Understanding the intricacies of employee compensation data is crucial for both employers and employees. The SSS E1 form, a fundamental document in the Philippines, plays a significant role in this process. As we delve into the world of employee compensation, it's essential to grasp the significance of this form and its implications for both parties involved.

In the Philippines, the Social Security System (SSS) is responsible for providing social security protection to employees in the private sector. The SSS E1 form is a vital document that serves as a declaration of an employee's compensation data. This form is used to report an employee's salary, wages, and other compensation to the SSS, which in turn, determines the employee's social security contributions. The accuracy of the information provided in the SSS E1 form is crucial, as it directly affects the employee's benefits and the employer's compliance with SSS regulations.

Importance of Accurate Compensation Data

Accurate compensation data is essential for both employers and employees. For employers, providing accurate information ensures compliance with SSS regulations, avoiding penalties and fines. On the other hand, employees rely on accurate compensation data to receive the correct benefits, including retirement, disability, and death benefits. Inaccurate or incomplete data can lead to delayed or denied benefits, causing undue stress and financial hardship for employees.

Consequences of Inaccurate Compensation Data

Inaccurate compensation data can have severe consequences for both employers and employees. Employers who fail to provide accurate information may face penalties, fines, and even legal action. Employees, on the other hand, may experience delayed or denied benefits, affecting their financial security and well-being.

To avoid these consequences, it's essential to understand the importance of accurate compensation data and the role of the SSS E1 form in providing this information.

Understanding the SSS E1 Form

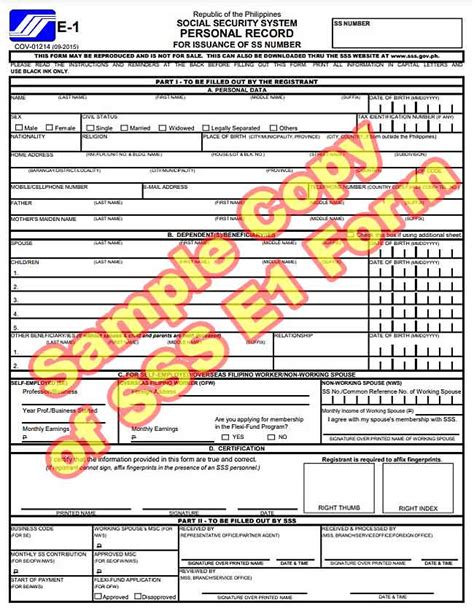

The SSS E1 form is a declaration of an employee's compensation data, including salary, wages, and other compensation. The form is typically submitted by the employer to the SSS on a monthly basis. The SSS E1 form contains essential information, including:

- Employee's name and SSS number

- Employer's name and SSS number

- Employee's salary and wages

- Other compensation, such as bonuses and allowances

- Social security contributions

Steps to Complete the SSS E1 Form

Completing the SSS E1 form requires attention to detail and accuracy. Here are the steps to follow:

- Gather necessary information: Ensure you have the employee's correct name, SSS number, and compensation data.

- Fill out the form: Complete the SSS E1 form with the required information, including employee's name, SSS number, salary, and social security contributions.

- Verify information: Double-check the information provided to ensure accuracy and completeness.

- Submit the form: Submit the completed form to the SSS on a monthly basis.

Tips for Accurate Compensation Data

To ensure accurate compensation data, follow these tips:

- Keep accurate records: Maintain accurate and up-to-date records of employee compensation data.

- Verify information: Regularly verify the information provided in the SSS E1 form to ensure accuracy.

- Use the correct form: Use the latest version of the SSS E1 form to ensure compliance with SSS regulations.

- Seek assistance: If unsure about completing the SSS E1 form, seek assistance from the SSS or a qualified professional.

Common Mistakes to Avoid

When completing the SSS E1 form, it's essential to avoid common mistakes that can lead to inaccurate compensation data. Here are some mistakes to avoid:

- Inaccurate employee information: Ensure the employee's name and SSS number are accurate and up-to-date.

- Incorrect compensation data: Verify the employee's salary, wages, and other compensation to ensure accuracy.

- Late submission: Submit the SSS E1 form on time to avoid penalties and fines.

Benefits of Accurate Compensation Data

Accurate compensation data provides numerous benefits for both employers and employees. Here are some benefits:

- Compliance with SSS regulations: Accurate compensation data ensures compliance with SSS regulations, avoiding penalties and fines.

- Correct benefits: Accurate compensation data ensures employees receive the correct benefits, including retirement, disability, and death benefits.

- Financial security: Accurate compensation data provides financial security for employees, ensuring they receive the correct benefits and contributions.

Conclusion

The SSS E1 form is a vital document that plays a crucial role in providing accurate compensation data. By understanding the importance of accurate compensation data and following the steps to complete the SSS E1 form, employers and employees can ensure compliance with SSS regulations and receive the correct benefits. Remember to avoid common mistakes and follow tips for accurate compensation data to ensure financial security and well-being.

What is the purpose of the SSS E1 form?

+The SSS E1 form is a declaration of an employee's compensation data, including salary, wages, and other compensation.

How often should the SSS E1 form be submitted?

+The SSS E1 form should be submitted on a monthly basis.

What are the consequences of inaccurate compensation data?

+Inaccurate compensation data can lead to delayed or denied benefits, affecting an employee's financial security and well-being.