The 2019 tax season brought several changes to tax forms that affected individuals and businesses. Understanding these changes is crucial to ensure accurate and timely filing of tax returns. In this article, we will discuss the top 5 changes on 2019 tax forms that you need to know.

The 2019 tax season was marked by significant changes, thanks to the Tax Cuts and Jobs Act (TCJA) of 2017. These changes aimed to simplify the tax filing process, reduce tax liabilities, and promote economic growth. However, the changes also introduced new complexities and requirements that taxpayers needed to navigate.

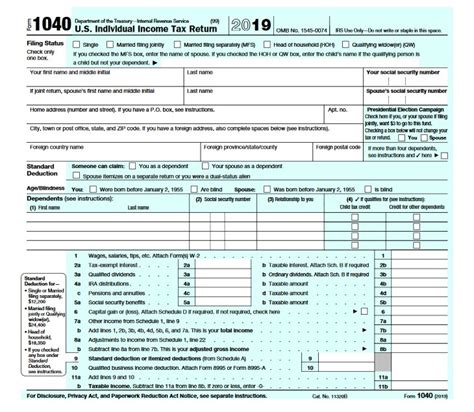

1. Changes to Form 1040

The most significant change in the 2019 tax season was the redesign of Form 1040. The new form is shorter and more streamlined, with six new schedules (A-F) that replaced the old schedules (A-D). The new schedules are designed to simplify the tax filing process and reduce the number of forms that taxpayers need to file.

Schedule A is now used for itemized deductions, such as mortgage interest, charitable contributions, and medical expenses. Schedule B is used for interest and dividend income, while Schedule C is used for business income and expenses. Schedule D is used for capital gains and losses, and Schedule E is used for supplemental income and loss. Schedule F is used for farm income and expenses.

What's New in Form 1040?

- The new Form 1040 is shorter, with only 23 lines, compared to the old form which had 79 lines.

- The form no longer includes the following lines:

- Lines 1-5 (wages, salaries, and tips)

- Lines 6-10 (interest and dividend income)

- Lines 11-15 (capital gains and losses)

- Lines 16-20 (other income)

- The form now includes a new line for reporting the qualified business income (QBI) deduction.

2. Changes to Standard Deduction

The standard deduction for the 2019 tax year increased significantly, thanks to the TCJA. The standard deduction is a fixed amount that taxpayers can deduct from their income without itemizing their deductions.

What's New in Standard Deduction?

- The standard deduction for single filers increased from $6,350 in 2017 to $12,000 in 2019.

- The standard deduction for married couples filing jointly increased from $12,700 in 2017 to $24,000 in 2019.

- The standard deduction for head of household filers increased from $9,350 in 2017 to $18,000 in 2019.

3. Changes to Itemized Deductions

The TCJA introduced significant changes to itemized deductions, including limits on state and local taxes (SALT) and mortgage interest.

What's New in Itemized Deductions?

- The SALT deduction is now limited to $10,000 per year, including state income taxes, sales taxes, and property taxes.

- The mortgage interest deduction is now limited to $750,000 of qualified residence loans, down from $1 million in 2017.

- The deduction for home equity interest is suspended until 2026, unless the loan is used to buy, build, or substantially improve the home.

4. Changes to Child Tax Credit

The child tax credit (CTC) was expanded in 2019, providing more benefits to families with children.

What's New in Child Tax Credit?

- The CTC increased from $1,000 per child in 2017 to $2,000 per child in 2019.

- The credit is now refundable, meaning that families can receive a refund even if they don't owe taxes.

- The income phase-out for the credit increased from $110,000 in 2017 to $400,000 in 2019.

5. Changes to Alternative Minimum Tax (AMT)

The AMT was introduced to ensure that high-income taxpayers pay a minimum amount of tax. The TCJA made significant changes to the AMT, including increasing the exemption amounts.

What's New in Alternative Minimum Tax?

- The exemption amount for single filers increased from $54,300 in 2017 to $70,300 in 2019.

- The exemption amount for married couples filing jointly increased from $84,500 in 2017 to $109,400 in 2019.

- The phase-out threshold for the exemption increased from $120,700 in 2017 to $500,000 in 2019.

In conclusion, the 2019 tax season brought significant changes to tax forms, including changes to Form 1040, standard deduction, itemized deductions, child tax credit, and alternative minimum tax. Understanding these changes is crucial to ensure accurate and timely filing of tax returns. We hope this article has provided valuable insights into the top 5 changes on 2019 tax forms.

If you have any questions or concerns about the 2019 tax forms or any other tax-related issues, please feel free to comment below. We would be happy to help.

What is the new standard deduction for single filers in 2019?

+The standard deduction for single filers increased to $12,000 in 2019.

What is the limit on state and local taxes (SALT) in 2019?

+The SALT deduction is now limited to $10,000 per year, including state income taxes, sales taxes, and property taxes.

What is the new exemption amount for single filers under the Alternative Minimum Tax (AMT) in 2019?

+The exemption amount for single filers increased to $70,300 in 2019.