As a tax professional or a business owner, it's essential to understand the Form 1099-PATR filing instructions and reporting requirements. This form is used to report patronage dividends and other distributions to the IRS and to provide a copy to the recipients. In this article, we will delve into the details of Form 1099-PATR, its importance, and the filing instructions and reporting requirements.

What is Form 1099-PATR?

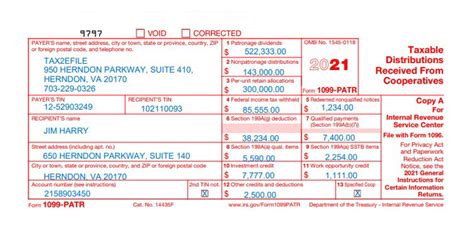

Form 1099-PATR is a tax form used by cooperatives to report patronage dividends and other distributions to their patrons. A cooperative is a business or organization owned and controlled by its members, who share in the profits and losses of the business. Patronage dividends are the profits earned by the cooperative that are distributed to its patrons based on their patronage.

Who Must File Form 1099-PATR?

Form 1099-PATR must be filed by any cooperative that distributes patronage dividends or other distributions to its patrons. This includes:

- Agricultural cooperatives

- Electric cooperatives

- Credit unions

- Mutual insurance companies

- Other types of cooperatives

Filing Instructions for Form 1099-PATR

To file Form 1099-PATR, follow these steps:

- Obtain the necessary forms: You can obtain Form 1099-PATR from the IRS website or by calling the IRS at 1-800-829-3676.

- Identify the patrons: Identify the patrons who received patronage dividends or other distributions from the cooperative.

- Determine the reporting threshold: Determine if the reporting threshold has been met. The reporting threshold is $10 or more for patronage dividends and $600 or more for other distributions.

- Complete Form 1099-PATR: Complete Form 1099-PATR for each patron who meets the reporting threshold. The form requires the patron's name, address, and taxpayer identification number (TIN).

- Report the distributions: Report the patronage dividends and other distributions made to each patron.

- Submit Form 1099-PATR to the IRS: Submit a copy of Form 1099-PATR to the IRS by January 31st of each year.

- Provide a copy to the patron: Provide a copy of Form 1099-PATR to each patron by January 31st of each year.

Reporting Requirements for Form 1099-PATR

The reporting requirements for Form 1099-PATR are as follows:

- Patronage dividends: Report patronage dividends of $10 or more made to each patron.

- Other distributions: Report other distributions of $600 or more made to each patron.

- Taxpayer identification number (TIN): Obtain the TIN of each patron and report it on Form 1099-PATR.

- Backup withholding: If a patron fails to provide a TIN, the cooperative must backup withhold on the distribution.

Penalties for Failure to File Form 1099-PATR

Failure to file Form 1099-PATR or failure to provide a copy to the patron can result in penalties. The penalties are as follows:

- Late filing penalty: A penalty of $50 per form for late filing, with a maximum penalty of $536,000 per year.

- Intentional disregard penalty: A penalty of $100 per form for intentional disregard, with a maximum penalty of $1,072,000 per year.

- Backup withholding penalty: A penalty of 24% of the distribution for failure to backup withhold.

Electronic Filing of Form 1099-PATR

The IRS encourages electronic filing of Form 1099-PATR. Electronic filing can be done through the IRS's Filing Information Returns Electronically (FIRE) system. To electronically file, you must:

- Obtain a Transmitter Control Code (TCC): Apply for a TCC through the IRS website.

- Create a file: Create a file in the IRS's specified format.

- Upload the file: Upload the file to the FIRE system.

Conclusion

Form 1099-PATR is an essential tax form for cooperatives to report patronage dividends and other distributions to their patrons. Understanding the filing instructions and reporting requirements is crucial to avoid penalties and ensure compliance with the IRS. By following the steps outlined in this article, cooperatives can ensure accurate and timely filing of Form 1099-PATR.

What is the deadline for filing Form 1099-PATR?

+The deadline for filing Form 1099-PATR is January 31st of each year.

Who must file Form 1099-PATR?

+Any cooperative that distributes patronage dividends or other distributions to its patrons must file Form 1099-PATR.

What is the reporting threshold for patronage dividends?

+The reporting threshold for patronage dividends is $10 or more.