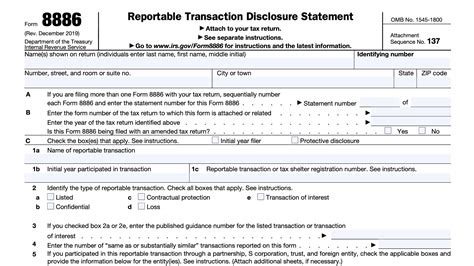

Form 8886 is a crucial document for taxpayers who have been involved in reportable transactions, such as listed transactions or other potentially abusive tax shelters. The threshold for filing Form 8886 is an important consideration, as it determines when a taxpayer is required to disclose their involvement in such transactions to the IRS. In this article, we will delve into five key facts about the Form 8886 threshold, helping you understand its significance and implications.

Understanding the Form 8886 Threshold

The Form 8886 threshold is the minimum amount or value of a reportable transaction that triggers the requirement to file Form 8886 with the IRS. This threshold is essential in determining whether a taxpayer's involvement in a potentially abusive tax shelter or listed transaction must be disclosed.

1. What is the Form 8886 Threshold?

The Form 8886 threshold varies depending on the type of reportable transaction and the taxpayer's involvement. Generally, the threshold is $10,000 for individual taxpayers and $50,000 for corporate taxpayers. However, this amount may be adjusted for inflation, and specific transactions may have different thresholds.

For example, if an individual taxpayer participates in a listed transaction with a value of $5,000, they would not be required to file Form 8886, as the transaction value is below the $10,000 threshold. On the other hand, if a corporate taxpayer engages in a reportable transaction with a value of $75,000, they would need to file Form 8886, as the transaction value exceeds the $50,000 threshold.

Key Factors Influencing the Form 8886 Threshold

Several factors can influence the Form 8886 threshold, including:

- The type of reportable transaction involved

- The taxpayer's level of involvement in the transaction

- The value or amount of the transaction

- Inflation adjustments to the threshold amounts

Understanding these factors is crucial in determining whether a taxpayer's involvement in a potentially abusive tax shelter or listed transaction must be disclosed.

2. How Does the Form 8886 Threshold Affect Taxpayers?

The Form 8886 threshold has significant implications for taxpayers. If a taxpayer's involvement in a reportable transaction meets or exceeds the threshold, they must file Form 8886 with the IRS. Failure to do so can result in penalties and fines.

On the other hand, if a taxpayer's involvement in a reportable transaction is below the threshold, they may not be required to file Form 8886. However, this does not necessarily mean that the transaction is exempt from reporting requirements.

Penalties for Failing to File Form 8886

The penalties for failing to file Form 8886 can be substantial. Taxpayers who fail to disclose their involvement in reportable transactions may face penalties, including:

- A penalty of $100 per day, up to a maximum of $50,000, for individual taxpayers

- A penalty of $500 per day, up to a maximum of $100,000, for corporate taxpayers

Additionally, taxpayers who intentionally fail to file Form 8886 or provide false or misleading information may face more severe penalties, including fines and even criminal prosecution.

3. How to Determine if You Need to File Form 8886

Determining whether you need to file Form 8886 can be complex. To make this determination, you should consider the following:

- The type of reportable transaction involved

- The value or amount of the transaction

- Your level of involvement in the transaction

If you are unsure whether you need to file Form 8886, it is recommended that you consult with a tax professional or attorney.

4. The Importance of Disclosure

Disclosure is critical when it comes to reportable transactions. By filing Form 8886, taxpayers can demonstrate their compliance with tax laws and regulations. Failure to disclose involvement in reportable transactions can lead to penalties, fines, and even reputational damage.

5. Best Practices for Filing Form 8886

Filing Form 8886 requires careful attention to detail. To ensure compliance, taxpayers should:

- Consult with a tax professional or attorney

- Carefully review the instructions for Form 8886

- Accurately complete all required fields and schedules

- File Form 8886 by the required deadline

By following these best practices, taxpayers can ensure that they comply with the requirements for filing Form 8886.

In conclusion, the Form 8886 threshold is a critical consideration for taxpayers who have been involved in reportable transactions. By understanding the key facts about the Form 8886 threshold, taxpayers can ensure compliance with tax laws and regulations.

What's Next?

If you have been involved in a reportable transaction and are unsure whether you need to file Form 8886, we encourage you to consult with a tax professional or attorney. By seeking professional advice, you can ensure that you comply with the requirements for filing Form 8886 and avoid potential penalties.

Share Your Thoughts

Have you been involved in a reportable transaction? Share your experiences and insights in the comments below.

What is the purpose of Form 8886?

+The purpose of Form 8886 is to report a taxpayer's involvement in a reportable transaction, such as a listed transaction or other potentially abusive tax shelter.

Who needs to file Form 8886?

+Taxpayers who have been involved in a reportable transaction and meet or exceed the threshold amount must file Form 8886.

What are the penalties for failing to file Form 8886?

+The penalties for failing to file Form 8886 can include fines, penalties, and even criminal prosecution.