Completing the VA Form 10-7959f-1 can be a daunting task, especially for those who are new to the process. The form is used to apply for the Veterans' Mortgage Life Insurance (VMLI) program, which provides financial protection to the families of severely disabled veterans. In this article, we will provide a comprehensive guide on how to complete the VA Form 10-7959f-1, highlighting the key steps and requirements to ensure a smooth application process.

Understanding the VA Form 10-7959f-1

Before diving into the completion process, it's essential to understand the purpose and scope of the VA Form 10-7959f-1. The form is used to apply for the VMLI program, which provides mortgage life insurance coverage to severely disabled veterans. The program is designed to help veterans purchase, build, or improve a home, and to ensure that their families are protected in the event of their death.

Who is Eligible for the VMLI Program?

To be eligible for the VMLI program, veterans must meet specific requirements, including:

- Having a service-connected disability rating of 70% or higher

- Receiving VA compensation for a service-connected disability

- Having a mortgage on a home that is adapted to their disability needs

Step 1: Gathering Required Documents

Before starting the application process, it's crucial to gather all required documents, including:

- VA Form 10-7959f-1 (Application for Veterans' Mortgage Life Insurance)

- VA Form 26-1880 (Request for Certificate of Eligibility)

- Proof of service-connected disability rating

- Proof of VA compensation for service-connected disability

- Mortgage documents, including the deed and title report

What to Expect During the Application Process

The application process typically takes several weeks to complete, and may involve additional documentation or verification. It's essential to be patient and responsive to VA requests for additional information.

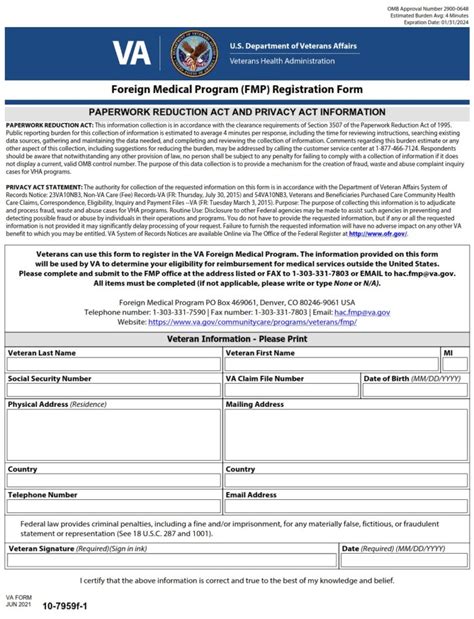

Step 2: Completing Section I - Veteran's Information

Section I of the VA Form 10-7959f-1 requires veterans to provide personal and contact information, including:

- Name and address

- Social Security number

- Date of birth

- Contact information, including phone number and email address

Tips for Completing Section I

- Ensure accuracy and completeness of information

- Use a legible and clear handwriting

- Provide a valid email address for electronic communication

Step 3: Completing Section II - Mortgage Information

Section II requires veterans to provide information about their mortgage, including:

- Mortgage lender and address

- Mortgage amount and interest rate

- Property address and value

Tips for Completing Section II

- Ensure accuracy and completeness of information

- Use a legible and clear handwriting

- Provide documentation, such as the deed and title report, to support mortgage information

Step 4: Completing Section III - Insurance Information

Section III requires veterans to provide information about their insurance needs, including:

- Amount of insurance coverage desired

- Type of insurance coverage desired (e.g., term life, whole life)

Tips for Completing Section III

- Ensure accuracy and completeness of information

- Use a legible and clear handwriting

- Consider consulting with a licensed insurance professional to determine the best insurance options

Step 5: Submitting the Application

Once the application is complete, it's essential to submit it to the VA for processing. Veterans can submit their application online, by mail, or through a VA representative.

Tips for Submitting the Application

- Ensure accuracy and completeness of information

- Use a secure and trackable method of submission (e.g., certified mail)

- Keep a copy of the application and supporting documents for personal records

What is the purpose of the VA Form 10-7959f-1?

+The VA Form 10-7959f-1 is used to apply for the Veterans' Mortgage Life Insurance (VMLI) program, which provides financial protection to the families of severely disabled veterans.

Who is eligible for the VMLI program?

+To be eligible for the VMLI program, veterans must have a service-connected disability rating of 70% or higher, receive VA compensation for a service-connected disability, and have a mortgage on a home that is adapted to their disability needs.

What documents are required to complete the VA Form 10-7959f-1?

+Required documents include the VA Form 10-7959f-1, VA Form 26-1880, proof of service-connected disability rating, proof of VA compensation for service-connected disability, and mortgage documents, including the deed and title report.

By following these steps and tips, veterans can ensure a smooth and successful application process for the VMLI program. Remember to stay patient and responsive to VA requests for additional information, and don't hesitate to seek guidance from a licensed insurance professional if needed.