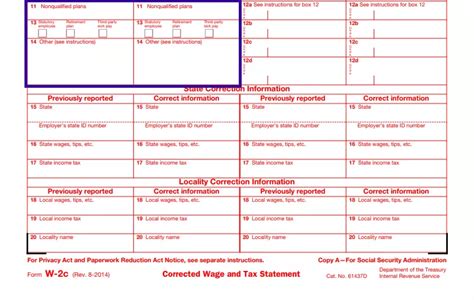

Filling out tax forms can be a daunting task, especially when it comes to correcting errors or making changes to previously filed forms. Form W-2c, also known as the Corrected Wage and Tax Statement, is used to correct errors or make changes to a previously filed Form W-2, Wage and Tax Statement. In this article, we will explore 5 easy ways to fill out Form W-2c, making the process less overwhelming and more manageable.

Understanding the Purpose of Form W-2c

Before we dive into the 5 easy ways to fill out Form W-2c, it's essential to understand the purpose of this form. Form W-2c is used to correct errors or make changes to a previously filed Form W-2, which reports an employee's income and taxes withheld. This form is typically used when an employer needs to correct errors such as incorrect Social Security numbers, incorrect wage amounts, or incorrect tax withholding amounts.

Gathering Necessary Information

Before filling out Form W-2c, it's crucial to gather all necessary information. This includes:

- The original Form W-2 that needs to be corrected

- The employee's correct Social Security number

- The correct wage amount and tax withholding amounts

- The reason for the correction

Having all this information readily available will make the process of filling out Form W-2c much smoother.

5 Easy Ways to Fill Out Form W-2c

1. Use the IRS Website

The IRS website provides a wealth of information and resources to help with filling out Form W-2c. The website offers a step-by-step guide on how to complete the form, as well as a list of frequently asked questions. Additionally, the IRS website provides access to the Form W-2c instructions, which outline the specific requirements for completing the form.

2. Use Tax Software

Tax software such as TurboTax or H&R Block can make filling out Form W-2c a breeze. These programs guide you through the process, asking questions and providing instructions to ensure accuracy. Additionally, tax software can perform calculations and check for errors, reducing the risk of mistakes.

Benefits of Using Tax Software

- Easy to use and navigate

- Guides you through the process

- Performs calculations and checks for errors

- Provides instructions and support

3. Consult with a Tax Professional

If you're not comfortable filling out Form W-2c on your own, consulting with a tax professional can be a great option. Tax professionals have extensive knowledge and experience with tax forms and can ensure accuracy and compliance. They can also provide guidance on how to correct errors and make changes to previously filed forms.

4. Use a Template

Using a template can make filling out Form W-2c much easier. Templates provide a pre-formatted version of the form, which can be completed by simply filling in the necessary information. Templates can be found online or through tax software.

Benefits of Using a Template

- Easy to use and navigate

- Provides a pre-formatted version of the form

- Reduces the risk of errors

5. Seek Help from the IRS

If you're having trouble filling out Form W-2c, don't hesitate to seek help from the IRS. The IRS offers a range of resources, including phone support, email support, and online chat. The IRS can provide guidance on how to complete the form, as well as answer any questions you may have.

Final Thoughts

Filling out Form W-2c doesn't have to be a daunting task. By following these 5 easy ways to fill out Form W-2c, you can ensure accuracy and compliance. Remember to gather all necessary information, use the IRS website or tax software, consult with a tax professional, use a template, or seek help from the IRS. By taking the time to fill out Form W-2c correctly, you can avoid errors and ensure that your employees receive accurate tax information.

We hope this article has been informative and helpful. If you have any questions or comments, please don't hesitate to share them below.

FAQ Section

What is Form W-2c used for?

+Form W-2c is used to correct errors or make changes to a previously filed Form W-2, Wage and Tax Statement.

How do I know if I need to file Form W-2c?

+You need to file Form W-2c if you need to correct errors or make changes to a previously filed Form W-2.

Can I file Form W-2c electronically?

+Yes, you can file Form W-2c electronically through the IRS website or through tax software.