Filling out tax forms can be a daunting task, especially for those who are new to the process. The ST-119 form, also known as the Exemption Certificate for Certain Purchases of Tangible Personal Property, is a crucial document for businesses and individuals who want to claim exemptions on certain purchases. In this article, we will guide you through three easy ways to fill out the ST-119 form, making the process less overwhelming and more manageable.

Understanding the ST-119 Form

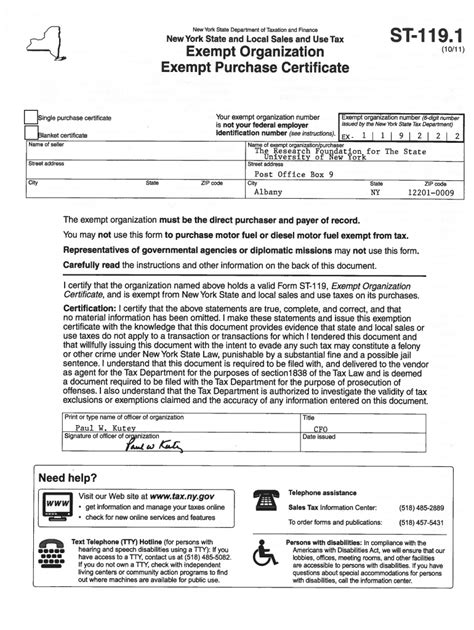

The ST-119 form is used to certify that a purchase is exempt from sales tax. It is typically required for purchases of tangible personal property, such as equipment, supplies, and materials. The form must be completed accurately and thoroughly to avoid any delays or issues with the exemption.

Who Needs to Fill Out the ST-119 Form?

The ST-119 form is required for various individuals and businesses, including:

- Businesses that purchase tangible personal property for resale or use in production

- Non-profit organizations that purchase exempt items

- Government agencies that purchase exempt items

- Individuals who purchase exempt items for personal use

Method 1: Filling Out the ST-119 Form Online

One of the easiest ways to fill out the ST-119 form is online. The New York State Department of Taxation and Finance provides an online portal where you can complete and submit the form electronically. To fill out the form online, follow these steps:

- Go to the New York State Department of Taxation and Finance website

- Click on the "Forms" tab and select "ST-119"

- Fill out the form electronically, making sure to provide all required information

- Submit the form online

Benefits of Filling Out the ST-119 Form Online

Filling out the ST-119 form online has several benefits, including:

- Convenience: You can complete and submit the form from anywhere with an internet connection

- Accuracy: The online form will automatically calculate any necessary fields and reduce the risk of errors

- Speed: The form will be processed faster than mailing a paper copy

Method 2: Filling Out the ST-119 Form by Mail

If you prefer to fill out the ST-119 form by mail, you can download and print the form from the New York State Department of Taxation and Finance website. To fill out the form by mail, follow these steps:

- Download and print the ST-119 form

- Fill out the form completely and accurately, making sure to provide all required information

- Sign and date the form

- Mail the form to the address listed on the form

Tips for Filling Out the ST-119 Form by Mail

When filling out the ST-119 form by mail, make sure to:

- Use black ink and write clearly

- Avoid using white-out or correction fluid

- Make sure to sign and date the form

- Use a secure envelope and mail the form to the correct address

Method 3: Filling Out the ST-119 Form with the Help of a Tax Professional

If you are unsure about how to fill out the ST-119 form or need assistance, consider consulting a tax professional. A tax professional can guide you through the process and ensure that the form is completed accurately and thoroughly. To fill out the ST-119 form with the help of a tax professional, follow these steps:

- Find a qualified tax professional who is familiar with the ST-119 form

- Provide the tax professional with all necessary information and documentation

- Let the tax professional complete and review the form

- Sign and date the form

Benefits of Filling Out the ST-119 Form with a Tax Professional

Filling out the ST-119 form with a tax professional has several benefits, including:

- Accuracy: A tax professional will ensure that the form is completed accurately and thoroughly

- Time-saving: A tax professional will save you time and effort

- Peace of mind: A tax professional will give you peace of mind knowing that the form is completed correctly

We hope this article has provided you with three easy ways to fill out the ST-119 form. Whether you choose to fill out the form online, by mail, or with the help of a tax professional, make sure to provide all required information and follow the instructions carefully. If you have any questions or concerns, don't hesitate to reach out to a tax professional or the New York State Department of Taxation and Finance.

What is the ST-119 form used for?

+The ST-119 form is used to certify that a purchase is exempt from sales tax.

Who needs to fill out the ST-119 form?

+The ST-119 form is required for businesses, non-profit organizations, government agencies, and individuals who purchase exempt items.

Can I fill out the ST-119 form online?

+Yes, you can fill out the ST-119 form online through the New York State Department of Taxation and Finance website.