The Small Business Administration (SBA) Form 770, also known as the Debtor's Financial Statement, is a crucial document that provides a comprehensive overview of a debtor's financial situation. This form is typically required when an individual or business is seeking financial assistance or debt relief from the SBA. In this article, we will delve into the details of SBA Form 770, its importance, and provide a step-by-step guide on how to complete it.

What is SBA Form 770?

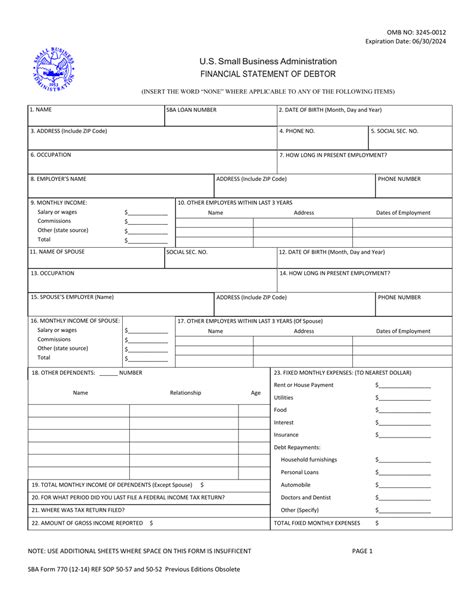

SBA Form 770 is a financial statement that provides a snapshot of a debtor's financial situation. The form requires debtors to disclose their income, expenses, assets, liabilities, and other relevant financial information. The purpose of this form is to help lenders and creditors assess the debtor's creditworthiness and determine their ability to repay debts.

Why is SBA Form 770 Important?

SBA Form 770 is essential for several reasons:

- It provides a clear picture of a debtor's financial situation, enabling lenders to make informed decisions about creditworthiness.

- It helps debtors identify areas where they can improve their financial management and reduce debt.

- It facilitates communication between debtors and creditors, promoting transparency and cooperation.

Who Needs to Complete SBA Form 770?

The following individuals and businesses may need to complete SBA Form 770:

- Small business owners seeking financial assistance or debt relief from the SBA.

- Individuals with outstanding debts, such as mortgages, credit cards, or personal loans.

- Business owners with debts related to their business operations.

How to Complete SBA Form 770

Completing SBA Form 770 requires careful attention to detail and accuracy. Here is a step-by-step guide to help you complete the form:

Section 1: Debtor Information

- Provide your name, address, and contact information.

- List all your dependents, including their names, ages, and relationships to you.

Section 2: Income

- Report all sources of income, including employment, self-employment, and investments.

- Provide documentation, such as pay stubs, tax returns, or financial statements, to support your income claims.

Section 3: Expenses

- List all your monthly expenses, including rent/mortgage, utilities, food, transportation, and debt payments.

- Provide documentation, such as receipts or invoices, to support your expense claims.

Section 4: Assets

- List all your assets, including cash, savings, investments, real estate, and personal property.

- Provide documentation, such as bank statements or property deeds, to support your asset claims.

Section 5: Liabilities

- List all your debts, including credit cards, loans, and mortgages.

- Provide documentation, such as loan agreements or credit card statements, to support your liability claims.

Section 6: Additional Information

- Provide any additional information that may impact your financial situation, such as pending lawsuits or tax liens.

Tips for Completing SBA Form 770

- Be honest and accurate when completing the form.

- Provide supporting documentation to verify your income, expenses, assets, and liabilities.

- Review and revise the form carefully before submitting it.

Conclusion

SBA Form 770 is a critical document that provides a comprehensive overview of a debtor's financial situation. By following the step-by-step guide outlined in this article, you can ensure that you complete the form accurately and effectively. Remember to be honest, provide supporting documentation, and review the form carefully before submitting it.

Next Steps

- If you have any questions or concerns about completing SBA Form 770, consult with a financial advisor or attorney.

- Submit the completed form to the SBA or your lender, along with any required supporting documentation.

What is the purpose of SBA Form 770?

+SBA Form 770 is a financial statement that provides a snapshot of a debtor's financial situation, enabling lenders to assess creditworthiness and determine ability to repay debts.

Who needs to complete SBA Form 770?

+Small business owners, individuals with outstanding debts, and business owners with debts related to their business operations may need to complete SBA Form 770.

How long does it take to complete SBA Form 770?

+The time it takes to complete SBA Form 770 varies depending on the complexity of your financial situation and the availability of supporting documentation. It's recommended to allocate several hours to complete the form accurately.