As a student or educational institution, it's essential to understand the significance of the 1098-T form. The 1098-T form, also known as the Tuition Statement, is a vital document that reports tuition payments and other related information to the Internal Revenue Service (IRS). In this article, we will delve into the world of the 1098-T form, exploring its purpose, benefits, and requirements.

The 1098-T form is an essential document for students, as it provides crucial information needed to claim education tax credits and deductions. The form reports the amount of tuition and related expenses paid during the tax year, as well as other relevant information, such as scholarships and grants received.

Understanding the 1098-T Form

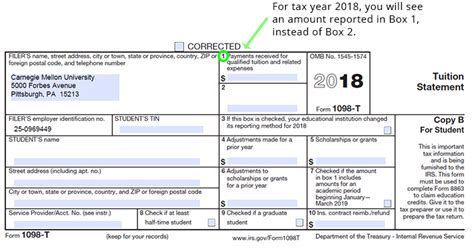

The 1098-T form is typically issued by educational institutions, such as colleges and universities, to students who have paid tuition and other related expenses. The form is usually sent to students by January 31st of each year, and it reports information for the previous tax year.

The 1098-T form includes the following information:

- Student's name, address, and taxpayer identification number (TIN)

- Educational institution's name, address, and employer identification number (EIN)

- Amount of tuition and related expenses paid during the tax year

- Amount of scholarships and grants received during the tax year

- Adjustments to previously reported tuition and related expenses

- Amount of tuition and related expenses that were not reported on a previous 1098-T form

Benefits of the 1098-T Form

The 1098-T form provides several benefits to students, including:

- Claiming education tax credits and deductions: The 1098-T form provides the necessary information for students to claim education tax credits and deductions, such as the American Opportunity Tax Credit and the Lifetime Learning Credit.

- Reducing tax liability: By claiming education tax credits and deductions, students can reduce their tax liability and potentially receive a refund.

- Keeping track of tuition payments: The 1098-T form helps students keep track of their tuition payments and other related expenses, making it easier to budget and plan for future expenses.

Requirements for the 1098-T Form

To be eligible to receive a 1098-T form, students must meet certain requirements, including:

- Being enrolled in an eligible educational institution

- Paying tuition and related expenses during the tax year

- Being a U.S. citizen or resident alien

- Having a valid TIN

Who Is Eligible to Receive a 1098-T Form?

The following individuals are eligible to receive a 1098-T form:

- Students enrolled in a degree program at an eligible educational institution

- Students enrolled in a certificate program at an eligible educational institution

- Students enrolled in a continuing education program at an eligible educational institution

How to Obtain a 1098-T Form

Students can obtain a 1098-T form by contacting their educational institution's registrar or student accounts office. The form can also be obtained online through the educational institution's website or through the IRS website.

What to Do If You Don't Receive a 1098-T Form

If you don't receive a 1098-T form, you should contact your educational institution's registrar or student accounts office to request a copy. You can also contact the IRS for assistance.

Common Errors on the 1098-T Form

Common errors on the 1098-T form include:

- Incorrect student name or address

- Incorrect tuition and related expenses amounts

- Incorrect scholarships and grants amounts

- Missing or incorrect TIN

How to Correct Errors on the 1098-T Form

If you find an error on your 1098-T form, you should contact your educational institution's registrar or student accounts office to request a correction. You can also contact the IRS for assistance.

Conclusion

In conclusion, the 1098-T form is an essential document for students, providing crucial information needed to claim education tax credits and deductions. By understanding the purpose, benefits, and requirements of the 1098-T form, students can ensure they receive the correct form and claim the tax benefits they are eligible for.

We encourage you to share your thoughts and experiences with the 1098-T form in the comments section below. If you have any questions or need further clarification, please don't hesitate to ask.

What is the purpose of the 1098-T form?

+The 1098-T form reports tuition payments and other related information to the IRS, providing students with the necessary information to claim education tax credits and deductions.

Who is eligible to receive a 1098-T form?

+Students enrolled in a degree program, certificate program, or continuing education program at an eligible educational institution are eligible to receive a 1098-T form.

What should I do if I don't receive a 1098-T form?

+If you don't receive a 1098-T form, you should contact your educational institution's registrar or student accounts office to request a copy. You can also contact the IRS for assistance.