Filing taxes can be a daunting task, especially for individuals who are new to the process or have complex financial situations. In the state of Georgia, the GA Pt 61 Form is a crucial document for taxpayers who need to report certain types of income or claim specific deductions. In this article, we will provide a comprehensive guide on how to file the GA Pt 61 Form, including step-by-step instructions and helpful tips.

What is the GA Pt 61 Form?

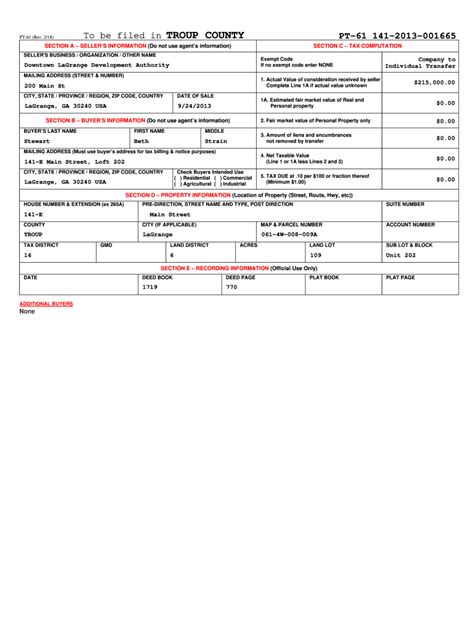

The GA Pt 61 Form is a tax form used by the state of Georgia to report certain types of income, such as interest, dividends, and capital gains. It is also used to claim deductions for items like charitable donations and medical expenses. The form is typically filed by individuals who have received income from sources other than a W-2 job, such as investors, freelancers, and small business owners.

Who Needs to File the GA Pt 61 Form?

You will need to file the GA Pt 61 Form if you have received income from any of the following sources:

- Interest from banks, savings and loans, and credit unions

- Dividends from stocks and mutual funds

- Capital gains from the sale of investments or assets

- Self-employment income from a business or freelance work

- Rental income from real estate investments

Additionally, you may need to file the GA Pt 61 Form if you have deductions to claim, such as:

- Charitable donations to qualified organizations

- Medical expenses that exceed 10% of your adjusted gross income

- Mortgage interest and property taxes on your primary residence

Step-by-Step Filing Guide

Filing the GA Pt 61 Form requires careful attention to detail and accuracy. Here is a step-by-step guide to help you navigate the process:

Step 1: Gather Your Documents

Before you begin filing the GA Pt 61 Form, make sure you have all the necessary documents and information. This includes:

- Your W-2 forms from any jobs you held during the tax year

- 1099 forms for any interest, dividends, or capital gains income

- Records of charitable donations and medical expenses

- Proof of mortgage interest and property taxes paid on your primary residence

Step 2: Download and Print the Form

You can download and print the GA Pt 61 Form from the Georgia Department of Revenue website. Make sure you have the most up-to-date version of the form, as it may change from year to year.

Step 3: Fill Out the Form

Carefully fill out the GA Pt 61 Form, making sure to report all required income and claim any eligible deductions. Use a calculator to ensure accuracy, and consider consulting with a tax professional if you are unsure about any part of the process.

Step 4: Sign and Date the Form

Once you have completed the GA Pt 61 Form, sign and date it. Make sure your signature is legible and matches the name on your tax return.

Step 5: File the Form

You can file the GA Pt 61 Form electronically or by mail. If you file electronically, you will need to create an account on the Georgia Department of Revenue website and follow the prompts to submit your return. If you file by mail, make sure to use the correct mailing address and include a check or money order for any tax due.

Tips and Reminders

Here are some additional tips and reminders to keep in mind when filing the GA Pt 61 Form:

- Make sure to file your return on time to avoid penalties and interest.

- Keep accurate records of your income and deductions, as you may need to refer to them during an audit.

- Consider consulting with a tax professional if you are unsure about any part of the process.

- Take advantage of any eligible deductions to minimize your tax liability.

Common Mistakes to Avoid

Here are some common mistakes to avoid when filing the GA Pt 61 Form:

- Failing to report all required income

- Claiming deductions for which you are not eligible

- Failing to sign and date the form

- Filing the form late or inaccurately

Conclusion

Filing the GA Pt 61 Form requires careful attention to detail and accuracy. By following the step-by-step guide outlined in this article, you can ensure that you are reporting all required income and claiming any eligible deductions. Remember to keep accurate records, avoid common mistakes, and take advantage of any eligible deductions to minimize your tax liability.

We hope this article has been helpful in guiding you through the process of filing the GA Pt 61 Form. If you have any further questions or concerns, please don't hesitate to reach out to a tax professional or the Georgia Department of Revenue.

What is the GA Pt 61 Form used for?

+The GA Pt 61 Form is used to report certain types of income, such as interest, dividends, and capital gains, and to claim deductions for items like charitable donations and medical expenses.

Who needs to file the GA Pt 61 Form?

+You will need to file the GA Pt 61 Form if you have received income from sources other than a W-2 job, such as investments, freelance work, or rental income.

How do I file the GA Pt 61 Form?

+You can file the GA Pt 61 Form electronically or by mail. If you file electronically, you will need to create an account on the Georgia Department of Revenue website and follow the prompts to submit your return.