsin Annual Report Form 18?

+The deadline for filing the Wisconsin Annual Report Form 18 varies depending on the business type and registration date. Generally, the deadline is on or before the end of the anniversary month of the business's registration date.

What is the penalty for failing to file the Wisconsin Annual Report Form 18?

+The penalty for failing to file the Wisconsin Annual Report Form 18 can result in a fine of up to $100, and the business may be dissolved or revoked.

Can I file the Wisconsin Annual Report Form 18 online?

+Yes, you can file the Wisconsin Annual Report Form 18 online through the Wisconsin Department of Financial Institutions website.