The world of tax filing can be complex and overwhelming, especially when it comes to dealing with specific forms and regulations. As a taxpayer, it's essential to stay on top of the requirements to avoid any penalties or delays in the processing of your return. One such form that may require attention is the CA Form 8453-OL, used for reporting certain types of income and claiming credits. In this article, we'll delve into the importance of accurately filing this form and provide five valuable tips to ensure a smooth process.

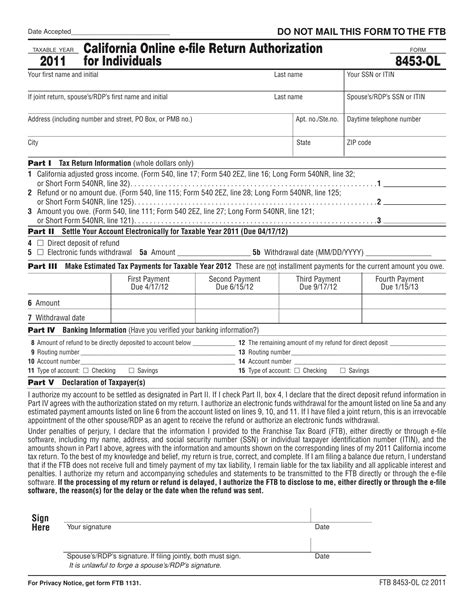

Understanding the CA Form 8453-OL

The CA Form 8453-OL is an online version of the original Form 8453, which is used to report income from certain types of investments, such as partnerships, S corporations, and fiduciaries. This form is typically filed by taxpayers who have income from these sources and need to report it on their state tax return. The online version of the form allows taxpayers to submit their information electronically, making the process more efficient and convenient.

Tip #1: Gather All Required Information

Before starting the filing process, it's crucial to gather all the necessary information and documents. This includes:

- Your social security number or Individual Taxpayer Identification Number (ITIN)

- Your spouse's social security number or ITIN (if filing jointly)

- The name and address of the partnership, S corporation, or fiduciary

- The type of income being reported (e.g., partnership income, S corporation income, etc.)

- The amount of income being reported

- Any supporting documentation, such as K-1 forms or Schedule K-1

Tip #2: Use the Correct Filing Status

When filing the CA Form 8453-OL, it's essential to use the correct filing status. The filing status will determine which lines of the form need to be completed and which credits can be claimed. The most common filing statuses are:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Using the incorrect filing status can lead to errors and delays in the processing of your return.

**Reporting Income and Claiming Credits**

The CA Form 8453-OL is used to report income from certain types of investments and claim credits. It's essential to accurately report all income and claim only the credits you're eligible for.

Tip #3: Report All Income

When completing the CA Form 8453-OL, make sure to report all income from the partnership, S corporation, or fiduciary. This includes:

- Partnership income

- S corporation income

- Fiduciary income

- Any other type of income required to be reported on the form

Failure to report all income can lead to penalties and interest on the unpaid tax.

**Claiming Credits**

The CA Form 8453-OL also allows taxpayers to claim certain credits, such as the California earned income tax credit (CalEITC). To claim credits, you'll need to:

- Meet the eligibility requirements for the credit

- Complete the required lines of the form

- Attach any supporting documentation

Tip #4: E-File for Faster Processing

E-filing the CA Form 8453-OL can significantly speed up the processing of your return. When you e-file, you'll receive an electronic confirmation that the Franchise Tax Board (FTB) has received your return. This can help reduce the risk of errors and ensure that your return is processed quickly.

Tip #5: Seek Professional Help If Needed

If you're unsure about how to complete the CA Form 8453-OL or need help with the filing process, consider seeking the assistance of a tax professional. A tax professional can help ensure that your return is accurate and complete, reducing the risk of errors and penalties.

By following these five tips, you can ensure a smooth and efficient filing process for your CA Form 8453-OL. Remember to gather all required information, use the correct filing status, report all income, claim only eligible credits, and consider e-filing for faster processing.

We hope this article has been informative and helpful in your tax filing journey. If you have any questions or need further clarification on the CA Form 8453-OL, please don't hesitate to reach out.

Share Your Thoughts!

Have you filed the CA Form 8453-OL before? Share your experiences and tips in the comments below! If you found this article helpful, please share it with others who may benefit from the information.

FAQ Section

What is the CA Form 8453-OL used for?

+The CA Form 8453-OL is used to report income from certain types of investments, such as partnerships, S corporations, and fiduciaries, and to claim credits.

Can I file the CA Form 8453-OL electronically?

+Yes, you can e-file the CA Form 8453-OL through the Franchise Tax Board's (FTB) website.

What credits can I claim on the CA Form 8453-OL?

+You can claim credits such as the California earned income tax credit (CalEITC) on the CA Form 8453-OL.