The complexities of tax season can be overwhelming, especially when dealing with health insurance premiums and tax credits. Form 8962 is a crucial document for individuals and families who received advance payments of the premium tax credit (APTC) during the tax year. If you're one of the many who received APTC and are now navigating the tax filing process, this article will guide you through completing Form 8962 for shared policy allocation with ease.

Understanding the Purpose of Form 8962

The primary purpose of Form 8962 is to reconcile the advance payments of the premium tax credit with the actual premium tax credit you're eligible for based on your annual income. The form is used to report the health insurance premiums you paid, the advance payments you received, and the premium tax credit you're claiming.

Breaking Down Form 8962: Shared Policy Allocation

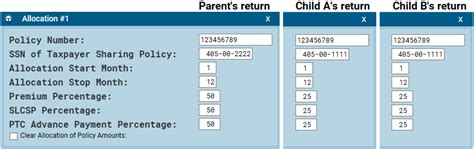

Form 8962 is divided into several sections, each addressing a specific aspect of the premium tax credit. The shared policy allocation section is where you'll report the allocation of the advance payments and the actual premium tax credit among multiple individuals or families who shared the same policy.

Section 1: Policy and Enrollment Information

In this section, you'll enter the policy details, including the policy number, issuer name, and enrollment dates. You'll also provide the names and Social Security numbers of all individuals covered under the policy.

Section 2: Advance Payments of Premium Tax Credit

Here, you'll report the total advance payments received for each month of the tax year. You'll need to reconcile these amounts with the actual premium tax credit you're eligible for based on your annual income.

Section 3: Premium Tax Credit Claimed

In this section, you'll calculate the premium tax credit you're claiming for the tax year. This will involve determining the applicable second lowest cost silver plan (SLCSP) premium and calculating the premium tax credit based on your income and family size.

Section 4: Shared Policy Allocation

This is where you'll allocate the advance payments and the actual premium tax credit among multiple individuals or families who shared the same policy. You'll need to provide the name and Social Security number of each individual, as well as the allocated amounts.

Tips for Completing Form 8962

- Gather all necessary documents: Before starting Form 8962, make sure you have all the required documents, including Form 1095-A, Form 1095-B, and your policy details.

- Use the correct SLCSP premium: Ensure you're using the correct SLCSP premium for your area and family size to calculate the premium tax credit.

- Accurately allocate the advance payments: When allocating the advance payments and premium tax credit among multiple individuals or families, ensure you're using the correct percentages and amounts.

- Seek professional help if needed: If you're unsure about any part of the process, consider seeking help from a tax professional or using tax preparation software.

Common Mistakes to Avoid

- Inaccurate policy information: Double-check your policy details, including the policy number and issuer name, to ensure accuracy.

- Incorrect SLCSP premium: Using the wrong SLCSP premium can result in an incorrect premium tax credit calculation.

- Inconsistent allocation: Ensure you're consistently allocating the advance payments and premium tax credit among multiple individuals or families.

Conclusion

Completing Form 8962 for shared policy allocation requires attention to detail and a clear understanding of the premium tax credit. By following the steps outlined in this article and avoiding common mistakes, you'll be able to navigate the process with ease. Remember to seek help if needed, and don't hesitate to reach out to a tax professional or the IRS for assistance.

Take the next step: Share your experiences with completing Form 8962 in the comments below. Have you encountered any challenges or have tips to share with fellow readers?

What is Form 8962 used for?

+Form 8962 is used to reconcile the advance payments of the premium tax credit with the actual premium tax credit you're eligible for based on your annual income.

How do I allocate the advance payments and premium tax credit among multiple individuals or families?

+You'll need to provide the name and Social Security number of each individual, as well as the allocated amounts, in Section 4 of Form 8962.

Where can I find the correct SLCSP premium for my area and family size?

+You can find the correct SLCSP premium on the HealthCare.gov website or by contacting your local health insurance marketplace.