The Internal Revenue Service (IRS) requires certain entities to register and file specific forms to comply with excise tax regulations. One such form is the IRS Form 8752, which is used for required registration for certain excise tax activities. In this article, we will delve into the details of Form 8752, its purpose, and the requirements for filing it.

What is IRS Form 8752?

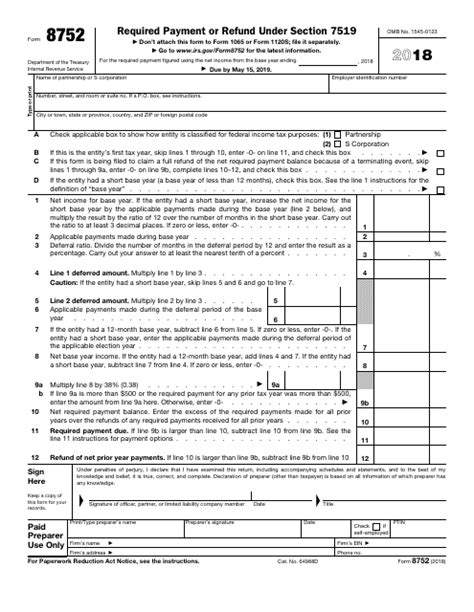

IRS Form 8752 is a registration form required for certain entities that engage in activities subject to excise taxes. The form is used to register with the IRS and obtain an employer identification number (EIN) for excise tax purposes. Form 8752 is typically filed by entities that are required to file Form 720, Quarterly Federal Excise Tax Return.

Who Needs to File Form 8752?

Form 8752 is required for entities that engage in activities subject to excise taxes, such as:

- Manufacturers and importers of certain products, such as gasoline, diesel fuel, and tobacco products

- Providers of communication and air transportation services

- Certain financial institutions and insurance companies

- Entities that engage in the production and sale of ozone-depleting chemicals

These entities must file Form 8752 to register with the IRS and obtain an EIN for excise tax purposes.

How to File Form 8752

Form 8752 can be filed electronically or by mail. To file electronically, entities can use the IRS's Electronic Federal Tax Payment System (EFTPS). To file by mail, entities can download and complete the form from the IRS website and mail it to the address listed in the instructions.

The form requires entities to provide their business name, address, and EIN, as well as information about their excise tax activities. Entities must also certify that they are eligible to register for excise tax purposes.

Deadlines for Filing Form 8752

The deadline for filing Form 8752 depends on the entity's excise tax activities. Generally, entities must file Form 8752 by the last day of the month following the quarter in which they began engaging in excise tax activities.

For example, if an entity began engaging in excise tax activities in January, the deadline for filing Form 8752 would be February 28th. Entities that fail to file Form 8752 by the deadline may be subject to penalties and interest.

Consequences of Not Filing Form 8752

Failure to file Form 8752 can result in significant penalties and interest. The IRS may impose penalties of up to $10,000 for failure to file Form 8752, as well as interest on any unpaid excise taxes.

In addition, entities that fail to file Form 8752 may be subject to audits and examinations by the IRS. This can result in additional penalties and interest, as well as potential litigation.

Exemptions from Filing Form 8752

Certain entities may be exempt from filing Form 8752. For example, entities that are exempt from excise taxes under Section 4221 of the Internal Revenue Code may not be required to file Form 8752.

Additionally, entities that have already registered with the IRS for excise tax purposes may not need to file Form 8752. However, these entities must still file Form 720, Quarterly Federal Excise Tax Return, to report their excise tax liability.

Additional Resources

For more information about Form 8752 and excise tax registration, entities can consult the following resources:

- IRS Publication 510, Excise Taxes

- IRS Form 720, Quarterly Federal Excise Tax Return

- IRS Form 720-CS, Carrier Summary Report

- IRS Website: irs.gov

Entities can also contact the IRS directly to ask questions or seek guidance on filing Form 8752.

Conclusion

In conclusion, Form 8752 is a critical registration form required for certain entities that engage in excise tax activities. Failure to file Form 8752 can result in significant penalties and interest, as well as potential audits and examinations.

Entities that engage in excise tax activities must file Form 8752 to register with the IRS and obtain an EIN for excise tax purposes. The form can be filed electronically or by mail, and entities must provide their business name, address, and EIN, as well as information about their excise tax activities.

We hope this article has provided valuable information about Form 8752 and excise tax registration. If you have any questions or comments, please feel free to share them below.

Who needs to file Form 8752?

+Entities that engage in activities subject to excise taxes, such as manufacturers and importers of certain products, providers of communication and air transportation services, and certain financial institutions and insurance companies.

What is the deadline for filing Form 8752?

+The deadline for filing Form 8752 depends on the entity's excise tax activities. Generally, entities must file Form 8752 by the last day of the month following the quarter in which they began engaging in excise tax activities.

What are the consequences of not filing Form 8752?

+Failure to file Form 8752 can result in significant penalties and interest, as well as potential audits and examinations by the IRS.