As a small business owner or self-employed individual, navigating the world of tax forms can be a daunting task. One of the most important forms you'll need to file is the IRS Form 7202, also known as the Credits for Sick Leave and Family Leave for Certain Self-Employed Individuals. In this article, we'll break down the process of mastering Form 7202 with TaxSlayer in 5 easy steps.

TaxSlayer is a popular tax preparation software that can help make the tax filing process more efficient and accurate. With its user-friendly interface and robust features, TaxSlayer is an excellent choice for individuals who want to file their taxes quickly and easily. By following these 5 easy steps, you'll be able to master Form 7202 with TaxSlayer and ensure that you're taking advantage of the credits you're eligible for.

What is Form 7202 and Why is it Important?

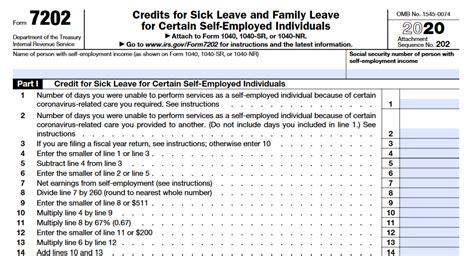

Before we dive into the steps, let's take a brief look at what Form 7202 is and why it's so important. Form 7202 is used to calculate the credits for sick leave and family leave for certain self-employed individuals. This form is crucial because it allows eligible individuals to claim a credit against their self-employment tax liability.

The credit is calculated based on the number of days the individual was unable to work due to illness or family leave, and the amount of sick leave or family leave pay received. By claiming this credit, self-employed individuals can reduce their tax liability and keep more of their hard-earned money.

Step 1: Gather Required Documents and Information

Before you start working on Form 7202 with TaxSlayer, make sure you have all the necessary documents and information. You'll need:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your business income and expenses

- Records of sick leave or family leave pay received

- Records of the number of days you were unable to work due to illness or family leave

Having all the required documents and information will make the process smoother and ensure that you're accurately calculating your credits.

Step 2: Create a TaxSlayer Account and Log In

If you haven't already, create a TaxSlayer account and log in to start working on Form 7202. TaxSlayer offers a free trial, so you can try out the software before committing to a purchase.

Once you're logged in, navigate to the "Forms" section and select Form 7202. TaxSlayer will guide you through the process, asking you questions and prompting you to enter the required information.

Step 3: Enter Business Income and Expenses

In this step, you'll enter your business income and expenses. TaxSlayer will use this information to calculate your self-employment tax liability. Make sure to accurately report all income and expenses, as this will impact your credits.

TaxSlayer will ask you questions about your business, such as:

- What type of business do you have?

- What is your business income?

- What are your business expenses?

Be prepared to provide detailed information about your business, including income statements and expense records.

Step 4: Calculate Sick Leave and Family Leave Credits

In this step, you'll calculate your sick leave and family leave credits. TaxSlayer will ask you questions about your sick leave and family leave pay, including:

- How many days did you receive sick leave or family leave pay?

- What was the amount of sick leave or family leave pay received?

Based on your answers, TaxSlayer will calculate your credits and apply them to your self-employment tax liability.

Step 5: Review and Submit Your Return

The final step is to review and submit your return. TaxSlayer will review your Form 7202 for accuracy and completeness, ensuring that you're taking advantage of the credits you're eligible for.

Once you've reviewed and submitted your return, you'll receive a confirmation from the IRS that your return has been accepted.

Final Thoughts

Mastering Form 7202 with TaxSlayer is a straightforward process that can help you reduce your tax liability and keep more of your hard-earned money. By following these 5 easy steps, you'll be able to accurately calculate your sick leave and family leave credits and ensure that you're taking advantage of the credits you're eligible for.

Remember to gather all the required documents and information, create a TaxSlayer account, enter your business income and expenses, calculate your credits, and review and submit your return. With TaxSlayer, you'll be able to navigate the complex world of tax forms with ease and confidence.

Call to Action

Don't wait until the last minute to file your taxes. Start working on Form 7202 with TaxSlayer today and ensure that you're taking advantage of the credits you're eligible for. Share this article with your friends and family who may be eligible for these credits, and help them save money on their taxes.

FAQ Section

What is Form 7202 used for?

+Form 7202 is used to calculate the credits for sick leave and family leave for certain self-employed individuals.

What documents do I need to file Form 7202?

+You'll need your Social Security number or ITIN, business income and expenses, records of sick leave or family leave pay received, and records of the number of days you were unable to work due to illness or family leave.

How do I calculate my sick leave and family leave credits?

+TaxSlayer will guide you through the process of calculating your credits based on your business income and expenses, and the number of days you received sick leave or family leave pay.