If you're an employee who has received undistributed capital gains from a mutual fund or other regulated investment company, you may need to report this income on your tax return using IRS Form 2439. Filling out this form correctly is crucial to avoid errors or delays in processing your tax return. In this article, we'll provide you with a step-by-step guide on how to fill out IRS Form 2439 correctly.

Understanding IRS Form 2439

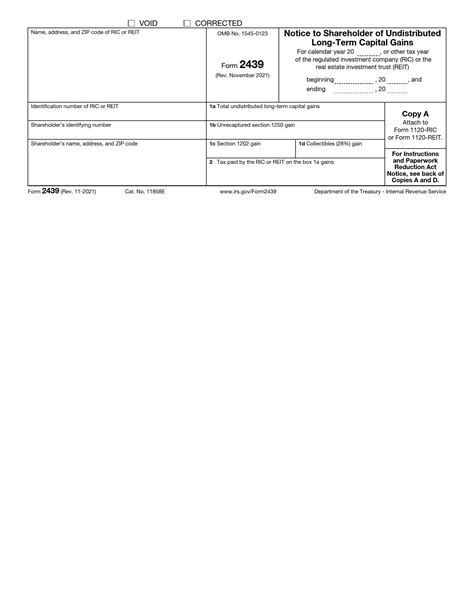

Before we dive into the instructions, let's take a brief look at what IRS Form 2439 is and why you need to use it. IRS Form 2439 is used to report undistributed capital gains from a mutual fund or other regulated investment company. This form is typically used by employees who have received capital gains distributions from their employer's retirement plan or other investment vehicles.

Who Needs to File IRS Form 2439?

You'll need to file IRS Form 2439 if you've received undistributed capital gains from a mutual fund or other regulated investment company. This includes:

- Employees who have received capital gains distributions from their employer's retirement plan

- Individuals who have invested in mutual funds or other regulated investment companies

- Beneficiaries of estates or trusts that have received undistributed capital gains

6 Ways to Fill Out IRS Form 2439 Correctly

Now that we've covered the basics, let's move on to the instructions for filling out IRS Form 2439.

Step 1: Gather Required Information

Before you start filling out IRS Form 2439, make sure you have the following information:

- Your name and address

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- The name and address of the mutual fund or other regulated investment company

- The amount of undistributed capital gains you've received

- The date you received the undistributed capital gains

Step 2: Complete Part I - Undistributed Capital Gains

In Part I of IRS Form 2439, you'll need to report the undistributed capital gains you've received. You'll need to provide the following information:

- The amount of undistributed capital gains you've received

- The date you received the undistributed capital gains

- The name and address of the mutual fund or other regulated investment company

Use the following format to report the undistributed capital gains:

- Column A: Amount of undistributed capital gains

- Column B: Date received

- Column C: Name and address of the mutual fund or other regulated investment company

Step 3: Complete Part II - Tax on Undistributed Capital Gains

In Part II of IRS Form 2439, you'll need to calculate the tax on the undistributed capital gains. You'll need to provide the following information:

- The amount of tax on the undistributed capital gains

- The date the tax was paid

Use the following format to report the tax on the undistributed capital gains:

- Column A: Amount of tax

- Column B: Date paid

Step 4: Complete Part III - Credit for Tax Withheld

In Part III of IRS Form 2439, you'll need to report the credit for tax withheld. You'll need to provide the following information:

- The amount of tax withheld

- The date the tax was withheld

Use the following format to report the credit for tax withheld:

- Column A: Amount of tax withheld

- Column B: Date withheld

Step 5: Complete Part IV - Statement

In Part IV of IRS Form 2439, you'll need to provide a statement explaining the reason for filing the form. You'll need to provide the following information:

- A brief explanation of the reason for filing the form

- Your signature and date

Step 6: Review and Sign the Form

Once you've completed all the parts of IRS Form 2439, review the form carefully to ensure that all the information is accurate and complete. Sign the form and date it.

Conclusion

Filling out IRS Form 2439 correctly is crucial to avoid errors or delays in processing your tax return. By following these steps, you'll be able to complete the form accurately and avoid any potential issues. Remember to review the form carefully before submitting it to the IRS.

Frequently Asked Questions

What is IRS Form 2439 used for?

+IRS Form 2439 is used to report undistributed capital gains from a mutual fund or other regulated investment company.

Who needs to file IRS Form 2439?

+Employees who have received capital gains distributions from their employer's retirement plan, individuals who have invested in mutual funds or other regulated investment companies, and beneficiaries of estates or trusts that have received undistributed capital gains need to file IRS Form 2439.

What information do I need to gather before filling out IRS Form 2439?

+You'll need to gather your name and address, Social Security number or ITIN, the name and address of the mutual fund or other regulated investment company, the amount of undistributed capital gains you've received, and the date you received the undistributed capital gains.