The Texas Sales Tax Exemption Certification Form 05-158 is a crucial document for businesses and organizations operating in the state of Texas. This form is used to certify that a purchaser is exempt from paying sales tax on certain transactions. In this article, we will delve into the importance of this form, its requirements, and the benefits of obtaining a sales tax exemption.

Understanding the Texas Sales Tax Exemption Certification Form 05-158

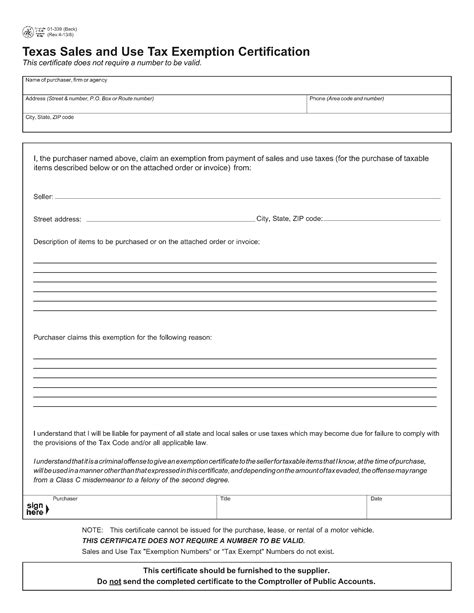

The Texas Sales Tax Exemption Certification Form 05-158 is a document provided by the Texas Comptroller's office, which is responsible for administering the state's sales tax laws. This form is used by businesses and organizations to certify that they are exempt from paying sales tax on certain transactions. The form is typically required when a business or organization makes a purchase that is exempt from sales tax, such as a purchase made for resale or a purchase made by a tax-exempt organization.

Benefits of Obtaining a Sales Tax Exemption

Obtaining a sales tax exemption can provide significant benefits to businesses and organizations. Some of the benefits of obtaining a sales tax exemption include:

- Reduced costs: By not having to pay sales tax on certain transactions, businesses and organizations can reduce their costs and improve their bottom line.

- Increased competitiveness: Businesses that are exempt from paying sales tax may be more competitive in their industry, as they can offer lower prices to their customers.

- Simplified accounting: Obtaining a sales tax exemption can simplify a business's accounting and bookkeeping processes, as they will not have to track and report sales tax on exempt transactions.

Requirements for Obtaining a Sales Tax Exemption

To obtain a sales tax exemption, businesses and organizations must meet certain requirements. Some of the requirements for obtaining a sales tax exemption include:

- Registration with the Texas Comptroller's office: Businesses and organizations must register with the Texas Comptroller's office to obtain a sales tax exemption.

- Completion of Form 05-158: Businesses and organizations must complete Form 05-158, which certifies that they are exempt from paying sales tax on certain transactions.

- Provision of supporting documentation: Businesses and organizations may be required to provide supporting documentation, such as a resale certificate or a tax-exempt certificate, to support their exemption claim.

Types of Sales Tax Exemptions

There are several types of sales tax exemptions available in Texas. Some of the most common types of sales tax exemptions include:

- Resale exemption: This exemption is available to businesses that purchase goods for resale.

- Tax-exempt organization exemption: This exemption is available to tax-exempt organizations, such as non-profit organizations and government agencies.

- Manufacturing exemption: This exemption is available to manufacturers that purchase goods and materials for use in the manufacturing process.

How to Complete Form 05-158

Completing Form 05-158 is a straightforward process. Here are the steps to follow:

- Download Form 05-158 from the Texas Comptroller's website.

- Complete the form by providing the required information, including the business's name, address, and tax ID number.

- Sign and date the form.

- Provide supporting documentation, if required.

- Submit the form to the Texas Comptroller's office.

Tips for Completing Form 05-158

Here are some tips for completing Form 05-158:

- Make sure to complete the form accurately and thoroughly.

- Provide all required supporting documentation.

- Sign and date the form.

- Submit the form to the Texas Comptroller's office in a timely manner.

Common Mistakes to Avoid When Completing Form 05-158

Here are some common mistakes to avoid when completing Form 05-158:

- Inaccurate or incomplete information.

- Failure to provide supporting documentation.

- Failure to sign and date the form.

- Failure to submit the form to the Texas Comptroller's office in a timely manner.

Consequences of Failure to Comply

Failure to comply with the requirements for obtaining a sales tax exemption can result in significant consequences, including:

- Denial of the exemption claim.

- Assessment of sales tax on exempt transactions.

- Penalties and interest.

Conclusion

In conclusion, the Texas Sales Tax Exemption Certification Form 05-158 is a crucial document for businesses and organizations operating in the state of Texas. By understanding the requirements and benefits of obtaining a sales tax exemption, businesses and organizations can reduce their costs, increase their competitiveness, and simplify their accounting and bookkeeping processes. By following the steps outlined in this article, businesses and organizations can ensure that they complete Form 05-158 accurately and thoroughly, and avoid common mistakes that can result in significant consequences.

We encourage you to share your experiences and tips for completing Form 05-158 in the comments section below. Additionally, if you have any questions or concerns about the Texas Sales Tax Exemption Certification Form 05-158, please do not hesitate to reach out to us.

What is the Texas Sales Tax Exemption Certification Form 05-158?

+The Texas Sales Tax Exemption Certification Form 05-158 is a document provided by the Texas Comptroller's office, which is used to certify that a purchaser is exempt from paying sales tax on certain transactions.

What are the benefits of obtaining a sales tax exemption?

+The benefits of obtaining a sales tax exemption include reduced costs, increased competitiveness, and simplified accounting and bookkeeping processes.

What are the requirements for obtaining a sales tax exemption?

+The requirements for obtaining a sales tax exemption include registration with the Texas Comptroller's office, completion of Form 05-158, and provision of supporting documentation.