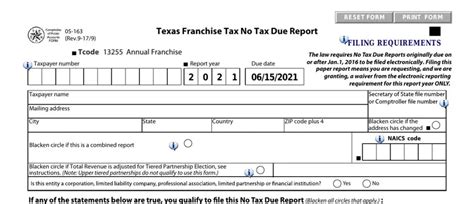

Texas, the Lone Star State, is renowned for its vast lands, vibrant cities, and a thriving economy. As a resident of Texas, understanding the state's tax laws and regulations is crucial for individuals and businesses alike. One of the key documents in this realm is the Texas Tax Form 05-163, also known as the "Apportionment Form". This form is used by businesses to report their Texas franchise tax and calculate their tax liability. In this article, we will delve into five essential facts about Texas Tax Form 05-163, providing you with a comprehensive understanding of its purpose, requirements, and benefits.

What is Texas Tax Form 05-163?

Texas Tax Form 05-163, or the Apportionment Form, is a document used by businesses to report their Texas franchise tax. The form is used to calculate the business's tax liability based on its total revenue, cost of goods sold, and other factors. The form is typically filed by businesses that have a presence in Texas and are required to pay franchise tax.

Purpose of Texas Tax Form 05-163

The primary purpose of Texas Tax Form 05-163 is to allow businesses to report their Texas franchise tax and calculate their tax liability. The form requires businesses to provide detailed information about their revenue, expenses, and other financial data. This information is used to determine the business's tax liability, which is based on a percentage of its total revenue.

Who Needs to File Texas Tax Form 05-163?

Texas Tax Form 05-163 is required to be filed by businesses that have a presence in Texas and are subject to franchise tax. This includes:

- Corporations

- Limited liability companies (LLCs)

- Partnerships

- S corporations

- Other business entities

Businesses that are exempt from franchise tax, such as non-profit organizations and certain government entities, are not required to file Texas Tax Form 05-163.

Benefits of Filing Texas Tax Form 05-163

Filing Texas Tax Form 05-163 provides several benefits to businesses, including:

- Accurate calculation of tax liability: The form helps businesses to accurately calculate their tax liability, ensuring that they pay the correct amount of franchise tax.

- Compliance with state regulations: Filing the form demonstrates compliance with Texas state regulations, reducing the risk of penalties and fines.

- Reduced audit risk: By providing detailed financial information, businesses can reduce the risk of audit and potential tax liabilities.

How to File Texas Tax Form 05-163

To file Texas Tax Form 05-163, businesses must:

- Obtain the form from the Texas Comptroller's website or through a tax professional

- Complete the form accurately and thoroughly, providing all required financial information

- File the form electronically or by mail, depending on the business's preference

- Pay any required tax liability, if applicable

Common Mistakes to Avoid When Filing Texas Tax Form 05-163

When filing Texas Tax Form 05-163, businesses should avoid common mistakes, such as:

- Inaccurate or incomplete financial information

- Failure to report all revenue and expenses

- Incorrect calculation of tax liability

- Late filing or payment of tax liability

By avoiding these mistakes, businesses can ensure accurate and timely filing of Texas Tax Form 05-163.

Tips for Completing Texas Tax Form 05-163

To ensure accurate and efficient completion of Texas Tax Form 05-163, businesses should:

- Review the form carefully and thoroughly

- Gather all required financial information before starting the form

- Use a tax professional or accountant to assist with completion, if necessary

- Double-check calculations and ensure accuracy

By following these tips, businesses can complete Texas Tax Form 05-163 with ease and accuracy.

In conclusion, Texas Tax Form 05-163 is a crucial document for businesses operating in Texas. By understanding the purpose, requirements, and benefits of the form, businesses can ensure accurate and timely filing, reducing the risk of penalties and fines. Remember to avoid common mistakes and follow tips for completion to make the process as smooth as possible.

We hope this article has provided you with valuable insights into Texas Tax Form 05-163. If you have any questions or comments, please feel free to share them below. Don't forget to share this article with others who may benefit from this information.

What is the purpose of Texas Tax Form 05-163?

+The primary purpose of Texas Tax Form 05-163 is to allow businesses to report their Texas franchise tax and calculate their tax liability.

Who needs to file Texas Tax Form 05-163?

+Businesses that have a presence in Texas and are subject to franchise tax, including corporations, LLCs, partnerships, S corporations, and other business entities.

What are the benefits of filing Texas Tax Form 05-163?

+Accurate calculation of tax liability, compliance with state regulations, and reduced audit risk.