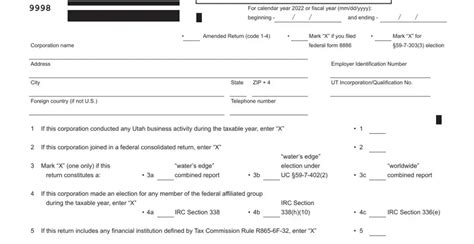

The Utah Form TC-20 - a crucial document for businesses operating in the state of Utah. Completing this form accurately and efficiently is essential to avoid any delays or penalties. In this article, we will guide you through the process of completing the Utah Form TC-20 with ease, breaking it down into 7 simple steps.

Utah Form TC-20 is a sales tax exemption certificate that allows businesses to purchase goods and services without paying sales tax. This form is typically used by wholesalers, retailers, and manufacturers who are exempt from paying sales tax on certain purchases. Completing this form accurately is crucial to ensure that your business is in compliance with Utah state tax laws.

Understanding the Importance of Utah Form TC-20

Before we dive into the steps to complete the form, it's essential to understand the importance of Utah Form TC-20. This form is used to claim exemption from sales tax on specific purchases, and it's crucial for businesses to keep accurate records of these exemptions. Failure to complete the form accurately or provide adequate documentation can result in penalties and fines.

Step 1: Gather Required Information

Before starting to fill out the form, gather all the required information. This includes:

- Your business name and address

- Your Utah sales tax account number (if applicable)

- The name and address of the seller

- A description of the goods or services being purchased

- The date of purchase

Step 2: Determine Your Exemption Type

Utah Form TC-20 allows for different types of exemptions, including:

- Wholesale exemption

- Retail exemption

- Manufacturing exemption

- Government exemption

Determine which exemption type applies to your business and select the corresponding box on the form.

Step 3: Complete the Purchaser Information Section

In this section, provide your business name, address, and Utah sales tax account number (if applicable). Make sure to include your business type and exemption type.

Step 4: Complete the Seller Information Section

In this section, provide the seller's name, address, and Utah sales tax account number (if applicable).

Step 5: Describe the Goods or Services Being Purchased

Provide a detailed description of the goods or services being purchased, including the quantity and price. This section is crucial in determining the exemption amount.

Step 6: Sign and Date the Form

Sign and date the form, indicating that the information provided is accurate and true. Make sure to include your title and business name.

Step 7: Retain a Copy for Your Records

Keep a copy of the completed form for your records, as you may be required to provide it to the Utah State Tax Commission or the seller.

By following these 7 simple steps, you can complete Utah Form TC-20 with ease and avoid any potential penalties or fines. Remember to keep accurate records and retain a copy of the completed form for your records.

Benefits of Accurately Completing Utah Form TC-20

Accurately completing Utah Form TC-20 can provide several benefits, including:

- Avoiding penalties and fines for non-compliance

- Ensuring accurate sales tax exemptions

- Reducing the risk of audits and tax liabilities

- Streamlining your business operations and record-keeping

Common Mistakes to Avoid When Completing Utah Form TC-20

When completing Utah Form TC-20, avoid the following common mistakes:

- Inaccurate or incomplete information

- Failure to sign and date the form

- Incorrect exemption type or classification

- Failure to retain a copy for your records

By avoiding these common mistakes, you can ensure that your Utah Form TC-20 is completed accurately and efficiently.

Conclusion

Completing Utah Form TC-20 accurately is crucial for businesses operating in the state of Utah. By following the 7 simple steps outlined in this article, you can ensure that your form is completed efficiently and accurately. Remember to avoid common mistakes and retain a copy of the completed form for your records.

We hope this article has been helpful in guiding you through the process of completing Utah Form TC-20. If you have any further questions or concerns, please don't hesitate to comment below.

What is Utah Form TC-20?

+Utah Form TC-20 is a sales tax exemption certificate that allows businesses to purchase goods and services without paying sales tax.

Who is required to complete Utah Form TC-20?

+Businesses that are exempt from paying sales tax on certain purchases are required to complete Utah Form TC-20.

What are the consequences of not completing Utah Form TC-20 accurately?

+Failure to complete Utah Form TC-20 accurately can result in penalties and fines for non-compliance.