The world of tax forms can be overwhelming, especially for those who are new to the process. One form that may cause confusion is the Form 8453-Ol, also known as the Declaration and Signature for Electronic Filing of Forms 1040-OL. In this article, we will break down the essential things you need to know about Form 8453-Ol, making it easier for you to navigate the tax filing process.

What is Form 8453-Ol?

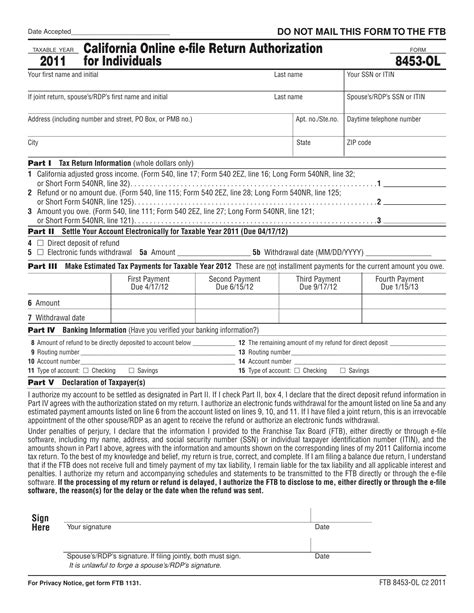

Form 8453-Ol is a declaration and signature form used for electronic filing of Forms 1040-OL. It serves as a confirmation that the taxpayer has reviewed and approved the information submitted on their tax return. This form is typically used by taxpayers who are filing their taxes electronically through a tax preparation software or a tax professional.

Why is Form 8453-Ol Important?

Form 8453-Ol is essential because it ensures that the taxpayer has authorized the electronic filing of their tax return. By signing this form, the taxpayer is confirming that the information submitted is accurate and complete. This form also provides a record of the taxpayer's declaration, which can be useful in case of any audit or dispute.

Who Needs to File Form 8453-Ol?

Form 8453-Ol is required for taxpayers who are filing their taxes electronically using Form 1040-OL. This includes:

- Taxpayers who are filing their taxes through a tax preparation software

- Taxpayers who are working with a tax professional

- Taxpayers who are filing their taxes electronically through the IRS Free File program

What Information is Required on Form 8453-Ol?

To complete Form 8453-Ol, taxpayers will need to provide the following information:

- Their name and social security number

- Their spouse's name and social security number (if applicable)

- Their address and phone number

- The tax year for which they are filing

- A declaration that they have reviewed and approved the information submitted on their tax return

How to Complete Form 8453-Ol

Completing Form 8453-Ol is a straightforward process. Here are the steps to follow:

- Review your tax return to ensure that the information is accurate and complete.

- Sign and date the form.

- Enter your name and social security number, as well as your spouse's name and social security number (if applicable).

- Enter your address and phone number.

- Enter the tax year for which you are filing.

- Check the box to confirm that you have reviewed and approved the information submitted on your tax return.

Tips for Filing Form 8453-Ol

Here are some tips to keep in mind when filing Form 8453-Ol:

- Make sure to review your tax return carefully before signing and submitting Form 8453-Ol.

- Use a secure and reputable tax preparation software or tax professional to ensure that your information is protected.

- Keep a copy of Form 8453-Ol for your records.

- Make sure to submit Form 8453-Ol by the tax filing deadline to avoid any penalties or delays.

Common Errors to Avoid When Filing Form 8453-Ol

When filing Form 8453-Ol, it's essential to avoid common errors that can cause delays or penalties. Here are some common errors to watch out for:

- Incomplete or inaccurate information

- Failure to sign and date the form

- Failure to check the box confirming that you have reviewed and approved the information submitted on your tax return

- Submitting the form after the tax filing deadline

Conclusion

Form 8453-Ol is an essential part of the tax filing process for taxpayers who are filing their taxes electronically using Form 1040-OL. By understanding the purpose and requirements of this form, taxpayers can ensure that their tax return is accurate and complete. Remember to review your tax return carefully, complete Form 8453-Ol accurately, and submit it by the tax filing deadline to avoid any penalties or delays.

What is Form 8453-Ol used for?

+Form 8453-Ol is a declaration and signature form used for electronic filing of Forms 1040-OL. It serves as a confirmation that the taxpayer has reviewed and approved the information submitted on their tax return.

Who needs to file Form 8453-Ol?

+Form 8453-Ol is required for taxpayers who are filing their taxes electronically using Form 1040-OL. This includes taxpayers who are filing their taxes through a tax preparation software, working with a tax professional, or filing their taxes electronically through the IRS Free File program.

What information is required on Form 8453-Ol?

+To complete Form 8453-Ol, taxpayers will need to provide their name and social security number, their spouse's name and social security number (if applicable), their address and phone number, the tax year for which they are filing, and a declaration that they have reviewed and approved the information submitted on their tax return.