Taxes can be a daunting and complex aspect of personal finance, and navigating the various forms and regulations can be overwhelming for many taxpayers. The TC-40W form is a crucial document for individuals who receive income from sources other than their primary employer, and understanding its purpose and requirements is essential for accurate tax filing. In this article, we will delve into the world of the TC-40W form, providing a comprehensive guide for taxpayers to ensure they are well-equipped to handle this important tax document.

What is the TC-40W Form?

The TC-40W form is a tax document used by the state of Utah to report withholding on non-wage income, such as pensions, annuities, and certain types of investments. This form is used by payers to report the amount of income withheld and paid to the state on behalf of the recipient. The TC-40W form is typically used in conjunction with the TC-40 form, which is the primary income tax return form for Utah residents.

Who Needs to File the TC-40W Form?

The TC-40W form is required for individuals who receive income from sources other than their primary employer, such as:

- Pension and annuity recipients

- Recipients of certain types of investment income

- Individuals who receive income from a trust or estate

- Non-resident aliens who receive income from Utah sources

Payers are also required to file the TC-40W form to report withholding on non-wage income. This includes:

- Employers who pay pensions or annuities

- Financial institutions that pay investment income

- Trusts and estates that distribute income to beneficiaries

How to Complete the TC-40W Form

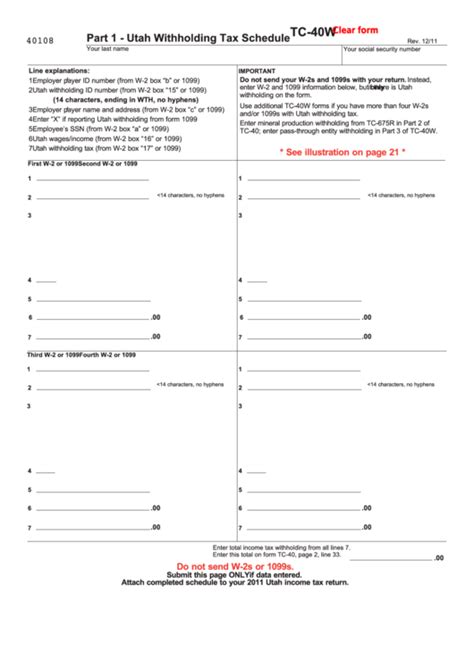

Completing the TC-40W form requires careful attention to detail and accuracy. Here are the steps to follow:

- Identify the payer and recipient information, including names, addresses, and tax identification numbers.

- Report the type and amount of income withheld, using the appropriate codes and descriptions.

- Calculate the amount of withholding tax, using the applicable tax rate and withholding tables.

- Report any adjustments or corrections to the withholding tax amount.

- Sign and date the form, certifying that the information is accurate and complete.

TC-40W Form Deadlines and Penalties

The TC-40W form is typically due on the last day of February following the tax year. For example, the 2022 TC-40W form is due on February 28, 2023. Failure to file the form on time may result in penalties and interest.

- Late filing penalty: 5% of the unpaid tax per month, up to a maximum of 25%.

- Late payment penalty: 0.5% of the unpaid tax per month, up to a maximum of 25%.

- Interest: calculated on the unpaid tax balance, starting from the original due date.

TC-40W Form Frequently Asked Questions

Here are some frequently asked questions about the TC-40W form:

- Q: Who is required to file the TC-40W form? A: Payers who withhold income tax on non-wage income, such as pensions, annuities, and certain types of investments.

- Q: What is the deadline for filing the TC-40W form? A: The last day of February following the tax year.

- Q: What are the penalties for late filing and payment? A: Late filing penalty: 5% of the unpaid tax per month, up to a maximum of 25%. Late payment penalty: 0.5% of the unpaid tax per month, up to a maximum of 25%. Interest: calculated on the unpaid tax balance, starting from the original due date.

Conclusion

In conclusion, the TC-40W form is an essential tax document for individuals who receive income from sources other than their primary employer. Understanding the purpose, requirements, and deadlines for filing the TC-40W form is crucial for accurate tax filing and avoiding penalties. By following the guidelines and instructions outlined in this article, taxpayers can ensure they are in compliance with Utah state tax regulations and avoid any potential issues.

We hope this comprehensive guide has been informative and helpful in understanding the TC-40W form. If you have any further questions or concerns, please do not hesitate to reach out to a tax professional or the Utah State Tax Commission.

What is the purpose of the TC-40W form?

+The TC-40W form is used to report withholding on non-wage income, such as pensions, annuities, and certain types of investments.

Who is required to file the TC-40W form?

+Payers who withhold income tax on non-wage income, such as pensions, annuities, and certain types of investments.

What is the deadline for filing the TC-40W form?

+The last day of February following the tax year.