As a business owner in New York State, filing sales tax forms is a crucial part of your tax obligations. The New York State Sales Tax Form ST-100 is used to report and pay sales tax on taxable sales and purchases. In this article, we will explore five ways to file the New York State Sales Tax Form ST-100, ensuring you stay compliant and avoid any potential penalties.

Understanding the New York State Sales Tax Form ST-100

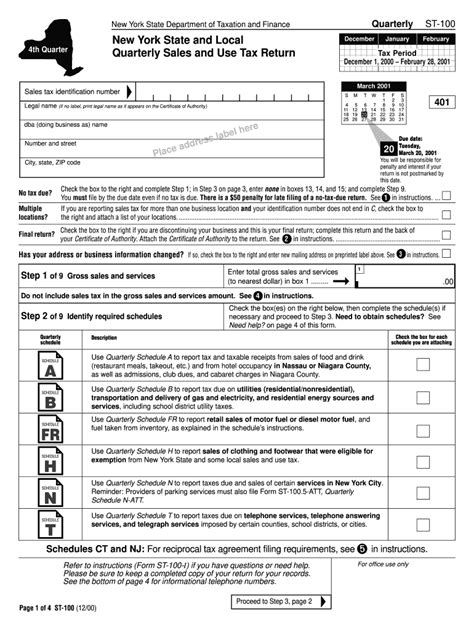

Before we dive into the filing methods, it's essential to understand the basics of the New York State Sales Tax Form ST-100. This form is used to report sales tax on taxable sales and purchases, and it's typically filed on a quarterly basis. The form requires you to provide information about your business, including your sales tax registration number, business name, and address.

Who Needs to File the New York State Sales Tax Form ST-100?

Any business that is registered for a sales tax certificate of authority in New York State is required to file the Form ST-100. This includes:

- Retailers

- Wholesalers

- Manufacturers

- Service providers

5 Ways to File the New York State Sales Tax Form ST-100

Now, let's explore the five ways to file the New York State Sales Tax Form ST-100:

1. Online Filing through the New York State Department of Taxation and Finance Website

The New York State Department of Taxation and Finance (DTF) website offers an online filing system for the Form ST-100. To file online, you'll need to create an account and log in to the website. Once you've logged in, you can access the Form ST-100 and complete it electronically.

2. Electronic Filing through a Third-Party Provider

If you prefer to use a third-party provider, you can file the Form ST-100 electronically through a certified software provider. These providers offer a range of services, including electronic filing, payment processing, and tax preparation.

3. Mail Filing

You can also file the Form ST-100 by mail. To do this, you'll need to complete the form and attach any required supporting documentation. Make sure to use the correct mailing address and postage to ensure timely delivery.

4. Fax Filing

Fax filing is another option for submitting the Form ST-100. To file by fax, you'll need to complete the form and attach any required supporting documentation. Make sure to use the correct fax number and cover sheet to ensure timely delivery.

5. In-Person Filing

If you prefer to file in person, you can visit a local New York State Department of Taxation and Finance office. Bring the completed Form ST-100 and any required supporting documentation with you.

Benefits of Filing the New York State Sales Tax Form ST-100 Electronically

Filing the Form ST-100 electronically offers several benefits, including:

- Faster processing times

- Reduced errors

- Increased security

- Environmentally friendly

Penalties for Late or Inaccurate Filing

Failure to file the Form ST-100 on time or inaccurately can result in penalties, including:

- Late filing fees

- Interest charges

- Accuracy penalties

Conclusion

Filing the New York State Sales Tax Form ST-100 is a crucial part of your tax obligations as a business owner in New York State. By understanding the five ways to file the form, you can ensure timely and accurate submission, avoiding any potential penalties. Remember to take advantage of electronic filing options to streamline the process and reduce errors.

What is the deadline for filing the New York State Sales Tax Form ST-100?

+The deadline for filing the Form ST-100 is typically the 20th day of the month following the end of the quarter.

Can I file the New York State Sales Tax Form ST-100 annually instead of quarterly?

+Yes, you can file the Form ST-100 annually if your total sales tax liability is less than $500 per year.

What is the penalty for late filing of the New York State Sales Tax Form ST-100?

+The penalty for late filing is 5% of the tax due per month or part of a month, up to a maximum of 25%.