Understanding the Process for Reclaiming a Missing Stimulus Check with Form 3911

If you're one of the many individuals who have not received their stimulus check, you may be wondering how to proceed. The good news is that the Internal Revenue Service (IRS) has a formal process in place to help you reclaim your missing payment. One of the key steps in this process is completing Form 3911, also known as the Taxpayer Statement Regarding Refund.

In this article, we'll guide you through the process of completing Form 3911 for a missing stimulus check. We'll cover the eligibility criteria, the necessary steps, and provide helpful tips to ensure a smooth experience.

Eligibility Criteria for Form 3911

Before we dive into the process, it's essential to understand who is eligible to file Form 3911. The following individuals may be eligible:

- Those who did not receive their stimulus check or Economic Impact Payment (EIP) by mail or direct deposit.

- Individuals who received a partial payment but did not receive the full amount they were eligible for.

- Taxpayers who were not eligible for a stimulus check but believe they should have been.

If you're unsure about your eligibility, you can visit the IRS website or consult with a tax professional.

Step-by-Step Guide to Completing Form 3911

Now that we've covered the eligibility criteria, let's move on to the step-by-step guide for completing Form 3911.

- Download or Obtain Form 3911: You can download Form 3911 from the IRS website or obtain a copy from your local IRS office.

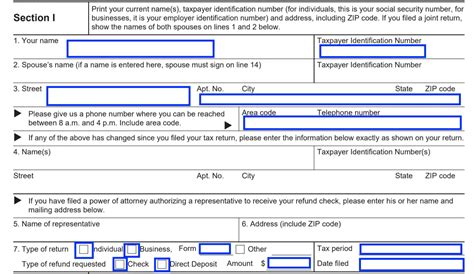

- Complete Section 1: Taxpayer Information: Fill in your name, address, and Social Security number or Individual Taxpayer Identification Number (ITIN).

- Complete Section 2: Stimulus Check Information: Provide the details of your missing stimulus check, including the amount you were eligible for and the payment method you chose.

- Complete Section 3: Statement: Write a brief statement explaining why you're filing Form 3911. Be sure to include the following information:

- The reason for filing the form (e.g., missing stimulus check).

- The amount of the missing payment.

- Any relevant supporting documentation (e.g., proof of income, dependent information).

- Sign and Date the Form: Sign and date the form, making sure to use the same name and address as on your tax return.

Supporting Documentation

When completing Form 3911, it's essential to include supporting documentation to help the IRS process your claim. The following documents may be required:

- Proof of income (e.g., W-2 forms, 1099 forms).

- Dependent information (e.g., birth certificates, Social Security numbers).

- Proof of identity (e.g., driver's license, passport).

Submitting Form 3911

Once you've completed Form 3911, you'll need to submit it to the IRS. You can do this in one of the following ways:

- Mail: Mail the form to the IRS address listed in the instructions.

- Fax: Fax the form to the IRS fax number listed in the instructions.

- In-Person: Take the form to your local IRS office.

Processing Time and Follow-up

After submitting Form 3911, the IRS will review your claim and issue a payment or notify you of any additional information needed. The processing time may vary, but you can expect to receive a response within 4-6 weeks.

If you have not received a response or payment after 6 weeks, you can contact the IRS to inquire about the status of your claim.

Tips and Reminders

To ensure a smooth experience, keep the following tips and reminders in mind:

- Make sure to complete the form accurately and thoroughly.

- Include all required supporting documentation.

- Keep a copy of the form and supporting documentation for your records.

- If you're unsure about any part of the process, consider consulting with a tax professional.

Conclusion and Next Steps

Completing Form 3911 is an essential step in reclaiming a missing stimulus check. By following the step-by-step guide and tips outlined in this article, you'll be well on your way to resolving the issue.

Remember to stay patient and persistent throughout the process. If you have any further questions or concerns, don't hesitate to reach out to the IRS or a tax professional.

What is Form 3911, and why do I need it?

+Form 3911 is a taxpayer statement regarding refunds, used to reclaim a missing stimulus check. You'll need it to provide the IRS with the necessary information to process your claim.

How long does it take to process Form 3911?

+The processing time for Form 3911 may vary, but you can expect to receive a response within 4-6 weeks.

Can I file Form 3911 online?

+No, Form 3911 cannot be filed online. You'll need to mail, fax, or submit it in person to the IRS.

We hope this article has provided you with the necessary information and guidance to complete Form 3911 and reclaim your missing stimulus check. If you have any further questions or concerns, don't hesitate to reach out.