As the tax season approaches, many individuals and businesses are preparing to file their tax returns. One important document that is often required for tax purposes is the Form 1099-NEC, which reports non-employee compensation. In this article, we will delve into the details of the 2019 Form 1099-NEC, explaining its purpose, who needs to file it, and what information is required.

The Importance of Form 1099-NEC

The Form 1099-NEC is a crucial document for both the payer and the recipient. It serves as a record of non-employee compensation, which includes payments made to independent contractors, freelancers, and other non-employees. The form is used to report these payments to the Internal Revenue Service (IRS) and is essential for accurate tax reporting.

Who Needs to File Form 1099-NEC?

Generally, any business or individual that makes payments to non-employees must file Form 1099-NEC. This includes:

- Businesses that pay independent contractors for services rendered

- Freelance workers who receive payments from clients

- Self-employed individuals who receive payments from customers

- Landlords who pay rent to tenants

What Information is Required on Form 1099-NEC?

The Form 1099-NEC requires the following information:

- Payer's name, address, and taxpayer identification number (TIN)

- Recipient's name, address, and TIN

- Amount of non-employee compensation paid

- Date payments were made

- Type of payment made (e.g., freelance work, rent, etc.)

The form also includes a section for reporting state and local taxes withheld, if applicable.

How to Complete Form 1099-NEC

Completing Form 1099-NEC is a straightforward process. Here are the steps to follow:

- Gather all necessary information, including payer and recipient details, payment amounts, and dates.

- Download and print Form 1099-NEC from the IRS website or obtain it from a tax professional.

- Fill out the form accurately and completely, using black ink.

- Sign and date the form.

- Provide a copy of the form to the recipient by January 31st of each year.

- File the original form with the IRS by January 31st of each year.

Penalties for Not Filing Form 1099-NEC

Failure to file Form 1099-NEC can result in significant penalties. The IRS may impose fines and interest on late or missing forms, which can range from $50 to $250 per form. Additionally, if the payer intentionally fails to file the form, they may be subject to a penalty of up to $500 per form.

Benefits of Filing Form 1099-NEC

Filing Form 1099-NEC provides several benefits to both the payer and the recipient. These benefits include:

- Accurate tax reporting: Form 1099-NEC ensures that non-employee compensation is accurately reported to the IRS, which helps to prevent tax errors and penalties.

- Reduced audit risk: Filing Form 1099-NEC reduces the risk of an audit, as it provides a clear record of non-employee compensation.

- Improved financial record-keeping: The form helps to maintain accurate financial records, which is essential for financial planning and decision-making.

Common Mistakes to Avoid When Filing Form 1099-NEC

When filing Form 1099-NEC, it's essential to avoid common mistakes that can result in penalties and delays. Here are some common mistakes to avoid:

- Incorrect or missing payer and recipient information

- Incorrect payment amounts or dates

- Failure to sign and date the form

- Failure to provide a copy of the form to the recipient

- Failure to file the form with the IRS by the deadline

Form 1099-NEC vs. Form 1099-MISC

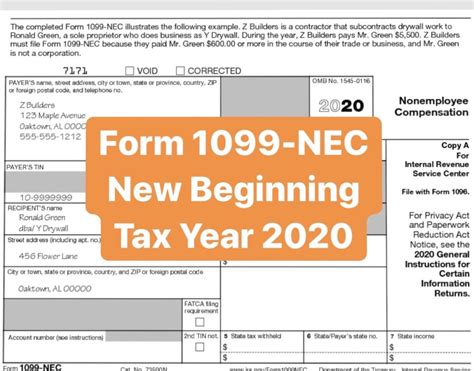

In 2020, the IRS introduced Form 1099-NEC, which replaced Form 1099-MISC for reporting non-employee compensation. While both forms report non-employee compensation, there are key differences between them. Here are some of the main differences:

- Form 1099-NEC is used specifically for reporting non-employee compensation, while Form 1099-MISC reports a broader range of payments, including rent, royalties, and prizes.

- Form 1099-NEC requires the payer's name, address, and TIN, while Form 1099-MISC requires the payer's name and address only.

- Form 1099-NEC has a separate section for reporting state and local taxes withheld, while Form 1099-MISC does not.

Best Practices for Filing Form 1099-NEC

To ensure accurate and timely filing of Form 1099-NEC, follow these best practices:

- Maintain accurate and up-to-date financial records

- Verify payer and recipient information before filing the form

- Use black ink and print the form clearly

- Sign and date the form

- Provide a copy of the form to the recipient by January 31st of each year

- File the original form with the IRS by January 31st of each year

Conclusion

In conclusion, Form 1099-NEC is a crucial document for reporting non-employee compensation to the IRS. By understanding the purpose, requirements, and benefits of the form, payers and recipients can ensure accurate tax reporting and avoid penalties. Remember to follow best practices for filing the form, and don't hesitate to seek professional help if you're unsure about any aspect of the process.

FAQ Section:

What is Form 1099-NEC used for?

+Form 1099-NEC is used to report non-employee compensation to the IRS. It is used by payers to report payments made to independent contractors, freelancers, and other non-employees.

Who needs to file Form 1099-NEC?

+Any business or individual that makes payments to non-employees must file Form 1099-NEC. This includes businesses that pay independent contractors for services rendered, freelance workers who receive payments from clients, and self-employed individuals who receive payments from customers.

What information is required on Form 1099-NEC?

+The form requires the payer's name, address, and taxpayer identification number (TIN), the recipient's name, address, and TIN, the amount of non-employee compensation paid, the date payments were made, and the type of payment made.