With the increasing demand for health savings accounts (HSAs), individuals are looking for ways to report Form 5498-SA. The form, which is issued by HSA custodians, reports the contributions made to an HSA, as well as the fair market value of the account. In this article, we will explore three easy ways to report Form 5498-SA.

What is Form 5498-SA?

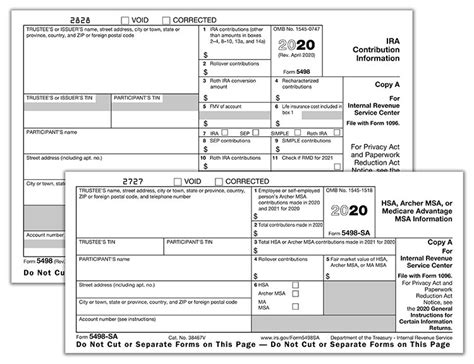

Form 5498-SA is a tax form that is used to report Health Savings Account (HSA) contributions and the fair market value of the account. The form is typically issued by the HSA custodian to the account holder by May 31st of each year. The form is used to report the following information:

- The amount of contributions made to the HSA

- The fair market value of the HSA at the end of the year

- The amount of distributions made from the HSA

Why is Form 5498-SA Important?

Form 5498-SA is an important tax document that is used to report HSA contributions and distributions. The form is used to determine the tax-deductible amount of HSA contributions, as well as to track the fair market value of the account. By reporting Form 5498-SA accurately, individuals can avoid any potential penalties or fines.

3 Easy Ways to Report Form 5498-SA

Here are three easy ways to report Form 5498-SA:

1. E-file Form 5498-SA

One of the easiest ways to report Form 5498-SA is to e-file it. The IRS accepts e-filed returns, and most tax software programs, such as TurboTax or H&R Block, allow individuals to e-file Form 5498-SA. To e-file Form 5498-SA, individuals will need to:

- Log in to their tax software account

- Select the "Health Savings Account" option

- Enter the information from Form 5498-SA

- Review and submit the return

2. Mail Form 5498-SA

Another way to report Form 5498-SA is to mail it to the IRS. To mail Form 5498-SA, individuals will need to:

- Complete the form accurately

- Sign and date the form

- Mail the form to the IRS address listed on the form

It's essential to keep a copy of the form and the mailing receipt, as proof of filing.

3. Use IRS Free File

The IRS offers a free filing option for individuals who meet certain income requirements. IRS Free File allows individuals to file Form 5498-SA for free, using tax software provided by the IRS. To use IRS Free File, individuals will need to:

- Go to the IRS website and select the "Free File" option

- Choose a tax software provider

- Complete the form accurately

- Review and submit the return

Tips for Reporting Form 5498-SA

Here are some tips to keep in mind when reporting Form 5498-SA:

- Make sure to report all HSA contributions and distributions accurately

- Keep a copy of the form and any supporting documentation

- Review the form carefully before submitting it to the IRS

- Consider consulting a tax professional if you have any questions or concerns

Common Mistakes to Avoid

Here are some common mistakes to avoid when reporting Form 5498-SA:

- Inaccurate or incomplete information

- Failure to report all HSA contributions and distributions

- Not keeping a copy of the form and supporting documentation

- Missing the deadline for filing the form

By avoiding these common mistakes, individuals can ensure that their Form 5498-SA is reported accurately and on time.

Conclusion

Reporting Form 5498-SA is an essential part of managing a Health Savings Account. By following the three easy ways to report Form 5498-SA outlined in this article, individuals can ensure that their HSA contributions and distributions are reported accurately and on time. Remember to keep a copy of the form and any supporting documentation, and consider consulting a tax professional if you have any questions or concerns.What is the deadline for filing Form 5498-SA?

+The deadline for filing Form 5498-SA is typically May 31st of each year.

Can I e-file Form 5498-SA?

+Yes, the IRS accepts e-filed returns, and most tax software programs allow individuals to e-file Form 5498-SA.

What happens if I don't report Form 5498-SA accurately?

+If you don't report Form 5498-SA accurately, you may be subject to penalties or fines.