As a business owner in Tacoma, Washington, you're likely familiar with the Business and Occupation (B&O) tax. The Tacoma B&O tax is a crucial part of the city's revenue system, and it's essential to understand how to file the tax form correctly to avoid any penalties or fines. In this article, we'll provide a step-by-step guide on how to file the Tacoma B&O tax form, making it easier for you to comply with the city's tax regulations.

The importance of filing the Tacoma B&O tax form cannot be overstated. The tax is levied on businesses that operate within the city limits, and it's used to fund various public services and infrastructure projects. By filing the tax form correctly, you'll not only avoid any penalties but also contribute to the growth and development of the city.

What is the Tacoma B&O Tax?

The Tacoma B&O tax is a type of business tax levied by the City of Tacoma on businesses that operate within the city limits. The tax is based on the gross income of the business, and it's calculated as a percentage of the business's total revenue. The tax rate varies depending on the type of business and the amount of gross income.

Who Needs to File the Tacoma B&O Tax Form?

All businesses that operate within the City of Tacoma are required to file the B&O tax form, unless they are exempt. Exemptions include:

- Businesses with a gross income of less than $12,000 per year

- Non-profit organizations

- Government agencies

- Businesses that are exempt under state or federal law

Step-by-Step Filing Guide

Filing the Tacoma B&O tax form is a straightforward process that can be completed online or by mail. Here's a step-by-step guide to help you file the tax form correctly:

Step 1: Gather Required Documents

Before you start filing the tax form, make sure you have the following documents:

- Business license number

- Federal tax ID number

- Gross income statements

- Expense reports

- Depreciation schedules (if applicable)

Step 2: Determine Your Tax Rate

The tax rate for the Tacoma B&O tax varies depending on the type of business and the amount of gross income. You can use the City of Tacoma's tax rate schedule to determine your tax rate.

Step 3: Complete the Tax Form

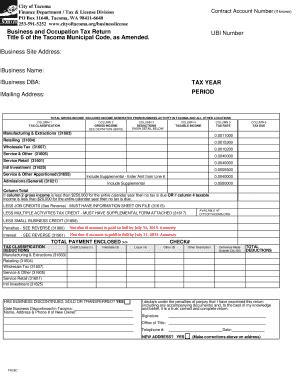

You can complete the tax form online or by mail. If you're filing online, you'll need to create an account on the City of Tacoma's website. If you're filing by mail, you can download the tax form from the city's website or pick one up at the city's finance department.

The tax form will require you to provide information about your business, including:

- Business name and address

- Business license number

- Federal tax ID number

- Gross income

- Tax rate

Step 4: Calculate Your Tax Liability

Once you've completed the tax form, you'll need to calculate your tax liability. You can use the tax rate schedule to determine the amount of tax you owe.

Step 5: Pay Your Tax Liability

You can pay your tax liability online or by mail. If you're paying online, you can use a credit or debit card. If you're paying by mail, you can send a check or money order to the City of Tacoma's finance department.

Step 6: File Your Tax Form

Once you've paid your tax liability, you can file your tax form. If you're filing online, you'll need to submit your form electronically. If you're filing by mail, you'll need to send your form to the City of Tacoma's finance department.

Tips and Reminders

Here are some tips and reminders to keep in mind when filing the Tacoma B&O tax form:

- Make sure to file your tax form on time to avoid any penalties or fines.

- Use the correct tax rate to avoid any errors or discrepancies.

- Keep accurate records of your business income and expenses to ensure you're reporting the correct amount of gross income.

- If you're unsure about any part of the filing process, contact the City of Tacoma's finance department for assistance.

Common Mistakes to Avoid

Here are some common mistakes to avoid when filing the Tacoma B&O tax form:

- Failing to file the tax form on time

- Using the incorrect tax rate

- Reporting incorrect gross income

- Failing to keep accurate records

Frequently Asked Questions

Here are some frequently asked questions about the Tacoma B&O tax form:

What is the deadline for filing the Tacoma B&O tax form?

The deadline for filing the Tacoma B&O tax form is April 30th of each year.How do I determine my tax rate?

You can use the City of Tacoma's tax rate schedule to determine your tax rate.Can I file the tax form online?

Yes, you can file the tax form online through the City of Tacoma's website.What if I'm exempt from paying the B&O tax?

If you're exempt from paying the B&O tax, you'll still need to file the tax form and claim your exemption.What is the penalty for failing to file the Tacoma B&O tax form?

+The penalty for failing to file the Tacoma B&O tax form is 10% of the unpaid tax liability, plus interest and fees.

Can I amend my tax form if I made an error?

+How do I contact the City of Tacoma's finance department if I have questions?

+You can contact the City of Tacoma's finance department by phone at (253) 591-5223 or by email at .

We hope this step-by-step guide has helped you understand how to file the Tacoma B&O tax form correctly. Remember to file your tax form on time, use the correct tax rate, and keep accurate records of your business income and expenses. If you have any questions or concerns, don't hesitate to contact the City of Tacoma's finance department for assistance.

Don't forget to share this article with your fellow business owners in Tacoma, and leave a comment below if you have any questions or need further clarification on any of the steps.