As the tax season approaches, individuals and tax professionals alike are gearing up to tackle the complex world of tax filing. One of the most critical forms for those who have taken distributions from qualified retirement accounts, such as 401(k) or IRA, is Form 5329. Specifically, Line 48 of Form 5329 can be a source of confusion for many filers. In this article, we will delve into the world of Form 5329, Line 48, and provide five essential filing tips to help you navigate this often-misunderstood section.

Understanding Form 5329 and Line 48

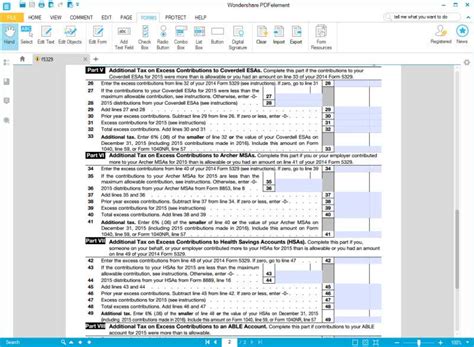

Form 5329 is used to report additional taxes on qualified plans, including IRAs and 401(k) plans. Line 48 of Form 5329 is specifically used to report the additional tax on early distributions from qualified retirement plans. This tax is also known as the "early withdrawal penalty" or "early distribution penalty."

Why is Form 5329, Line 48, Important?

Failing to properly report and pay the additional tax on early distributions can result in penalties and interest. The IRS takes a dim view of underreporting or failure to report income, and the consequences can be severe. By accurately completing Form 5329, Line 48, you can avoid costly mistakes and ensure compliance with tax laws.

5 Essential Filing Tips for Form 5329, Line 48

Here are five essential filing tips to help you master Form 5329, Line 48:

Tip 1: Determine If You Need to File Form 5329

Before you start filling out Form 5329, you need to determine if you are required to file it. If you took a distribution from a qualified retirement account before age 59 1/2, you may be subject to the early distribution penalty. However, there are some exceptions, such as using the distribution for a first-time home purchase or to pay for qualified education expenses.

Tip 2: Gather Required Documents

To accurately complete Form 5329, Line 48, you will need to gather the following documents:

- Form 1099-R, which reports the distribution from the qualified retirement account

- A copy of the qualified retirement account statement

- Documentation supporting any exceptions to the early distribution penalty

Tip 3: Calculate the Additional Tax

To calculate the additional tax on early distributions, you will need to multiply the distribution amount by 10% (or 25% if the distribution is from a SIMPLE IRA). You can use the following formula:

Additional Tax = Distribution Amount x 10% (or 25%)

For example, if you took a distribution of $10,000 from a qualified retirement account, the additional tax would be:

Additional Tax = $10,000 x 10% = $1,000

Tip 4: Complete Form 5329, Line 48

To complete Form 5329, Line 48, you will need to enter the additional tax calculated in Tip 3. Make sure to follow the instructions carefully and enter the correct amount.

Tip 5: Report the Additional Tax on Your Tax Return

Finally, you will need to report the additional tax on your tax return. You can do this by completing Form 1040, Line 58. Make sure to attach a copy of Form 5329 to your tax return.

Additional Considerations

In addition to the five essential filing tips, there are a few more things to keep in mind when completing Form 5329, Line 48:

- If you are under age 55 and separated from service, you may be exempt from the early distribution penalty.

- If you are using the distribution for a first-time home purchase, you may be exempt from the early distribution penalty.

- You may be able to waive the early distribution penalty if you can show that the distribution was due to a hardship or disability.

Conclusion

Mastering Form 5329, Line 48, requires attention to detail and a thorough understanding of the tax laws. By following the five essential filing tips outlined in this article, you can ensure accurate completion of this critical form. Remember to gather required documents, calculate the additional tax, complete Form 5329, Line 48, and report the additional tax on your tax return.

We hope this article has provided valuable insights into the world of Form 5329, Line 48. If you have any questions or need further clarification, please don't hesitate to reach out.

What is Form 5329 used for?

+Form 5329 is used to report additional taxes on qualified plans, including IRAs and 401(k) plans.

What is the early distribution penalty?

+The early distribution penalty is a 10% tax on distributions from qualified retirement accounts taken before age 59 1/2.

How do I calculate the additional tax on early distributions?

+To calculate the additional tax, multiply the distribution amount by 10% (or 25% if the distribution is from a SIMPLE IRA).