The tax season is upon us, and with it comes the daunting task of filling out tax forms. One of the most important forms for investors and traders is the TaxSlayer Form 8949, also known as the Sales and Other Dispositions of Capital Assets form. This form is used to report the sale or exchange of capital assets, such as stocks, bonds, and real estate. In this article, we will explore the different ways to fill out TaxSlayer Form 8949, providing you with a comprehensive guide to help you navigate this complex form.

Understanding TaxSlayer Form 8949

Before we dive into the different ways to fill out the form, it's essential to understand what it's used for. TaxSlayer Form 8949 is used to report the sale or exchange of capital assets, which include:

- Stocks

- Bonds

- Mutual funds

- Real estate

- Other investment assets

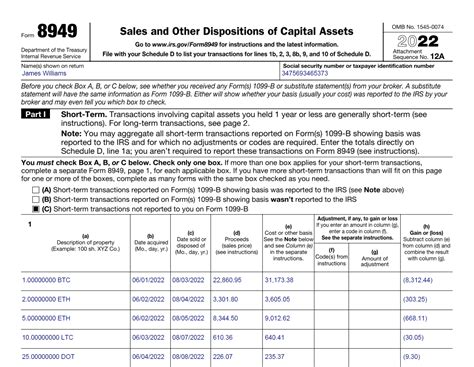

The form requires you to report the details of each sale or exchange, including the date of sale, the gross proceeds, and any gain or loss.

Method 1: Manual Entry

One way to fill out TaxSlayer Form 8949 is to manually enter the information for each sale or exchange. This involves:

- Gathering all the necessary documents, including brokerage statements and 1099-B forms

- Entering the date of sale, gross proceeds, and any gain or loss for each transaction

- Calculating the total gain or loss for each asset class

- Transferring the information to the TaxSlayer software or paper form

Manual entry can be time-consuming and prone to errors, especially if you have multiple transactions to report.

Method 2: Importing from Brokerage Statements

Another way to fill out TaxSlayer Form 8949 is to import the information directly from your brokerage statements. Many online brokerages provide a downloadable file that can be imported into tax software, including TaxSlayer. This method can save time and reduce errors.

- Gather your brokerage statements and download the file

- Import the file into TaxSlayer software

- Review and verify the information to ensure accuracy

- Make any necessary adjustments or corrections

Method 3: Using TaxSlayer's Automatic Import Feature

TaxSlayer offers an automatic import feature that allows you to import information from participating brokerages. This feature can save time and reduce errors.

- Log in to your TaxSlayer account and select the import feature

- Choose the brokerage account you want to import

- Follow the prompts to complete the import process

- Review and verify the information to ensure accuracy

Method 4: Using a Tax Professional

If you have complex investments or multiple transactions to report, it may be beneficial to hire a tax professional to fill out TaxSlayer Form 8949. A tax professional can help you navigate the form and ensure accuracy.

- Gather all the necessary documents and information

- Meet with a tax professional to discuss your tax situation

- Allow the tax professional to complete the form on your behalf

- Review and verify the information to ensure accuracy

Method 5: Using TaxSlayer's Guided Interview

TaxSlayer's guided interview feature can help you fill out Form 8949 by asking you a series of questions and guiding you through the process.

- Log in to your TaxSlayer account and select the guided interview feature

- Answer the questions to the best of your ability

- Follow the prompts to complete the form

- Review and verify the information to ensure accuracy

Tips and Reminders

- Make sure to keep accurate records of your investments and transactions

- Use the correct dates and amounts when reporting sales and exchanges

- Double-check your math and calculations to avoid errors

- Consider hiring a tax professional if you have complex investments or multiple transactions to report

By following these methods and tips, you can accurately and efficiently fill out TaxSlayer Form 8949 and ensure you're taking advantage of the deductions and credits you're eligible for.

Conclusion

Filling out TaxSlayer Form 8949 can be a daunting task, but by using one of the methods outlined above, you can make the process easier and more efficient. Remember to keep accurate records, use the correct dates and amounts, and double-check your math and calculations to avoid errors. If you're unsure or have complex investments, consider hiring a tax professional to help you navigate the form.

We hope this article has provided you with a comprehensive guide to filling out TaxSlayer Form 8949. If you have any questions or comments, please feel free to share them below.

What is TaxSlayer Form 8949?

+TaxSlayer Form 8949 is a tax form used to report the sale or exchange of capital assets, such as stocks, bonds, and real estate.

How do I import information from my brokerage statements?

+You can import information from your brokerage statements by downloading a file from your online brokerage account and importing it into TaxSlayer software.

What if I have complex investments or multiple transactions to report?

+If you have complex investments or multiple transactions to report, it may be beneficial to hire a tax professional to help you fill out TaxSlayer Form 8949.