As a business owner in Illinois, you're likely familiar with the importance of obtaining the necessary licenses and permits to operate your business. One of the key forms you'll need to file is the Illinois Form ST-556, also known as the Certificate of Registration. In this article, we'll take a closer look at the Illinois Form ST-556, including what it is, why you need it, and a step-by-step guide on how to file it.

What is Illinois Form ST-556?

The Illinois Form ST-556 is a Certificate of Registration that's required for businesses that engage in the sale of tangible personal property, such as retail stores, restaurants, and other businesses that sell goods or services subject to sales tax. The form is used to register your business with the Illinois Department of Revenue and to obtain a Certificate of Registration, which is required to operate a business in the state.

Why Do You Need Illinois Form ST-556?

The Illinois Form ST-556 is a crucial document that's required for businesses that operate in Illinois. Here are some reasons why you need to file this form:

- Registration requirement: The Illinois Form ST-556 is a registration requirement for businesses that engage in the sale of tangible personal property. Failing to register your business can result in penalties and fines.

- Sales tax collection: If your business sells goods or services subject to sales tax, you'll need to collect and remit sales tax to the state. The Illinois Form ST-556 is used to register your business for sales tax purposes.

- Compliance with state laws: Filing the Illinois Form ST-556 is a necessary step in complying with state laws and regulations. By registering your business, you'll be able to operate your business in compliance with state laws.

Step-by-Step Filing Guide for Illinois Form ST-556

Filing the Illinois Form ST-556 is a relatively straightforward process. Here's a step-by-step guide to help you file the form:

Step 1: Gather Required Information

Before you start filing the Illinois Form ST-556, you'll need to gather some required information, including:

- Business name and address: Make sure you have your business name and address handy.

- Federal Employer Identification Number (FEIN): You'll need to provide your FEIN, which is a unique identifier assigned to your business by the IRS.

- Business type: You'll need to indicate the type of business you operate, such as sole proprietorship, partnership, or corporation.

- Owner/officer information: You'll need to provide information about the owners or officers of your business, including their names, addresses, and social security numbers or FEINs.

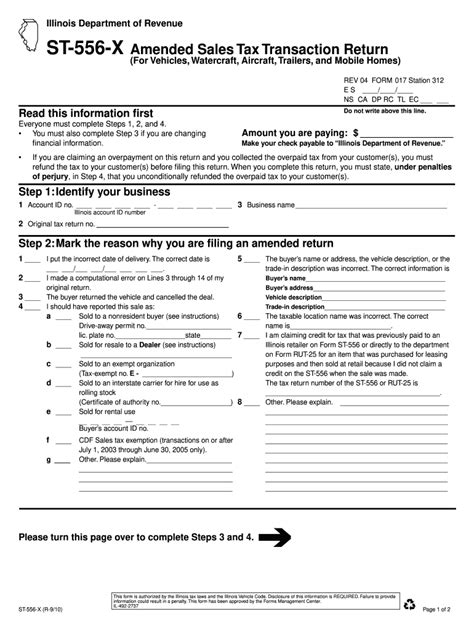

Step 2: Complete the Illinois Form ST-556

Once you have all the required information, you can start completing the Illinois Form ST-556. The form is available on the Illinois Department of Revenue's website, and you can complete it online or by mail.

- Section 1: Business Information: Complete this section with your business name, address, and FEIN.

- Section 2: Business Type: Indicate the type of business you operate.

- Section 3: Owner/Officer Information: Provide information about the owners or officers of your business.

- Section 4: Certification: Sign and date the form to certify that the information provided is accurate.

Step 3: Submit the Illinois Form ST-556

Once you've completed the Illinois Form ST-556, you can submit it to the Illinois Department of Revenue. You can submit the form online or by mail.

- Online submission: You can submit the form online through the Illinois Department of Revenue's website.

- Mail submission: You can mail the form to the Illinois Department of Revenue at the address indicated on the form.

Step 4: Pay the Registration Fee

You'll need to pay a registration fee when you submit the Illinois Form ST-556. The fee is currently $125, but it's subject to change, so be sure to check the Illinois Department of Revenue's website for the most up-to-date information.

Tips and Reminders

Here are some tips and reminders to keep in mind when filing the Illinois Form ST-556:

- File on time: Make sure you file the Illinois Form ST-556 on time to avoid penalties and fines.

- Provide accurate information: Ensure that the information you provide on the form is accurate and complete.

- Keep a copy of the form: Keep a copy of the completed form for your records.

What is the purpose of the Illinois Form ST-556?

+The Illinois Form ST-556 is used to register your business with the Illinois Department of Revenue and to obtain a Certificate of Registration, which is required to operate a business in the state.

How do I file the Illinois Form ST-556?

+You can file the Illinois Form ST-556 online or by mail. The form is available on the Illinois Department of Revenue's website.

What is the registration fee for the Illinois Form ST-556?

+The registration fee for the Illinois Form ST-556 is currently $125, but it's subject to change, so be sure to check the Illinois Department of Revenue's website for the most up-to-date information.

We hope this guide has been helpful in explaining the Illinois Form ST-556 and how to file it. If you have any further questions or need additional assistance, please don't hesitate to ask.