The Form ST-120.1 is a vital document for businesses operating in New York State, particularly those involved in sales tax collection. As a business owner or accountant, it's essential to understand the ins and outs of this form to ensure compliance with state regulations and avoid any potential penalties.

What is Form ST-120.1?

Form ST-120.1, also known as the "New York State and Local Sales and Use Tax Return," is a quarterly tax return form used by businesses to report and pay sales tax to the New York State Department of Taxation and Finance. This form is typically filed by businesses that are required to collect sales tax on behalf of the state, such as retailers, wholesalers, and service providers.

Who Needs to File Form ST-120.1?

Not all businesses operating in New York State need to file Form ST-120.1. However, if your business is required to collect sales tax, you'll need to file this form on a quarterly basis. This includes businesses that:

- Sell taxable goods or services

- Collect sales tax from customers

- Have a presence in New York State, such as a storefront or warehouse

- Are registered for a Certificate of Authority to collect sales tax

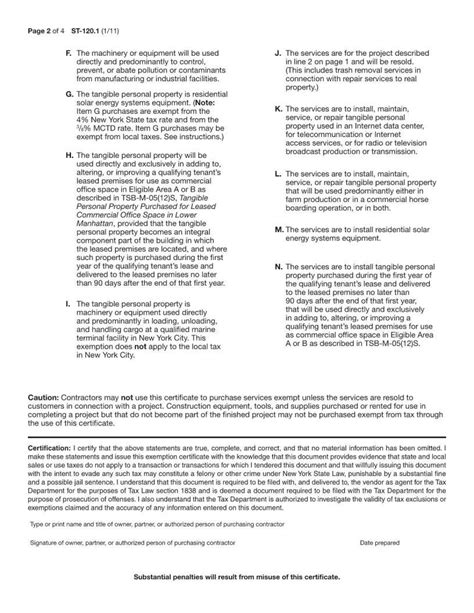

Key Components of Form ST-120.1

Form ST-120.1 is a multi-page document that requires businesses to report various types of sales tax information. Some of the key components of this form include:

- Business identification information, such as the business name, address, and tax identification number

- Sales tax liability, including the total amount of sales tax collected and the amount of sales tax due to the state

- Taxable sales, including the total amount of sales subject to sales tax

- Exempt sales, including the total amount of sales exempt from sales tax

- Credits and deductions, including any applicable credits or deductions claimed by the business

Penalties for Late or Inaccurate Filing

Businesses that fail to file Form ST-120.1 on time or accurately may be subject to penalties and interest. These penalties can be significant, ranging from 5% to 30% of the total sales tax due, depending on the circumstances. Additionally, businesses may be subject to audit and collection activities by the New York State Department of Taxation and Finance.

Best Practices for Filing Form ST-120.1

To avoid penalties and ensure compliance with state regulations, businesses should follow these best practices when filing Form ST-120.1:

- File the form on time, typically by the 20th day of the month following the end of the quarter

- Ensure accurate reporting of sales tax information, including taxable sales, exempt sales, and credits and deductions

- Keep accurate records of sales tax transactions, including receipts, invoices, and bank statements

- Seek professional advice from a tax professional or accountant if unsure about any aspect of the form

Electronic Filing Options

The New York State Department of Taxation and Finance offers electronic filing options for Form ST-120.1, including:

- Online filing through the state's website

- Electronic fund transfer (EFT) for payment of sales tax

- Electronic filing through a certified software provider

Conclusion and Next Steps

Filing Form ST-120.1 is a critical component of sales tax compliance in New York State. By understanding the essential facts about this form and following best practices for filing, businesses can avoid penalties and ensure accurate reporting of sales tax information. If you have any questions or concerns about Form ST-120.1, consult with a tax professional or accountant for guidance.

What is the deadline for filing Form ST-120.1?

+The deadline for filing Form ST-120.1 is typically the 20th day of the month following the end of the quarter.

Who needs to file Form ST-120.1?

+Businesses that are required to collect sales tax on behalf of the state, such as retailers, wholesalers, and service providers, need to file Form ST-120.1.

What are the penalties for late or inaccurate filing of Form ST-120.1?

+The penalties for late or inaccurate filing of Form ST-120.1 can range from 5% to 30% of the total sales tax due, depending on the circumstances.