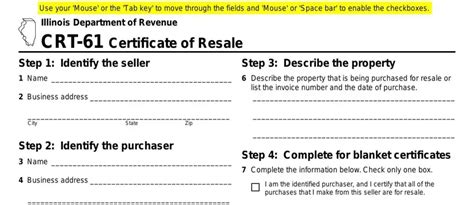

As a business owner in Illinois, you're likely familiar with the numerous forms and filings required to maintain compliance with state regulations. One of the most critical forms is the CRT-61, also known as the Certificate of Registration, which is used to register and obtain a tax account with the Illinois Department of Revenue. In this article, we'll delve into the world of CRT-61 Illinois form, exploring its significance, and providing you with 5 essential filing tips to ensure a smooth and error-free process.

What is the CRT-61 Illinois Form?

The CRT-61 form is a certificate of registration that allows businesses to register for various tax accounts with the Illinois Department of Revenue. This form is required for businesses that need to obtain a tax account, such as sales tax, use tax, employer withholding tax, and more. The CRT-61 form serves as a crucial document that helps the state track and manage tax compliance.

Why is the CRT-61 Form Important?

The CRT-61 form is essential for businesses operating in Illinois, as it enables them to:

- Register for necessary tax accounts

- Obtain a tax account number

- File tax returns and make payments

- Avoid penalties and fines for non-compliance

5 Essential Filing Tips for the CRT-61 Illinois Form

Filing the CRT-61 form can be a daunting task, but with the right guidance, you can avoid common mistakes and ensure a successful filing process. Here are 5 essential filing tips to keep in mind:

Tip 1: Determine Your Business Type

Before filing the CRT-61 form, it's crucial to determine your business type. This will help you identify the correct tax accounts you need to register for. Illinois recognizes several business types, including:

- Sole proprietorship

- Partnership

- Corporation

- Limited liability company (LLC)

- Trust

Each business type has unique requirements and tax obligations. Ensure you select the correct business type to avoid errors.

Tip 2: Gather Required Documents

To complete the CRT-61 form, you'll need to gather several documents, including:

- Business license or certificate of registration

- Federal tax ID number (FEIN)

- Social Security number (if applicable)

- Partnership or LLC agreement (if applicable)

Ensure you have all the required documents before starting the filing process.

Tip 3: Understand Tax Account Requirements

The CRT-61 form requires you to register for specific tax accounts. These accounts include:

- Sales tax

- Use tax

- Employer withholding tax

- Unemployment insurance tax

Understand the tax account requirements for your business type and ensure you register for the correct accounts.

Tip 4: Complete the Form Accurately

When completing the CRT-61 form, ensure you provide accurate and up-to-date information. This includes:

- Business name and address

- Federal tax ID number (FEIN)

- Social Security number (if applicable)

- Tax account information

Double-check your information to avoid errors and delays.

Tip 5: File the Form Electronically or by Mail

The CRT-61 form can be filed electronically or by mail. If you choose to file electronically, you can use the Illinois Department of Revenue's online portal, MyTax Illinois. If you prefer to file by mail, ensure you use the correct address and follow the instructions carefully.

Additional Resources

For more information on the CRT-61 Illinois form, you can visit the Illinois Department of Revenue's website or consult with a tax professional. Remember to stay up-to-date with changing regulations and requirements to ensure compliance.

Stay Compliant with the CRT-61 Illinois Form

Filing the CRT-61 form is a crucial step in maintaining compliance with Illinois state regulations. By following these 5 essential filing tips, you can ensure a smooth and error-free process. Remember to stay informed and up-to-date with changing regulations to avoid penalties and fines.

Take Action Today

Don't wait until it's too late. Take action today and file your CRT-61 form to ensure compliance with Illinois state regulations. If you have any questions or concerns, consult with a tax professional or contact the Illinois Department of Revenue for assistance.

Engage with Us

We hope this article has provided you with valuable insights and information on the CRT-61 Illinois form. Share your thoughts and experiences in the comments below. If you have any questions or topics you'd like us to cover in future articles, please let us know.

What is the CRT-61 form used for?

+The CRT-61 form is used to register and obtain a tax account with the Illinois Department of Revenue.

Who needs to file the CRT-61 form?

+Businesses operating in Illinois need to file the CRT-61 form to register for necessary tax accounts.