When it comes to reporting and paying taxes on investments, understanding the differences between Form 4797 and Schedule D is crucial for taxpayers. Both forms are used to report capital gains and losses, but they serve distinct purposes and have different requirements. In this article, we will delve into the specifics of Form 4797 and Schedule D, exploring their similarities and differences, and providing guidance on when to use each form.

Form 4797: Sales of Business Property

Form 4797, also known as the Sales of Business Property form, is used to report the sale or exchange of business property, including depreciable assets, such as real estate, equipment, and vehicles. This form is typically used by businesses and self-employed individuals who have sold or disposed of property used in their trade or business.

When to Use Form 4797:

- Sale or exchange of depreciable assets, such as buildings, machinery, or equipment

- Sale or exchange of business use percentage of a property, such as a rental property

- Disposition of property under a like-kind exchange (Section 1031 exchange)

Key Features of Form 4797:

- Calculates gain or loss on the sale of business property

- Allows for depreciation recapture, which can impact taxable income

- Requires the calculation of the adjusted basis of the property sold

How to Complete Form 4797

To complete Form 4797, taxpayers need to:

- Identify the type of property sold (depreciable asset, real estate, etc.)

- Calculate the adjusted basis of the property sold

- Determine the gain or loss on the sale

- Complete Part I, II, or III, depending on the type of property sold

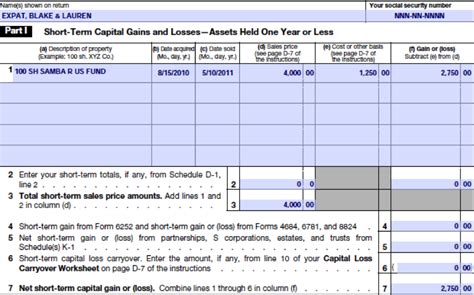

Schedule D: Capital Gains and Losses

Schedule D, also known as the Capital Gains and Losses form, is used to report the sale or exchange of capital assets, such as stocks, bonds, mutual funds, and real estate. This form is typically used by individuals and businesses that have sold or disposed of capital assets.

When to Use Schedule D:

- Sale or exchange of capital assets, such as stocks, bonds, or mutual funds

- Sale or exchange of personal use property, such as a primary residence

- Calculation of net capital gain or loss

Key Features of Schedule D:

- Calculates net capital gain or loss from the sale of capital assets

- Allows for the calculation of long-term and short-term capital gains and losses

- Requires the reporting of wash sales, if applicable

How to Complete Schedule D

To complete Schedule D, taxpayers need to:

- Identify the type of property sold (capital asset, personal use property, etc.)

- Calculate the gain or loss on the sale

- Determine the holding period (short-term or long-term)

- Complete Part I, II, or III, depending on the type of property sold

Comparison of Form 4797 and Schedule D

While both Form 4797 and Schedule D are used to report gains and losses from property sales, there are key differences between the two forms:

- Purpose: Form 4797 is used for business property sales, while Schedule D is used for capital asset sales.

- Depreciation: Form 4797 requires depreciation recapture, while Schedule D does not.

- Holding Period: Schedule D requires the calculation of holding period, while Form 4797 does not.

- Capital Gains: Schedule D calculates net capital gain or loss, while Form 4797 calculates gain or loss on the sale of business property.

Example Scenarios

To illustrate the differences between Form 4797 and Schedule D, consider the following scenarios:

Scenario 1: John sells his rental property, which he has used for business purposes. He would use Form 4797 to report the sale, as it is a business property.

Scenario 2: Sarah sells her stocks, which she has held for over a year. She would use Schedule D to report the sale, as it is a capital asset.

Scenario 3: Michael sells his primary residence, which he has used for personal purposes. He would use Schedule D to report the sale, as it is a personal use property.

Conclusion

In conclusion, Form 4797 and Schedule D serve distinct purposes and have different requirements. Taxpayers must understand the differences between the two forms to accurately report gains and losses from property sales. By following the guidelines outlined in this article, taxpayers can ensure compliance with tax regulations and avoid costly errors.

We hope this article has been informative and helpful in understanding the differences between Form 4797 and Schedule D. If you have any questions or need further clarification, please leave a comment below.

What is the main difference between Form 4797 and Schedule D?

+The main difference between Form 4797 and Schedule D is the type of property being sold. Form 4797 is used for business property sales, while Schedule D is used for capital asset sales.

Do I need to file both Form 4797 and Schedule D?

+No, you would only need to file one or the other, depending on the type of property being sold. If you are unsure which form to use, consult with a tax professional or refer to the IRS instructions.

Can I use Schedule D to report the sale of business property?

+No, Schedule D is only used for capital asset sales. If you are selling business property, you would need to use Form 4797.