As the tax season approaches, many Kentuckians are gearing up to file their tax returns. For individuals residing in the Bluegrass State, the Kentucky Form 740 is the standard form used to report personal income taxes. However, navigating the complexities of tax filing can be overwhelming, especially for those who are new to the process or have undergone significant life changes. In this article, we will provide five essential tips for filing Kentucky Form 740, helping you to avoid common pitfalls and ensure a smooth tax filing experience.

Understanding the Basics of Kentucky Form 740

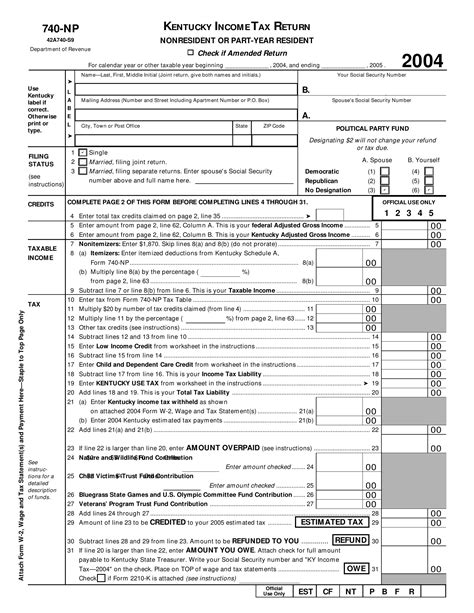

Before diving into the tips, it's essential to understand the basics of Kentucky Form 740. The form is used to report an individual's income, deductions, and credits, as well as calculate their state tax liability. The form consists of several sections, including income, adjustments, deductions, and credits. Taxpayers can file their Form 740 electronically or by mail, and the deadline for submission is typically April 15th.

Tip #1: Gather All Necessary Documents

One of the most critical steps in filing Kentucky Form 740 is gathering all necessary documents. This includes:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Interest statements from banks and investments

- Dividend statements

- Charitable donation receipts

- Medical expense receipts

Having all these documents in one place will help you accurately report your income, deductions, and credits.

**Organizing Your Documents**

To make the filing process more manageable, consider organizing your documents into separate categories. This can include:

- Income documents (W-2s, 1099s, etc.)

- Deduction documents (charitable donations, medical expenses, etc.)

- Credit documents (education credits, child tax credits, etc.)

By categorizing your documents, you'll be able to quickly locate the information you need when completing your Form 740.

Tip #2: Choose the Correct Filing Status

Your filing status plays a significant role in determining your tax liability. Kentucky recognizes the following filing statuses:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Choose the correct filing status to ensure you're eligible for the deductions and credits you're entitled to.

**Filing Status and Its Impact on Tax Liability**

Your filing status can significantly impact your tax liability. For example, married couples who file jointly may be eligible for a lower tax rate than those who file separately. Similarly, head of household filers may be eligible for a higher standard deduction.

Tip #3: Claim All Eligible Deductions and Credits

Kentucky offers a range of deductions and credits that can help reduce your tax liability. Some of the most common deductions and credits include:

- Standard deduction

- Itemized deductions (medical expenses, charitable donations, etc.)

- Earned income tax credit (EITC)

- Child tax credit

- Education credits

Make sure to claim all eligible deductions and credits to minimize your tax liability.

Tip #4: Take Advantage of Tax Credits

Tax credits can provide a significant reduction in your tax liability. Some of the most common tax credits in Kentucky include:

- Earned income tax credit (EITC)

- Child tax credit

- Education credits

- Savers credit

Unlike deductions, which reduce your taxable income, tax credits directly reduce your tax liability. Make sure to take advantage of all eligible tax credits.

**Understanding Tax Credits**

Tax credits can be confusing, but they're essentially a dollar-for-dollar reduction in your tax liability. For example, if you're eligible for a $1,000 tax credit and your tax liability is $2,000, your new tax liability would be $1,000.

Tip #5: E-File Your Return

E-filing your Kentucky Form 740 can provide several benefits, including:

- Faster refund processing

- Reduced errors

- Increased security

Kentucky offers several e-filing options, including the Kentucky Department of Revenue's online portal and third-party tax preparation software.

Conclusion

Filing Kentucky Form 740 can be a daunting task, but by following these five essential tips, you can ensure a smooth and stress-free tax filing experience. Remember to gather all necessary documents, choose the correct filing status, claim all eligible deductions and credits, take advantage of tax credits, and e-file your return. By doing so, you'll be well on your way to minimizing your tax liability and maximizing your refund.

Get Involved

We'd love to hear from you! Share your tax filing experiences and tips in the comments below. If you have any questions or concerns, feel free to ask, and we'll do our best to provide guidance.

What is the deadline for filing Kentucky Form 740?

+The deadline for filing Kentucky Form 740 is typically April 15th.

Can I e-file my Kentucky Form 740?

+Yes, Kentucky offers several e-filing options, including the Kentucky Department of Revenue's online portal and third-party tax preparation software.

What is the standard deduction for Kentucky Form 740?

+The standard deduction for Kentucky Form 740 varies depending on your filing status. You can find the standard deduction amounts on the Kentucky Department of Revenue's website.