As a taxpayer, it's essential to understand the various forms and regulations set by the Internal Revenue Service (IRS). One such form is the Federal Form 2210, also known as the Underpayment of Estimated Tax by Individuals, Estates, and Trusts. In this article, we will delve into the world of Form 2210, explaining its purpose, who needs to file it, and how to complete it easily.

The Importance of Form 2210

The IRS requires individuals, estates, and trusts to make estimated tax payments throughout the year if they expect to owe $1,000 or more in taxes. Form 2210 is used to calculate the underpayment of estimated taxes and to determine if penalties are owed. The form is essential in ensuring that taxpayers comply with the tax laws and avoid any potential penalties.

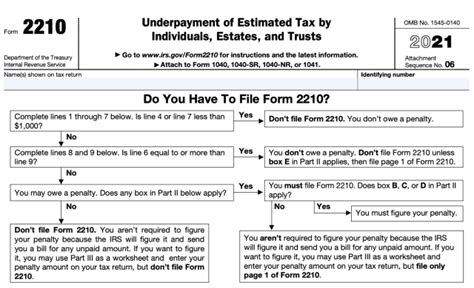

Who Needs to File Form 2210?

Not everyone needs to file Form 2210. However, if you're an individual, estate, or trust that meets the following conditions, you'll need to file this form:

- You're required to make estimated tax payments and have underpaid your taxes.

- You're filing Form 1040, 1040-SR, or 1040-NR and owe $1,000 or more in taxes.

- You're an estate or trust filing Form 1041 and owe $500 or more in taxes.

How to Complete Form 2210 Easily

Completing Form 2210 can seem daunting, but with the right guidance, it's a straightforward process. Here's a step-by-step guide to help you complete the form easily:

Step 1: Gather Required Information

Before starting, gather the necessary information and documents:

- Your tax return (Form 1040, 1040-SR, or 1040-NR)

- Your estimated tax payments (Form 1040-ES)

- Your previous year's tax return (if applicable)

Step 2: Calculate Your Underpayment

Use the following steps to calculate your underpayment:

- Determine your required annual payment: This is the amount you should have paid in estimated taxes throughout the year.

- Calculate your total estimated tax payments: Add up all the estimated tax payments you made during the year.

- Determine your underpayment: Subtract your total estimated tax payments from your required annual payment.

Step 3: Complete Part I of Form 2210

Part I of Form 2210 requires you to calculate your underpayment. Follow these steps:

- Enter your required annual payment (Line 1)

- Enter your total estimated tax payments (Line 2)

- Calculate your underpayment (Line 3)

Step 4: Complete Part II of Form 2210

Part II of Form 2210 requires you to calculate the penalty for underpayment. Follow these steps:

- Determine the number of quarters you underpaid (Line 4)

- Calculate the penalty for each quarter (Line 5)

- Calculate the total penalty (Line 6)

Step 5: Complete Part III of Form 2210 (If Applicable)

If you're waiving the penalty, complete Part III of Form 2210. You'll need to explain why you're eligible for the waiver.

Step 6: Sign and Date the Form

Once you've completed the form, sign and date it. Make sure to keep a copy for your records.

Penalty Relief: Waiving the Penalty

If you've underpaid your estimated taxes, you may be eligible for penalty relief. The IRS waives the penalty if you meet one of the following conditions:

- You didn't owe any taxes in the prior tax year.

- You're a first-time filer.

- You experience casualty, disaster, or other unusual circumstances.

- You're retired or disabled.

To waive the penalty, complete Part III of Form 2210 and attach a statement explaining why you're eligible for the waiver.

Common Mistakes to Avoid

When completing Form 2210, it's essential to avoid common mistakes that can lead to errors and penalties. Here are some mistakes to watch out for:

- Failing to report all income: Make sure to report all your income, including self-employment income and investments.

- Underestimating your tax liability: Ensure you accurately estimate your tax liability to avoid underpayment.

- Missing deadlines: Make timely estimated tax payments to avoid penalties.

- Failing to file Form 2210: If you're required to file Form 2210, make sure to do so to avoid additional penalties.

Tips for Filing Form 2210

Filing Form 2210 can be a straightforward process if you follow these tips:

- File electronically: The IRS recommends filing Form 2210 electronically to reduce errors and processing time.

- Use the correct form: Ensure you're using the correct form for your tax year.

- Keep accurate records: Keep accurate records of your estimated tax payments and tax returns.

- Seek professional help: If you're unsure about completing Form 2210, consider seeking help from a tax professional.

Conclusion: Understanding Form 2210

Form 2210 is an essential tax form that helps individuals, estates, and trusts calculate their underpayment of estimated taxes. By following the steps outlined in this article, you can complete Form 2210 easily and avoid any potential penalties. Remember to gather the required information, calculate your underpayment, and complete the form accurately. If you're unsure about any part of the process, consider seeking help from a tax professional.

We hope this article has helped you understand Form 2210 and how to complete it easily. If you have any questions or comments, please feel free to share them below.

What is Form 2210?

+Form 2210 is the Underpayment of Estimated Tax by Individuals, Estates, and Trusts form. It's used to calculate the underpayment of estimated taxes and determine if penalties are owed.

Who needs to file Form 2210?

+You need to file Form 2210 if you're an individual, estate, or trust that meets the following conditions: You're required to make estimated tax payments and have underpaid your taxes. You're filing Form 1040, 1040-SR, or 1040-NR and owe $1,000 or more in taxes. You're an estate or trust filing Form 1041 and owe $500 or more in taxes.

How do I calculate my underpayment?

+To calculate your underpayment, follow these steps: Determine your required annual payment. Calculate your total estimated tax payments. Determine your underpayment by subtracting your total estimated tax payments from your required annual payment.