The CBP Form 28 is a crucial document used by U.S. Customs and Border Protection (CBP) to request additional information from importers and other parties involved in the importation process. This form is a vital tool for CBP to ensure compliance with customs regulations and to facilitate the smooth clearance of goods.

In this article, we will delve into the details of CBP Form 28, its purpose, and its significance in the customs clearance process. We will also explore the various sections of the form, the information required, and the procedures for submission.

What is CBP Form 28?

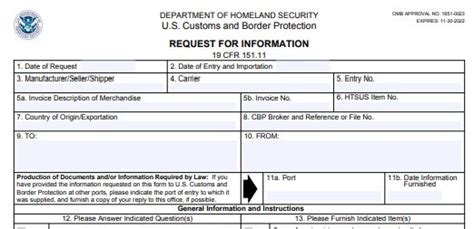

CBP Form 28, also known as the "Request for Information," is a document used by CBP to request additional information from importers, exporters, and other parties involved in the importation process. The form is used to clarify discrepancies or inconsistencies in the documentation submitted with the shipment, such as the commercial invoice, bill of lading, or other relevant documents.

Purpose of CBP Form 28

The primary purpose of CBP Form 28 is to enable CBP to gather more information about the shipment, which may be necessary to determine the admissibility, tariff classification, appraisement, or other factors relevant to the clearance of the goods. By requesting additional information, CBP aims to ensure that the goods comply with all applicable laws, regulations, and requirements.

Sections of CBP Form 28

CBP Form 28 consists of several sections, each requiring specific information from the importer or other parties involved in the importation process. The sections include:

- Section 1: Request for Information

- This section specifies the type of information requested by CBP, such as documentation, samples, or other relevant data.

- Section 2: Importer's Response

- This section requires the importer to provide a detailed response to the request for information, including any supporting documentation or evidence.

- Section 3: CBP's Action

- This section indicates the action taken by CBP based on the information provided by the importer, such as the release of the shipment or the imposition of penalties.

Information Required on CBP Form 28

When completing CBP Form 28, the importer or other parties involved in the importation process must provide accurate and detailed information in response to the request. The information required may include:

- Documentation: Copies of relevant documents, such as the commercial invoice, bill of lading, or other shipping documents.

- Samples: Physical samples of the goods, if requested by CBP.

- Explanation: A detailed explanation of the discrepancy or inconsistency, including any relevant facts or circumstances.

- Evidence: Supporting evidence, such as certificates of origin, laboratory test results, or other documentation.

Procedures for Submission

When submitting CBP Form 28, the importer or other parties involved in the importation process must follow the procedures outlined by CBP. These procedures include:

- Timing: The form must be submitted within the timeframe specified by CBP, usually within a few days of receipt of the request.

- Format: The form must be completed in a legible and accurate manner, using black ink or typed responses.

- Supporting Documentation: All supporting documentation must be attached to the form, as requested by CBP.

Consequences of Non-Compliance

Failure to comply with the request for information on CBP Form 28 can result in significant consequences, including:

- Penalties: Imposition of penalties, fines, or other sanctions for non-compliance.

- Delayed Clearance: Delayed clearance of the shipment, which can impact the importer's business operations and reputation.

- Loss of Privileges: Loss of privileges, such as the ability to participate in trusted trader programs or other benefits.

Benefits of Complying with CBP Form 28

Complying with CBP Form 28 can bring several benefits to importers and other parties involved in the importation process, including:

- Smooth Clearance: Ensuring the smooth clearance of goods, which can help to maintain business operations and reputation.

- Reduced Risk: Reducing the risk of penalties, fines, or other sanctions for non-compliance.

- Improved Compliance: Demonstrating a commitment to compliance with customs regulations, which can help to build trust with CBP and other stakeholders.

Best Practices for CBP Form 28

To ensure compliance with CBP Form 28, importers and other parties involved in the importation process should follow these best practices:

- Respond Promptly: Respond promptly to the request for information, within the timeframe specified by CBP.

- Provide Accurate Information: Provide accurate and detailed information in response to the request, including any supporting documentation or evidence.

- Seek Professional Advice: Seek professional advice from a qualified customs broker or attorney, if necessary, to ensure compliance with CBP regulations.

Conclusion

CBP Form 28 is a critical document used by CBP to request additional information from importers and other parties involved in the importation process. By understanding the purpose, sections, and procedures for submission, importers can ensure compliance with customs regulations and avoid significant consequences. By following best practices and seeking professional advice, importers can ensure the smooth clearance of goods and maintain a strong reputation in the global marketplace.

FAQs

What is CBP Form 28?

+CBP Form 28 is a document used by U.S. Customs and Border Protection (CBP) to request additional information from importers and other parties involved in the importation process.

What is the purpose of CBP Form 28?

+The primary purpose of CBP Form 28 is to enable CBP to gather more information about the shipment, which may be necessary to determine the admissibility, tariff classification, appraisement, or other factors relevant to the clearance of the goods.

What information is required on CBP Form 28?

+The information required on CBP Form 28 may include documentation, samples, explanations, and evidence, as requested by CBP.