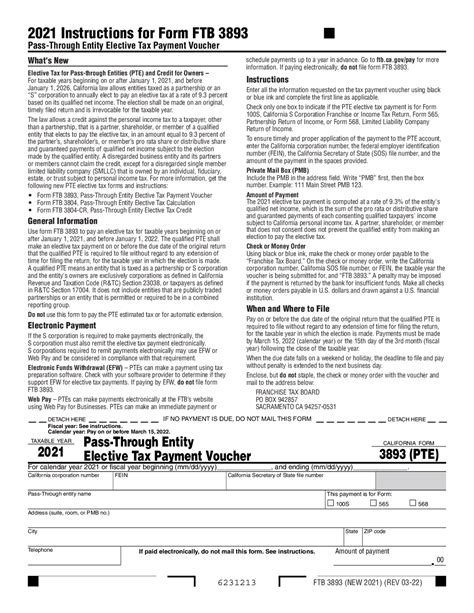

California Form 3893, also known as the "Pass-Through Entity Elective Tax Election and Credit Agreement", is a crucial document for businesses operating in California. If you're a business owner or tax professional, understanding the intricacies of this form is essential to ensure you're taking advantage of the available tax credits and refunds.

What is California Form 3893?

Benefits of Filing California Form 3893

Filing California Form 3893 can provide several benefits for businesses, including:- Reduced tax liability: By electing to pay taxes at the entity level, PTEs can reduce the overall tax liability for the business and its owners.

- Simplified tax compliance: Filing Form 3893 can simplify the tax compliance process for PTEs, as it eliminates the need for individual owners to report their share of the entity's income on their personal tax returns.

- Increased tax credits: Businesses that file Form 3893 may be eligible for additional tax credits, such as the Research and Development (R&D) tax credit.

Eligibility Requirements

- Be a pass-through entity (PTE) that is subject to California taxation.

- Have a tax year that ends on or after December 31, 2021.

- Make an annual election to pay taxes at the entity level.

- File the election by the original due date of the entity's tax return (including extensions).

How to File California Form 3893

Filing California Form 3893 is a relatively straightforward process. Here are the steps to follow:- Gather required information: Before filing Form 3893, you'll need to gather certain information, including the entity's name, address, and tax identification number.

- Complete the form: Complete Form 3893 by answering the required questions and providing the necessary information.

- Sign and date the form: Sign and date the form to confirm the election.

- File the form: File the completed form with the California Franchise Tax Board (FTB) by the original due date of the entity's tax return (including extensions).

Claiming Your Refund

- Determine your refund amount: Calculate the amount of taxes paid at the entity level and determine the amount of refund due.

- Complete Form 3893-CR: Complete Form 3893-CR, "Pass-Through Entity Elective Tax Credit and Refund Agreement", to claim your refund.

- File the form: File the completed form with the California FTB by the original due date of the entity's tax return (including extensions).

Common Mistakes to Avoid

When filing California Form 3893, there are several common mistakes to avoid, including:- Missing the filing deadline: Make sure to file the form by the original due date of the entity's tax return (including extensions).

- Incomplete or inaccurate information: Ensure that all required information is complete and accurate to avoid delays or rejection.

- Failure to sign and date the form: Sign and date the form to confirm the election.

Conclusion

California Form 3893 is an important document for businesses operating in California. By understanding the benefits and eligibility requirements of this form, businesses can reduce their tax liability and simplify their tax compliance process. If you're eligible to file Form 3893, make sure to follow the steps outlined above to claim your refund.What is the purpose of California Form 3893?

+California Form 3893 is an elective tax form that allows pass-through entities (PTEs) to make an annual election to pay taxes at the entity level.

Who is eligible to file California Form 3893?

+To be eligible to file California Form 3893, businesses must be a pass-through entity (PTE) that is subject to California taxation and have a tax year that ends on or after December 31, 2021.

How do I claim my refund if I've filed California Form 3893?

+To claim your refund, complete Form 3893-CR, "Pass-Through Entity Elective Tax Credit and Refund Agreement", and file it with the California FTB by the original due date of the entity's tax return (including extensions).