In the realm of tax compliance, accurate and timely filing of tax returns is crucial for individuals and businesses alike. For employers in Vermont, one such critical return is the VT Form WHT-434, which pertains to withholding tax. This form is a cornerstone of Vermont's tax system, aiming to ensure that employers correctly withhold and remit taxes on behalf of their employees. Understanding the intricacies of this form is essential for seamless compliance and avoidance of potential penalties.

Overview of VT Form WHT-434

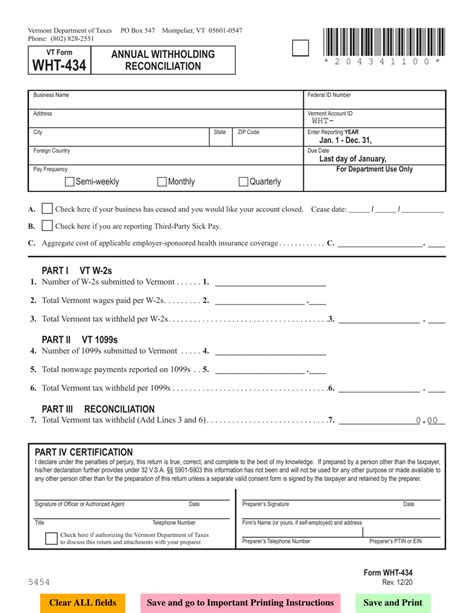

VT Form WHT-434, also known as the Withholding Tax Return, is a quarterly return that Vermont employers must file with the Vermont Department of Taxes. This form is used to report the amount of Vermont income tax withheld from employees' wages and other compensation. Employers must accurately calculate, withhold, and remit these taxes to the state to avoid penalties and interest.

Who Needs to File VT Form WHT-434?

All Vermont employers who are required to withhold Vermont income tax from employee wages must file VT Form WHT-434. This includes businesses, organizations, and governmental entities that pay wages to employees who are subject to Vermont income tax withholding. Additionally, employers who pay pensions, annuities, and other compensation subject to Vermont withholding must also file this return.

Due Dates and Filing Frequency

VT Form WHT-434 is a quarterly return, due on the last day of the month following the end of each quarter. The due dates are as follows:

- April 30th for the first quarter (January 1 - March 31)

- July 31st for the second quarter (April 1 - June 30)

- October 31st for the third quarter (July 1 - September 30)

- January 31st of the following year for the fourth quarter (October 1 - December 31)

Employers must file this return even if no tax was withheld during the quarter.

How to Complete VT Form WHT-434

Completing VT Form WHT-434 requires careful attention to detail. Here are the key steps to follow:

-

Gather necessary information: Collect all relevant data, including the total amount of wages paid, the amount of Vermont income tax withheld, and any adjustments or deductions applicable.

-

Fill in employer information: Enter your employer identification number, name, and address in the spaces provided.

-

Report withholding tax: Calculate and report the total amount of Vermont income tax withheld from employee wages during the quarter.

-

Claim deductions and adjustments: If applicable, claim any deductions or adjustments for exemptions, overpayments, or other adjustments.

-

Calculate the tax due or overpayment: Determine if you owe additional tax or are due a refund based on the calculations.

-

Attach supporting documentation: Include any necessary supporting schedules or documentation, such as a reconciliation of the total tax withheld.

Penalties and Interest for Non-Compliance

Failure to file VT Form WHT-434, pay the required tax, or accurately report withholding information can result in penalties and interest. These can include:

-

Late filing penalty: A penalty of 5% of the unpaid tax for each month or part of a month, up to a maximum of 25%.

-

Late payment penalty: An additional 1% penalty for each month or part of a month, up to a maximum of 25%.

-

Interest: Accrual of interest on the unpaid tax and penalties at a rate determined by the Vermont Department of Taxes.

Conclusion and Next Steps

Understanding and accurately completing VT Form WHT-434 is crucial for Vermont employers to maintain compliance with state tax laws. By following the guidelines outlined above and ensuring timely filing, employers can avoid potential penalties and interest. It is also recommended to consult the Vermont Department of Taxes or a tax professional for any specific questions or concerns regarding VT Form WHT-434.

What is VT Form WHT-434 used for?

+VT Form WHT-434 is used by Vermont employers to report the amount of Vermont income tax withheld from employee wages and other compensation on a quarterly basis.

Who is required to file VT Form WHT-434?

+All Vermont employers who are required to withhold Vermont income tax from employee wages must file VT Form WHT-434.

What are the due dates for filing VT Form WHT-434?

+The due dates are April 30th, July 31st, October 31st, and January 31st of the following year for the first, second, third, and fourth quarters, respectively.