Understanding Minnesota Tax Form M1: A Comprehensive Guide

As a resident of Minnesota, it's essential to understand the state's tax laws and filing requirements to avoid any penalties or fines. The Minnesota Tax Form M1 is a crucial document that individuals and businesses must file to report their income tax. In this article, we will provide a detailed guide on how to complete and file the Minnesota Tax Form M1, including instructions, deadlines, and tips to ensure a smooth filing process.

Who Needs to File Minnesota Tax Form M1?

Minnesota residents, non-residents, and businesses are required to file the Tax Form M1 if they have earned income from Minnesota sources. This includes:

- Individuals who earned income from Minnesota sources, such as wages, salaries, tips, and self-employment income

- Businesses, including sole proprietorships, partnerships, S corporations, and C corporations, that have earned income from Minnesota sources

- Estates and trusts that have earned income from Minnesota sources

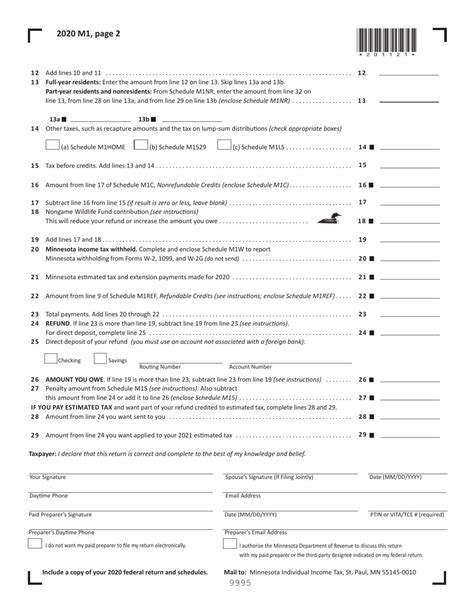

Minnesota Tax Form M1 Instructions

Completing the Minnesota Tax Form M1 requires careful attention to detail and accuracy. Here's a step-by-step guide to help you complete the form:

- Gather necessary documents: Collect all necessary documents, including:

- W-2 forms from employers

- 1099 forms for self-employment income and other sources

- Interest statements from banks and investments

- Dividend statements from investments

- Charitable donation receipts

- Medical expense receipts

- Determine your filing status: Choose your filing status, which may be single, married filing jointly, married filing separately, head of household, or qualifying widow(er).

- Complete the income section: Report all income earned from Minnesota sources, including:

- Wages, salaries, and tips

- Self-employment income

- Interest and dividends

- Capital gains and losses

- Rent and royalty income

- Complete the deductions section: Claim deductions for:

- Standard deduction or itemized deductions

- Personal exemptions

- Medical expenses

- Charitable donations

- Mortgage interest and property taxes

- Complete the credits section: Claim credits for:

- Earned Income Tax Credit (EITC)

- Child Tax Credit

- Education credits

- Energy credits

- Sign and date the form: Sign and date the form, and include your Social Security number or Individual Taxpayer Identification Number (ITIN).

Minnesota Tax Form M1 Filing Deadlines

The Minnesota Tax Form M1 is due on the same day as the federal income tax return, which is typically April 15th. However, if you need an extension, you can file for an automatic six-month extension by submitting Form M1-EXT.

Electronic Filing Options

Minnesota offers several electronic filing options for the Tax Form M1, including:

- Minnesota e-File: The state's free e-filing system allows you to file your tax return online.

- Tax software: Many tax software providers, such as TurboTax and H&R Block, offer electronic filing options for Minnesota tax returns.

- Paid preparer: You can also hire a paid preparer to e-file your tax return.

Minnesota Tax Form M1 Amendments

If you need to make changes to your original tax return, you can file an amended return using Form M1X. You can file an amended return electronically or by mail.

Minnesota Tax Refunds

If you're due a refund, you can choose to receive it by direct deposit, check, or prepaid debit card. To ensure timely processing, make sure to file your tax return accurately and completely.

Minnesota Tax Audits

If you're selected for an audit, the Minnesota Department of Revenue will contact you to request additional information or documentation. Be prepared to provide supporting documentation for your income, deductions, and credits.

Minnesota Tax Form M1 Frequently Asked Questions

Here are some frequently asked questions about the Minnesota Tax Form M1:

- Q: What is the deadline for filing the Minnesota Tax Form M1? A: The deadline is typically April 15th, but you can file for an automatic six-month extension by submitting Form M1-EXT.

- Q: Can I e-file my Minnesota tax return? A: Yes, Minnesota offers several electronic filing options, including the state's free e-filing system, tax software, and paid preparers.

- Q: How do I amend my Minnesota tax return? A: You can file an amended return using Form M1X, either electronically or by mail.

What is the Minnesota Tax Form M1 used for?

+The Minnesota Tax Form M1 is used to report individual and business income tax to the state of Minnesota.

Who is required to file the Minnesota Tax Form M1?

+Minnesota residents, non-residents, and businesses that have earned income from Minnesota sources are required to file the Tax Form M1.

What is the deadline for filing the Minnesota Tax Form M1?

+The deadline is typically April 15th, but you can file for an automatic six-month extension by submitting Form M1-EXT.

We hope this comprehensive guide has helped you understand the Minnesota Tax Form M1 and its filing requirements. If you have any further questions or concerns, please don't hesitate to comment below or share this article with others who may find it helpful.