As a freelancer, independent contractor, or small business owner, receiving a PNC 1099 form can be a crucial part of your tax reporting obligations. The 1099 form is used to report various types of income, such as freelance work, interest, dividends, and capital gains, to the Internal Revenue Service (IRS). In this article, we will delve into the world of PNC 1099 forms, exploring what they are, how they work, and what you need to do to comply with tax reporting requirements.

What is a PNC 1099 Form?

A PNC 1099 form is a tax document used to report income earned from various sources, such as freelance work, interest, dividends, and capital gains. The form is typically issued by a payer, such as a bank or a client, to report income earned by a recipient, such as a freelancer or independent contractor. The PNC 1099 form is used to report income earned during the tax year, which is typically January 1 to December 31.

Types of 1099 Forms

There are several types of 1099 forms, each used to report different types of income. Some of the most common types of 1099 forms include:

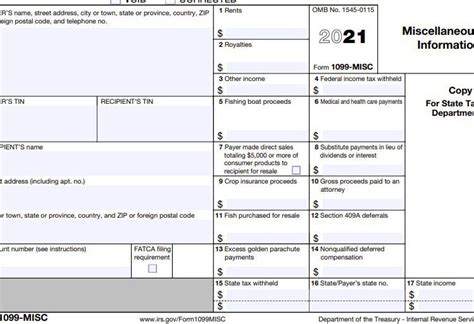

- 1099-MISC: Used to report miscellaneous income, such as freelance work, royalties, and prizes.

- 1099-INT: Used to report interest income, such as interest earned on bank accounts and investments.

- 1099-DIV: Used to report dividend income, such as dividends earned on stock investments.

- 1099-B: Used to report capital gains and losses, such as gains and losses from the sale of stocks, bonds, and other investments.

How to Obtain a PNC 1099 Form

If you are a freelancer, independent contractor, or small business owner, you can obtain a PNC 1099 form from the payer who issued the form. The payer is typically required to provide you with a copy of the 1099 form by January 31 of each year. If you do not receive a 1099 form, you can contact the payer to request a copy.

PNC 1099 Form Requirements

To be considered a valid 1099 form, the form must meet certain requirements. These requirements include:

- The form must be issued by a payer, such as a bank or client.

- The form must be issued to a recipient, such as a freelancer or independent contractor.

- The form must report income earned during the tax year.

- The form must be completed accurately and thoroughly.

- The form must be provided to the recipient by January 31 of each year.

How to Complete a PNC 1099 Form

Completing a PNC 1099 form is a relatively straightforward process. Here are the steps you need to follow:

- Gather the necessary information, including the payer's name and address, the recipient's name and address, and the amount of income earned.

- Complete the form accurately and thoroughly, making sure to report all income earned during the tax year.

- Sign and date the form.

- Provide a copy of the form to the recipient by January 31 of each year.

PNC 1099 Form Deadlines

There are several deadlines associated with PNC 1099 forms. These deadlines include:

- January 31: The deadline for payers to provide recipients with a copy of the 1099 form.

- February 28: The deadline for payers to file the 1099 form with the IRS.

- March 31: The deadline for payers to file the 1099 form with the IRS if filing electronically.

Penalties for Not Filing a PNC 1099 Form

Failure to file a PNC 1099 form can result in penalties and fines. The penalties for not filing a 1099 form include:

- A penalty of $50 per form for failing to file a 1099 form with the IRS.

- A penalty of $100 per form for failing to provide a recipient with a copy of the 1099 form.

- A penalty of $250 per form for intentionally failing to file a 1099 form or provide a recipient with a copy of the form.

PNC 1099 Form Exceptions

There are several exceptions to the PNC 1099 form requirements. These exceptions include:

- Payments made to corporations are not required to be reported on a 1099 form.

- Payments made to tax-exempt organizations are not required to be reported on a 1099 form.

- Payments made to individuals who earn less than $600 in a calendar year are not required to be reported on a 1099 form.

How to Report Income from a PNC 1099 Form

Reporting income from a PNC 1099 form is a relatively straightforward process. Here are the steps you need to follow:

- Gather the necessary information, including the 1099 form and any other relevant tax documents.

- Complete Form 1040, which is the standard form used to report personal income tax.

- Report the income from the 1099 form on Schedule C, which is the form used to report business income and expenses.

- Calculate your tax liability based on the income reported on the 1099 form.

PNC 1099 Form Audits

The IRS may audit a PNC 1099 form to ensure that the income reported is accurate and complete. If you are audited, you will be required to provide documentation to support the income reported on the 1099 form. This documentation may include:

- A copy of the 1099 form.

- Records of the income earned, such as invoices and receipts.

- Records of any expenses related to the income earned.

Conclusion

PNC 1099 forms are an important part of tax reporting requirements for freelancers, independent contractors, and small business owners. By understanding what a PNC 1099 form is, how it works, and what you need to do to comply with tax reporting requirements, you can avoid penalties and fines and ensure that you are in compliance with IRS regulations. Remember to always keep accurate and complete records, and to report income from a PNC 1099 form on your tax return.

If you have any questions or concerns about PNC 1099 forms, we encourage you to leave a comment below. We will do our best to respond to your questions and provide additional information and resources.

What is a PNC 1099 form?

+A PNC 1099 form is a tax document used to report income earned from various sources, such as freelance work, interest, dividends, and capital gains.

Who is required to file a PNC 1099 form?

+Payers who make payments to freelancers, independent contractors, and small business owners are required to file a PNC 1099 form with the IRS.

What is the deadline for filing a PNC 1099 form?

+The deadline for filing a PNC 1099 form with the IRS is February 28 for paper filers and March 31 for electronic filers.