Wisconsin state taxes can be a daunting task for many residents, but understanding the various filing options can help make the process smoother. In this article, we will delve into the five ways to file your Wisconsin state tax form, ensuring you comply with the state's tax laws and regulations.

Tax season can be overwhelming, especially with the numerous forms and paperwork required. However, the Wisconsin Department of Revenue provides several options to file your state tax form, making it more accessible and convenient for residents. By exploring these options, you can choose the method that best suits your needs and ensures you meet the tax filing deadline.

Whether you're a seasoned tax filer or a newcomer to Wisconsin, understanding the state's tax laws and regulations is crucial. The Wisconsin state tax form is used to report your income, claim deductions and credits, and calculate your tax liability. In this article, we will walk you through the five ways to file your Wisconsin state tax form, including electronic filing, paper filing, and using tax preparation software.

1. Electronic Filing (e-File)

Electronic filing, or e-filing, is a convenient and efficient way to submit your Wisconsin state tax form. The Wisconsin Department of Revenue offers free e-filing options through their website, which allows you to file your taxes online. To e-file, you will need to create an account on the department's website and follow the prompts to upload your tax information.

E-filing offers several benefits, including faster processing times, reduced errors, and instant confirmation of receipt. Additionally, you can check the status of your refund online and receive notifications when your refund is issued.

Benefits of E-Filing:

• Faster processing times • Reduced errors • Instant confirmation of receipt • Check the status of your refund online • Receive notifications when your refund is issued

2. Paper Filing

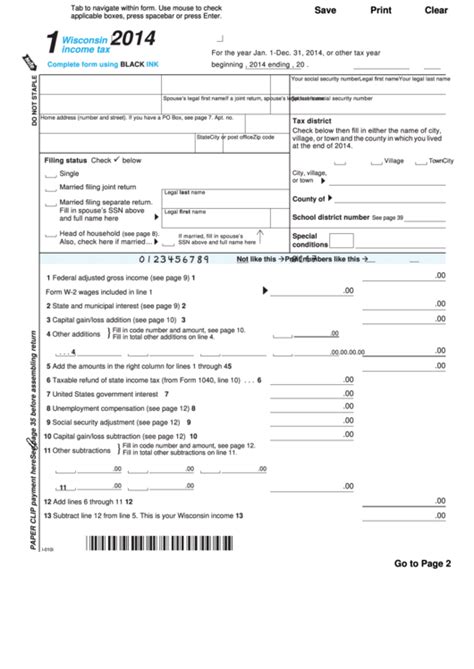

If you prefer to file your Wisconsin state tax form by mail, you can use the paper filing option. You will need to download and print the required forms from the Wisconsin Department of Revenue's website or pick them up at a local library or other designated location.

To paper file, complete the forms accurately and legibly, and attach any required documentation, such as W-2s and 1099s. Mail the forms to the address listed on the instructions, making sure to use the correct postage.

Benefits of Paper Filing:

• No need for internet access • Can be more familiar for those who prefer paper forms • Allows for a paper record of your tax submission

3. Tax Preparation Software

Tax preparation software is another option for filing your Wisconsin state tax form. These programs, such as TurboTax and H&R Block, guide you through the tax filing process, helping you complete your return accurately and efficiently.

Tax preparation software often includes features like automatic calculations, error checking, and audit protection. Additionally, these programs may offer free e-filing options, making it easy to submit your taxes online.

Benefits of Tax Preparation Software:

• Guides you through the tax filing process • Automatic calculations and error checking • Audit protection • Often includes free e-filing options

4. Tax Professional or Accountant

If you're unsure about filing your Wisconsin state tax form or have complex tax situations, consider hiring a tax professional or accountant. These experts can help you navigate the tax laws and regulations, ensuring you take advantage of all the deductions and credits you're eligible for.

Tax professionals and accountants can also represent you in case of an audit, providing peace of mind and protection. However, be prepared for the additional cost of hiring a professional, which may vary depending on the complexity of your return.

Benefits of Hiring a Tax Professional:

• Expert guidance and advice • Help with complex tax situations • Representation in case of an audit • Peace of mind and protection

5. Wisconsin e-File Approved Software Providers

The Wisconsin Department of Revenue has partnered with several software providers to offer free or low-cost e-filing options. These providers, such as TaxAct and Credit Karma Tax, offer guided tax preparation and e-filing services.

To use one of these providers, visit the Wisconsin Department of Revenue's website and follow the links to the approved software providers. You will need to create an account and follow the prompts to upload your tax information.

Benefits of Wisconsin e-File Approved Software Providers:

• Free or low-cost e-filing options • Guided tax preparation • E-filing services • Partnered with the Wisconsin Department of Revenue

In conclusion, filing your Wisconsin state tax form is a crucial part of complying with state tax laws and regulations. By exploring the five ways to file your tax form, you can choose the method that best suits your needs and ensures you meet the tax filing deadline. Whether you prefer e-filing, paper filing, or using tax preparation software, make sure to take advantage of the resources available to you and seek professional help if needed.

Now that you've learned about the five ways to file your Wisconsin state tax form, take a moment to share your thoughts and experiences with us. Have you used any of these methods before? Do you have any questions or concerns about filing your taxes? Leave a comment below, and we'll do our best to address your queries.

What is the deadline for filing Wisconsin state taxes?

+The deadline for filing Wisconsin state taxes is typically April 15th, but it may vary depending on the year and any extensions granted.

Do I need to file a Wisconsin state tax return if I only have income from a part-time job?

+Yes, you may need to file a Wisconsin state tax return even if you only have income from a part-time job. Check the Wisconsin Department of Revenue's website for more information on filing requirements.

Can I amend my Wisconsin state tax return if I made an error?

+Yes, you can amend your Wisconsin state tax return if you made an error. You will need to file an amended return, Form 1X, and attach a statement explaining the changes.